FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

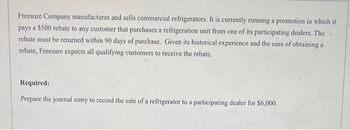

Transcribed Image Text:Freesure Company manufactures and sells commercial refrigerators. It is currently running a promotion in which it

pays a $500 rebate to any customer that purchases a refrigeration unit from one of its participating dealers. The

rebate must be returned within 90 days of purchase. Given its historical experience and the ease of obtaining a

rebate, Freesure expects all qualifying customers to receive the rebate.

Required:

Prepare the journal entry to record the sale of a refrigerator to a participating dealer for $6,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Supply Club, Incorporated, sells a variety of paper products, office supplies, and other products used by businesses and individual consumers. During July 2024, it started a loyalty program through which qualifying customers can accumulate points and redeem those points for discounts on future purchases. Redemption of a loyalty point reduces the price of one dollar of future purchases by 20% (equal to 20 cents). Customers earn one loyalty point for each dollar of goods purchased, but do not earn additional loyalty points for purchases that are made by redeeming loyalty points. Based on past experience, Supply Club estimates a 60% probability that any point issued will be redeemed for the discount. During July 2024, the company redeemed 11,200 points and sold additional product of $140,000, so it recorded of revenue of $151,200. The aggregate stand-alone selling price of the purchased products is $151,200. Eighty percent of sales were cash sales, and the remainder were credit sales.…arrow_forwardCheck my work AM [The following information applies to the questions displayed below.] On October 29, 2016, Lobo Co. began operations by purchasing razors for resale. Lobo uses the perpetual inventory method. The razors have a 90-day warranty that requires the company to replace any nonworking razor. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $16 and its retail selling price is $90 in both 2016 and 2017. The manufacturer has advised the company to expect warranty costs to equal 8% of dollar sales. The following transactions and events occurred. Ya M 2016 Nov. 11 Sold 60 razors for $5,400 cash. Tue 30 Recognized warranty expense related to November sales with an adjusting entry. 9 Replaced 12 razors that were returned under the warranty. 16 Sold 180 razors for $16,200 cash. 29 Replaced 24 razors that were returned under the warranty. 31 Recognized warranty expense related to…arrow_forwardA plumbing supply company has a discount policy which states that, if a customer pays within 15 days of the invoice, the customer can take a 3% discount; otherwise, the full amount is due in 60 days from the date of the invoice. Which of the following notations are used in business to reflect this discount? A. 3/15,n/60 B. 3/60,15/n C. 15/3,60/n D. 3/n,15/60arrow_forward

- Kingbird Inc. sold $16,200 of its designer tables to Santos Furniture and Design Studios on account. Kingbird estimates that $1,800 of these sales will either be returned or an allowance will be granted. Prepare the entries when (a) Kingbird makes the sale (use the gross method), and (b) Kingbird grants an allowance of $1,000 when some of the tables do not meet exact specifications but still could be sold by Santos. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forwardReview the following sales transactions for Dish Mart and record any required journal entries. Note that all sales transactions are with the same customer, Emma Purcell. Mar. 5 Dish Mart made a cash sale of 12 sets of dishes at a price of $600 per set to customer Emma Purcell. The cost per set is $500 to Dish Mart. Mar. 9 Dish Mart sold 20 sets of dishes to Emma for $550 per set on credit, at a cost to Dish Mart of $450 per set. Terms of the sale are 10/15, n/60, invoice date March 9. Mar. 13 Emma discovers 8 of the dish sets are damaged from the March 9 sale and returns them to Dish Mart for a full refund. Mar. 14 Dish Mart sells 8 sets of dishes to Emma for $570 per set on credit, at a cost to Dish Mart of $400 per set. Terms of the sale are 10/10, n/60, invoice date March 14. Mar. 15 Emma discovers that 3 of the dish sets from the March 14 purchase and 7 of the dish sets from the March 5 sale are missing a few dishes but keeps them since Dish Mart granted an allowance of…arrow_forwardMayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5.5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $700 of merchandise on credit (that had cost $350) to Natara Morris. 5 Sold $6,700 of merchandise (that had cost $3,350) to customers who used their Zisa cards. 6 Sold $5,656 of merchandise (that had cost $2,828) to customers who used their Access cards. 8 Sold $4,680 of merchandise (that had cost $2,340) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $606 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required:Prepare journal…arrow_forward

- On November 1, Year 1, Hydra Corp sold 100 machines to a customer for $60 each. The cost of each machine is $20.Hydra allows customers to return any unused machine within 6 months and receive a full refund. The company reasonably estimates that 10 machines (seven in Year 1, three in Year 2) will be returned. What amount of net revenue is recognized from the sale of these machines in Year 1?arrow_forwardOn March 15, Drexel Corp. provides goods to a retailer through consignment where Drexel Corp. retains ownership of the goods until the goods are sold to the retailer’s customer. Sale to the final customer is documented when the goods are scanned at the cash register of the retailer. Drexel Corp. receives a daily report on the number of units sold by the retailer to the end customer. Any unsold product can be returned to Drexel Corp. at any time. Drexel Corp. has the right through the contract to recall any goods shipped and to transfer the goods to another retailer as a way to increase the rate of sales to the final customer. After the sale of the products to the final customer, the retailer cannot return the items to Drexel Corp. During March, Drexel Corp. transferred 600 units to the retailer, and the retailer sold 500 units. The product cost Drexel Corp. $80 per unit and the product was sold for $115 per unit to the end customer. The retailer sent a payment to Drexel Corp. for the…arrow_forwardMayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 4.5% service charge for sales on its credit card. Access deducts a 3.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $500 of merchandise on credit (that had cost $250) to Natara Morris. 5 Sold $6,800 of merchandise (that had cost $3,400) to customers who used their Zisa cards. 6 Sold $5,616 of merchandise (that had cost $2,808) to customers who used their Access cards. 8 Sold $4,890 of merchandise (that had cost $2,445) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $395 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required:Prepare journal…arrow_forward

- Answer each question independently. Read the requirements. Requirement 1. A restaurant made cash sales of $4,000 subject to a 5% sales tax. Record the sales and the related sales tax. (Ignore cost of goods sold.) Also record the payment of the tax to the state. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by preparing a compound journal entry to record the sales and the related sales tax. Date Accounts and Explanations Debit Creditarrow_forwardSupply Club, Incorporated, sells a variety of paper products, office supplies, and other products used by businesses and individual consumers. During July 2024, it started a loyalty program through which qualifying customers can accumulate points and redeem those points for discounts on future purchases. Redemption of a loyalty point reduces the price of one dollar of future purchases by 20% (equal to 20 cents). Customers do not earn additional loyalty points for purchases on which loyalty points are redeemed. Based on past experience, Supply Club estimates a 60% probability that any point issued will be redeemed for the discount. During July 2021, the company redeemed 10,200 points and sold additional product of $127,500, so it recorded $137,700 of revenue. The aggregate stand-alone selling price of the purchased products is $137,700. Seventy percent of sales were cash sales, and the remainder were credit sales. Required: 1. & 2. Prepare Supply Club's journal entry to record July and…arrow_forwardPlease dont use any AI. It's strictly prohibited.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education