Creative Computing sells a tablet computer called the Protab. The $780 sales price of a Protab Package includes the following:

One Protab computer.

A 6-month limited warranty. This warranty guarantees that Creative will cover any costs that arise due to repairs or replacements associated with defective products for up to six months.

A coupon to purchase a Creative Probook e-book reader for $450, a price that represents a 40% discount from the regular Probook price of $750. It is expected that 20% of the discount coupons will be utilized.

A coupon to purchase a one-year extended warranty for $65. Customers can buy the extended warranty for $110 at other times if they do not use the $65 coupon. Creative estimates that 30% of customers will purchase an extended warranty.

Creative does not sell the Protab without the limited warranty, option to purchase a Probook, and the option to purchase an extended warranty, but estimates that if it did so, a Protab alone would sell for $760.

Required:

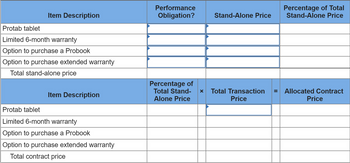

1. & 2. Indicate below whether each item is a separate performance obligation and allocate the transaction price of 95,000 Protab Packages to the separate performance obligations in the contract.

3. Prepare a

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

- Jackson Music Emporium Carries a wide variety of musical instruments, sound reproduction equipment, recorded music, and sheet music. Jackson uses two sales promotion techniques namely (a) warranties and (b) premiums to attract customers. Musical instruments and sound equipment are sold with a one-year warranty for replacement of parts and labor. The estimated warranty cost, based on past experience, is 2% of sales. The premium is offered on the recorded and sheet music. Customers receive a coupon for each peso spent on recorded music or sheet music. Customers may exchange 20 coupons and P20 for a cassette player. Jackson pays P34 for each cassette player and estimates that 60% of the coupons given to the customers will be redeemed. Jackson's total sales for 2019 were P7,200,000; P5,400,000 from musical instrument and sound reproduction equipment and P1,800,000 from recorded music and sheet music. Replacement parts and labor for warranty work totaled P164,000 during 2019. A total of…arrow_forwardA motorcycle is for sale for $20,200. The dealer is willing to sell it on the following terms: No down payment; pay $300 at the end of each of the first 6 months; pay $500 at the end of each month after that until the loan has been paid in full.At a 12% annual interest rate compounded monthly, how many $500 payments will be required?arrow_forwardMajik Corporation offers a variety of electronic instruments, tooling equipment, technical reference books, and audio training manuals. Majik uses warranties and premiums as sales promotion techniques to attract customers. Electronic instruments and tooling equipment are sold with a 1-year warranty for replacement of parts and labor. Estimated warranty cost, based on past experience, is 1.5% of sales. The premium offered on technical reference books and audio training manuals allows customers receive an MP3 player in exchange 250 for coupons and $25. Customers receive 1 coupon for each dollar spent on technical reference books and audio training manuals. Each MP3 player costs $35 and Makjik estimates 65% of the coupons given to customers will be redeemed. Majik's total 2020 sales totaled $8,250,000 with $6,500,000 from electronic instruments and tooling equipment and $1,750,000 from technical reference books and audio training manuals. Warranty replacement parts and labor costs totaled…arrow_forward

- images are not allowed in answerarrow_forwardrrarrow_forwardWally Co. began selling merchandise on November 1, 2022. The company offers a 50-day warranty for defective merchandise. Based on prior experience with similar merchandise, Wally Co. predicts that 2.80% of the units sold will encounter a fault within the warranty period, with a replacement or repair of a damaged unit costing an average of $30. In November, Wally Co. sold 25,000 units and 400 defective units were returned. In December, Wally Co. sold 32,000 units and 544 defective units were returned. The actual cost of replacing the defective units was $38,500. Prepare a journal entry to accrue for the estimated warranty costs for the November and December sales at December 31, 2022. Prepare one summary journal entry at December 31, 2022, to record the cost of replacing the defective merchandise returned during November and December. What amounts will be included in Wally Co.’s 2022 income statement and balance sheet at December 31, 2022, with regard to the warranty? Show steps…arrow_forward

- XYZ Construction Inc. wants to purchase a new pick-up truck. The price for the new truck is $43, 688. The dealer allows XYZ to trade - in the old truck for $5,224. XYZ can payback the remaining balance through a 4-year payment plan. Given the agreed interest rate is 3%: How much is the monthly payment?arrow_forwardCreative Computing sells a tablet computer called the Protab. The $785 sales price of a Protab Package includes the following: One Protab computer. • A 6-month limited warranty. This warranty guarantees that Creative will cover any costs that arise due to repairs or replacements associated with defective products for up to six months. ● • A coupon to purchase a Creative Probook e-book reader for $425, a price that represents a 50% discount from the regular Probook price of $850. It is expected that 20% of the discount coupons will be utilized. • A coupon to purchase a one-year extended warranty for $55. Customers can buy the extended warranty for $55 at other times as well. Creative estimates that 45% of customers will purchase an extended warranty. Creative does not sell the Protab without the limited warranty, option to purchase a Probook, and the option to purchase an extended warranty, but estimates that if it did so, a Protab alone would sell for $765. All Protah salos r ●arrow_forwardMacrovision sells a variety of satellite TV packages. The popular $600 Basic Package includes a hardware component (consisting of a satellite dish and receiver) along with a twelve-month subscription to 130 TV channels. Macrovision sells the hardware component without a subscription for $180, and sells a twelve-month subscription to the same 130 channels without hardware for $540/year. Let’s account for the sale of one Basic Package for $600 on January 1, 2018. Required: 1. Identify the performance obligations in the Basic Package contract, and determine when revenue for each should be recognized. 2. For the single Basic Package sold on January 1, 2018, allocate the $600 transaction price to the performance obligations in the contract, and prepare a journal entry to record the sale (ignoring any entry to record the reduction in inventory and the corresponding cost of goods sold). 3. Prepare any journal entry necessary to record revenue related to the same contract on January 31,…arrow_forward

- Extravagant Company, which uses IFRS, sells home appliances. On January 1, 2024, it sells a fridge to a customer for $5,300 cash and, as part of a promotion, Extravagant gives the customer a free 15- month extended warranty (service-type warranty). The fridge also has a 9-month assurance-type warranty, which is estimated to cost Extravagant 4% of sales revenue. Assume that the 15-month extended warranty begins after the 9-month assurance-type warranty has expired, so the customer effectively receives 24 months of warranty coverage. Additional information follows: (a) The fridge, if sold by itself, would normally sell for $5,100. The cost of the fridge to Extravagant, based on a first-in first-out (FIFO) perpetual inventory system, is $1,900. (b) The extended warranty, if sold by itself, would normally sell for $1,275. Required: (A) Prepare the journal entry/entries that should be recorded on January 1, 2024. (B) How much Operating Income would be reported by Extravagant for the…arrow_forwardYou sign a simple discount promissory note for $7,000 at a discount rate of 3%, for 36 months.arrow_forwardSoftware Supplier Inc. sells to a customer a perpetual software license and post-contract customer support for a 12-month period, commencing at the time that the software is activated. Software Supplier Inc. charges $240 upfront when the software is purchased and $16 a month for 12 months, due at the end of the month. Software Supplier Inc. sells the software separately for $320 while the standalone selling price of the post-contract customer support is $160. Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Note: If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). a. How should the transaction price be allocated among the performance obligation(s)? Performance Obligations Transaction Price as Stated Standalone Selling Price Allocated Transaction Price (rounded) Software Customer support $ $ Account Name To record sale of software.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education