Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

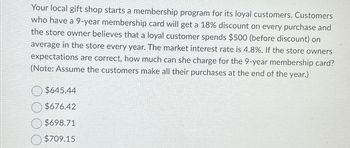

Transcribed Image Text:Your local gift shop starts a membership program for its loyal customers. Customers

who have a 9-year membership card will get a 18% discount on every purchase and

the store owner believes that a loyal customer spends $500 (before discount) on

average in the store every year. The market interest rate is 4.8%. If the store owners

expectations are correct, how much can she charge for the 9-year membership card?

(Note: Assume the customers make all their purchases at the end of the year.)

$645.44

$676.42

$698.71

$709.15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- suppose you are in a hurry to get your income refund. if you mail your tax return, you’ll receive your refund in 5 weeks. if you file the return electronically through a tax service, you can get the estimated refund tomorrow. the service subtracts 100 dollar fee and pays you the remaining expected refund of $1956. what is the apr? what is the ear? how large does the refund have to be for the apr to be 15%?arrow_forwardSolve the problem. Emily is buying a new table for $1400. The dealer is charging her an annual interest rate of 10.8%. If she pays off the loan in 36 months, what are her monthly payments If she makes a down payment of $230, how much will her monthly payments be? $102.98; $43.03 $51.49; $43.03 $111.49; $8.46 $102.98; $8.46arrow_forwardYour parents are giving you $100 a month for four years while you are in college. At a 6% annual discount rate, what are these payments worth to you when you first start college? (show steps, Answer: $4,258.03)arrow_forward

- You plan to spend $400 to buy a new IPAD at the beginning of year3 and $1,000 to buy a new phone at the End of year 6. By using excel, please calculate how much you need to save in each year? Suppose you deposit in the beginning of each year. Suppose your last deposit is at the beginning of year 6. Interest rate is 8%. Answers should be rounded to the 2nd decimal place.arrow_forwardYou decide to save money to buy a car by opening a special account at a bank that offers 8% APR compunded monthly. You deposit $300 each month for 36 months. How much will you have in your account in 36 months?arrow_forwardYou are the owner of four Taco Bell restaurant locations. You have a business loan with Citizens Bank taken out 54 days ago that is due in 116 days. The amount of the loan is $37,000, and the rate is 7.5% using ordinary interest. You currently have some excess cash. You have the choice of sending Citizens $19,800 now as a partial payment on your loan or purchasing an additional $19,800 of serving supplies such as food containers, cups, and plastic dinnerware for your inventory at a special discount price that is "12% off" your normal cost of these items. a. How much interest will you save on this loan if you make the partial payment and don't purchase the additional serving supplies?Do not round intermediate calculations. Round final answer to the nearest cent. $ b. How much will you save by purchasing the discounted serving supplies and not making the partial payment?Do not round intermediate calculations. Round final answer to the nearest cent. $arrow_forward

- 2. Assume F&S offers a “Fit 70” coupon book with 70 prepaid visits over the next year. F&S has learned that Fit 70 purchasers make an average of 60 visits before the coupon book expires. A customer purchases a Fit 70 book by paying $650 in advance, and for any additional visits over 70 during the year after the book is purchased, the customer can pay a $15 visitation fee per visit. F&S typically charges $15 to nonmembers who use the facilities for a single day.a. & b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price.c. Prepare the journal entry to recognize revenue for the sale of a new Fit 70 bookarrow_forwardA friend of yours bought a new sports car with a $4,500 down payment plus a $27,000 car loan that is financed at an interest rate of 0.75% per month for 60 months. a. Calculate the required monthly loan payment on the car. b. How much does your friend still owe on the car loan immediately after she makes the 24th monthly payment? c. If, after the 24th payment, she decides to pay $100 more each month, how many months will it take her to payoff the remaining loan she owes? a. The required monthly payment is (Round to the nearest cent.) b. Your friend still owes $on the car loan. (Round to the nearest dollar.) c. It will take her months (Round-up to the nearest month)arrow_forwardJesse's Pool sells a special family season pass package for $500. The package allows unlimited use of the indoor pool from Oct. 1, 2023 to May 31, 2024 (8 months); the pass normally sells $400. In addition, the purchaser gets 3 towels that would normally sell for $100. And lastly the package includes 10 coupons that give 30% off purchases of food while at Jesse's Pool. It is expected that 80% of the coupons will be used, and the average purchase would be $25. Jessie sold 10 packages on 10/1/2023 giving the passes, towels and coupons to the purchasers. By the end of the year, 20 of the 100 coupons had been redeemed (Jessie records the revenue in adjusting entries). (round to the nearest $1) Instructions: Record the (1) sale of the 10 packages on Oct 1. Be sure to show your work. Work (required and graded) Identify the Performance Obligations (PO's): What value is allocated to each of these PO's? Oct 1 Entry Acct and Amount Debit Account and Amount Credit Record the adjusting entry as of…arrow_forward

- You decide to do some remodeling in the kitchen. Your parents agree to lend you the money, but you insist on paying them interest. The agreement is that they will lend you $8000.00 at a simple interest rate of 2% per year. Once the interest amounts to $480, you agree to pay them back the $8000 plus the $480 interest. After how many months will you have to pay them back? Please answer step by steparrow_forward4) Brenda is buying a living room set for her home. At Furniture, Inc., she picks out a set for a total cash price of $1,899 The salesperson tells her if she qualifies for an installment loan, she may pay 10% down and finance the balance with payments of $88.35 per month for 24 months?arrow_forwardAlexa takes out a loan of 94,000 at an annual effective discount rate of 6%. The loan is to be repaid with annual payments of 10,000. The first payment is due 4 years after the loan is taken out. Calculate the amount of the drop payment. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answwer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education