Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

not use ai please

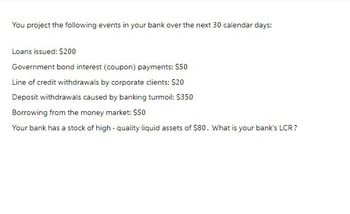

Transcribed Image Text:You project the following events in your bank over the next 30 calendar days:

Loans issued: $200

Government bond interest (coupon) payments: $50

Line of credit withdrawals by corporate clients: $20

Deposit withdrawals caused by banking turmoil: $350

Borrowing from the money market: $50

Your bank has a stock of high-quality liquid assets of $80. What is your bank's LCR?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nearby Bank has the following balance sheet (in millions): Assets Liabilities and Equity Cash $60 Demand deposits $140 5-year T notes $60 1-year CD $160 30-year mortgages $200 Equity $20 Total Assets $320 Total L and E $320 What is the maturity gap for Nearby Bank?arrow_forwardThe whole task is attached in the photoarrow_forwardSuppose you deposit $100 in a bank, which of the following will occur A The bank's assets will increase by $100 B The bank's liabilities will increase by $200 C The bank's liabilities will decrease by $100 D The bank's reserves will increase by $200arrow_forward

- Consider a bank with the following balance sheet Assets Liabilities Required reserves Excess reserves T-bills Commercial loans $ 9 million Checkable deposits $ million Bank capital $ 44 million $ 52 million $ 100 million $ 10 million The bank makes a loan commitment for $15 million to a commercial customer. Before the commitment, the bank's capital ratio equals%. (Round your response to two decimal places.)arrow_forwardThe financial statements for MHM Bank (MHM) are shown below: Calculate the dollar value of MHM’s earning assets. Calculate the dollar value of MHM’s interest-bearing liabilities. Calculate MHM’s spread. Calculate MHM’s interest expense ratio.arrow_forwardCan you help me with this question?arrow_forward

- Below, we see the balance sheet for Schlau Bank. Assets Reserves: $ 100 Long-term investments: $ 100 Total Assets: ? Liabilities Demand deposits: $ 150 Borrowing from other banks: $40 Total liabilities: ? Stockholders' equity: ? a. Calculate the stockholders' equity for Schlau Bank. b. After a mortgage crisis, 20% of the Schlau Bank's long-term investments default, losing completely their value. Is Schlau Bank able to withstand this test without getting insolvent? Explain your answer. c. In case of insolvency, explain (briefly) how the Fed minimizes the risk of possible losses by depositors and preverits a bank run from happening in (healthy) banks in the financial system. Tablearrow_forwardIn the example below, we will use year-end assets. Bank A receives $70 in deposits at 5% and, together with 40 in equity, makes a loan of $90 at 7%. The remaining of assets is G-Bond. We will ignore taxes for the moment. Bank A Cash Reserves for Deposit ? Loan 7% $90 G-Bond 5% ? Deposits 5% $70 Equity $40 Total Assets $? Total Equity and Deposit $110 If Cash Reserves for deposit is at least 8% of the deposit under the Basel Accord, how much of the G-Bond Bank A should purchase? $17 $14 $16 $18 $20 $15 $19 $21arrow_forwardNeed answers for D. 1, D. 2, and D. 3arrow_forward

- If a bank has $200,000 of checkable deposits, a required reserve ratio of 20 percent, and it holds $80,000 in reserves, then the maximum deposit outflow it can sustain without altering its balance sheet is A) $50,000. B) $40,000. C) $30,000. D) $25,000. Answer: A How to solve it?arrow_forward9. Bank leverage Use the information presented in Southwestern Mutual Bank's balance sheet to answer the following questions. Bank's Balance Sheet Assets Liabilities and Owners' Equity Reserves $150 Deposits $1,200 Loans $600 Debt $200 Securities $750 Capital (owners' equity) $100 Suppose a new customer adds $100 to his account at Southwestern Mutual Bank, which the owners of the bank then use to make $100 worth of new loans. This would increase the loans account and the account. This would also bring the leverage ratio from its initial value of to a new value of Which of the following do bankers take into account when determining how to allocate their assets? Check all that apply. The total value of liabilities The riskiness of each asset The size of the monetary basearrow_forwardImagine that the banking system's balance sheet can be represented by the following t-account: Assets LIABILITIES AND NET WORTH RESERVES 200 DEPOSITS 2000 BONDS 800 LOANS 1000 NETWORTH 0 TOTAL 2000 TOTAL 2000 Assuming the bank is "loaned up" the required reserve ratio is ___________ (round to two decimal places) The money multiplier is ___________ Imagine that the central bank uses open market operations to buy $300 worth of bonds from the bank above. Fill in the following t-account assuming that the money multiplier has taken its full effect: ASSETS LIABILITIES AND NET WORTH RESERVES __?___ DEPOSITS ___?__ BONDS ____?___ LOANS ____?____ NET WORTH ___?___ TOTAL _____?______ TOTAL ___?___arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education