EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

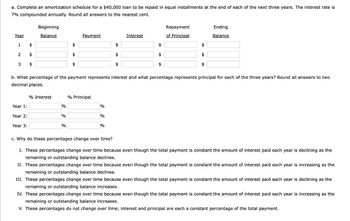

Transcribed Image Text:a. Complete an amortization schedule for a $40,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is

7% compounded annually. Round all answers to the nearest cent.

Year

Beginning

Balance

1

2

3

$

$

$

Repayment

Payment

Interest

of Principal

Ending

Balance

b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two

decimal places.

% Interest

% Principal

Year 1:

%

%

Year 2:

%

%

Year 3:

%

%

c. Why do these percentages change over time?

I. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the

remaining or outstanding balance declines.

II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the

remaining or outstanding balance declines.

III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the

remaining or outstanding balance increases.

IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the

remaining or outstanding balance increases.

V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- If Bergen Air Systems takes out a $100,000 loan, with eight equal principal payments due over the next eight years, how much will be accounted for as a current portion of a noncurrent note payable each year?arrow_forwardNext Level Potter wishes to deposit a sum that at 12% interest, compounded semiannually, will permit 2 withdrawals: 40,000 at the end of 4 years and 50,000 at the end of 10 years. Analyze the problem to determine the required deposit, stating the procedure to follow and the tables to use in developing the solution.arrow_forwarda. Set up an amortization schedule for a $19,000 loan to be repaid in equal installments atthe end of each of the next 3 years. The interest rate is 8% compounded annually.b. What percentage of the payment represents interest and what percentage representsprincipal for each of the 3 years? Why do these percentages change over time?arrow_forward

- a. Complete an amortization schedule for a $29,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 10% compounded annually. Round all answers to the nearest cent. Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 2 $ fill in the blank 3 $ fill in the blank 4 $ fill in the blank 5 $ fill in the blank 6 2 $ fill in the blank 7 $ fill in the blank 8 $ fill in the blank 9 $ fill in the blank 10 $ fill in the blank 11 3 $ fill in the blank 12 $ fill in the blank 13 $ fill in the blank 14 $ fill in the blank 15 $ fill in the blank 16 b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places. % Interest % Principal Year 1: fill in the blank 17% fill in the blank 18% Year 2: fill in the blank 19% fill in the blank 20% Year 3: fill in the…arrow_forwarda. Complete an amortization schedule for a $11,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 10% compounded annually. Round all answers to the nearest cent. Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 2 $ fill in the blank 3 $ fill in the blank 4 $ fill in the blank 5 $ fill in the blank 6 2 $ fill in the blank 7 $ fill in the blank 8 $ fill in the blank 9 $ fill in the blank 10 $ fill in the blank 11 3 $ fill in the blank 12 $ fill in the blank 13 $ fill in the blank 14 $ fill in the blank 15 $ fill in the blank 16 b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places. % Interest % Principal Year 1: fill in the blank 17% fill in the blank 18% Year 2: fill in the blank 19% fill in the blank 20% Year 3: fill in the…arrow_forward4) Set up an amortization schedule for a $25,000 loan to be repaid in equal installments at the end of each of the next 3 years. Interest rate is 10% compounded annually.a. What percentage of the payment represents interest and what percentage represents principal for each of the 3 years.arrow_forward

- Complete the next line of the schedule. arrow_forwardPrepare an amortization schedule for a three-year loan of $96,000. The interest rate is 9 percent per year, and the loan calls for equal annual payments. How much total interest is paid over the life of the loan? Year 1: Beginning Balance, Total Payment, Interest Payment, Principal Payment, Ending balance Year 2: Beginning Balance, Total Payment, Interest Payment, Principal Payment, Ending balance Year 3: Beginning Balance, Total Payment, Interest Payment, Principal Payment, Ending balance Total Interest for all 3 Years.arrow_forwardPrepare an amortization schedule for a five-year loan of $59,000. The interest rate is 7 percent per year, and the loan calls for equal annual payments. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Year BeginningBalance TotalPayment InterestPayment PrincipalPayment EndingBalance 1 $ $ $ $ $ 2 3 4 5 How much total interest is paid over the life of the loan? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Total interest paid $arrow_forward

- 5.Consider a $10,000 loan to be repaid in equal installments at the end of each of the next 5 years. The interest rate is 7%. a. Set up an amortization schedule for the loan. Round your answers to the nearest cent. Enter "0" if required Year Payment Repayment Interest Repayment of Principal Balance 1 $ $ $ $ 2 $ $ $ $ 3 $ $ $ $ 4 $ $ $ $ 5 $ $ $ $ Total $ $ $ b. c. How large must each annual payment be if the loan is for $20,000? Assume that the interest rate remains at 7% and that the loan is still paid off over 5 years. Round your answer to the nearest cent.$ d. How large must each payment be if the loan is for $20,000, the interest rate is 7%, and the loan is paid off in equal installments at the end of each of the next 10 years? This loan is for the same amount as the loan in part b, but the payments are spread out over twice…arrow_forwardDevelop a complete amortization table for a loan of $4500, to be paid back in 24 uniform monthly installments, based on an interest rate of 6%. The amortization table must include the Payment Number, Principal Owed (beginning of period), Interest Owed in Each Period, Total Owed (end of each period), Principal Paid in Each Payment, Uniform Monthly Payment Amount. You must also show the equations used to calculate each column of thetable. You are encouraged to use spreadsheets. The entire table must be shown.arrow_forwardComplete an amortization schedule for a 542, 000 loan to be repaid in equal instaliments at the end of each of the next 3 years. The interest rate is 7% compounded annually. If an amount is zero, enter "0". Do not round intermediate calculations. Round your answers to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning