Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

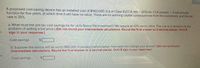

Transcribed Image Text:A proposed cost-saving device has an installed cost of $560,000. It is in Class 8 (CCA rate = 20%) for CCA purposes It will actually

function for five years, at which time it will have no value. There are no working capital consequences from the investment, and the tax

rate is 35%.

a What must the pre-tax cost savings be for us to favour the investment? We require an 12% return. (Hint This one is a variation on the

problem of setting a bid price.) (Do not round your intermediate calculations. Round the final answer to 2 decimal pleces. Omit S

sign in your response.)

Cost savings

b. Suppose the device will be worth $80.000 in salvage (before taxes). How does this change your answer? (Do not round your

intermediate calculations. Round the final answer to 2 decimal pieces. Omit S sign in your response.)

Cost savings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering a new product launch. The project will cost $820,000, have a 4-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 210 units per year; price per unit will be $16,400, variable cost per unit will be $11,300, and fixed costs will be $555,000 per year. The required return on the project is 12 percent, and the relevant tax rate is 24 percent. Based on your experience, you think the unit sales, variable cost, and fixed cost projections given here are probably accurate to within +10 percent. a. What are the best-case and worst-case NPVs with these projections? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. What is the base-case NPV? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What is the sensitivity of your base-case NPV to changes in fixed costs? Note: A…arrow_forwardSuppose you are considering an investment project that requires $800,000, has a six-year life, and has a salvage value of $100,000. Sales volume is projected to be 65,000 units per year. Price per unit is $63, variable cost per unit is $42, and fixed costs are $532,000 per year. The depreciation method is a five-year MACRS. The tax rate is 35% and you expect a 20% return on this investment.(a) Determine the break-even sales volume.(b) Calculate the cash flows of the base case over six years and its NPW.(c) lf the sales price per unit increases to $400, what is the required break-even volume?(d) Suppose the projections given for price, sales volume, variable costs, and fixed costs are all accurale to wi thin ± 15%. What would be the NPW figures of the best-case and worst-case scenarios?arrow_forwardYou are considering a new product launch. The project will cost $2,350,000, have a fouryear life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 330 units per year; price per unit will be $19,600, variable cost per unit will be $14,000, and fixed costs will be $720,000 per year. The required return on the project is 10 percent, and the relevant tax rate is 21 percent. a. Based on your experience, you think the unit sales, variable cost, and fixed cost projections given here are probably accurate to within +-10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your NPV answers to 2 decimal places, e.g., 32.16. Round your other answers to the nearest whole number, e.g. 32.) \table[[Scenario,Unit Sales,Variable Cost,Fixed…arrow_forward

- What is the payback period on each of the above projects? Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept? Why? If you use a cutoff period of three years, which projects would you accept? Why? If the opportunity cost of capital is 10%, which projects have positive NPVs? How do you know? “If a firm uses a single cutoff period for all projects, it is likely to accept too many short-lived projects.” Is this statement true or false? How do you know? If the firm uses the discounted-payback rule, will it accept any negative NPV projects? Will it turn down any positive NPV projects? How do you know?arrow_forwardAn investment project requires an initial payment of $500,000, and then will earn a constant return of $45,000 every year forever. Is this a profitable investment project? Oyes, it is profitable O you can't tell with this information Ono, it is not profitablearrow_forwardYou are considering a new product launch. The project will cost $960,000, have a 5-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 350 units per year; price per unit will be $15,955, variable cost per unit will be $12,000, and fixed costs will be $625,000 per year. The required return on the project is 10 percent, and the relevant tax rate is 23 percent. Based on your experience, you think the unit sales, variable cost, and fixed cost projections given here are probably accurate to within +10 percent. a. What are the best-case and worst-case NPVs with these projections? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. What is the base-case NPV? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What is the sensitivity of your base-case NPV to changes in fixed costs? Note: A…arrow_forward

- We are evaluating a project that costs RM604,000, has an 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 55,000 units per year. Price per unit is RM36, variable cost per unit is RM17, and fixed costs are RM685,000 per year. The tax rate is 21 percent and we require a return of 15 percent on this project. (i) Calculate the base-case cash flow and NPV., (ii) Assume the sales figure increases to 56,000 units per year, calculate the sensitivity of NPV to changes in the sales figure?arrow_forwardmartin development company is deciding whether to proceed with Project X. The cost would be $9 million in year 0, there is a 50% chance that X would be hugely successful and would generate a cash after tax flow of $6 million per year during years 1, 2 and three. however there is a 50% chance that X would be less successful and would generate only $1 million per year for the three years. If Project X is hugely successful it would open the door to another investment project why which would require an outlay of 10 million dollars at the end of year 2. project Y would then be sold to another company at a price of $20 million at the end of year 3 Martins weighted average cost of capital is 11%. A)if the company does not consider real options what is Project X expected NPV? b) What is X is expected NPV with the growth option? c)what is the value of the growth option?arrow_forwardYou are considering a risk-free investment that costs $4000 and pays $5000 in one year. You can either pay all cash for the investment or you can borrow part and pay cash for the other part. If you borrow $2000, you will be required to pay back $2080 in one year. The risk-free rate is 4%. What is the project’s NPV? Is the NPV affected if you borrow some of the funds?arrow_forward

- Need help with entire problem.arrow_forwardConsider a project with a 3-year life and no salvage value. The initial cost to set up the project is $100,000. This amount is to be linearly depreciated to zero over the life of the project. The price per unit is $90, variable costs are $72 per unit and fixed costs are $10,000 per year. The project has a required return of 12%. Ignore taxes. 1. How many units must be sold for the project to achieve accounting break-even? 2. How many units must be sold for the project to achieve cash break-even? 3. How many units must be sold for the project to achieve financial break-even? 4. What is the degree of operating leverage at the financial break-even?arrow_forwardYou are considering a new product launch. The project will cost $1.675 million, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 195 units per year; price per unit will be $16,300; variable cost per unit will be $9,400; and fixed costs will be $550,000 per year. The required return on the project is 12 percent and the relevant tax rate is 21 percent. a. Based on your experience, you think the unit sales, variable cost, and fixed cost projections given above are probably accurate to within ±10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios? (A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and round your NPV answers to 2 decimal places, e.g., 32.16.) Scenario Upper bound Lower bound Unit sales 214 175 units Variable cost per unit $ 10,340 $ 8,480 Fixed costs $ 605,000 $ 495,000 Scenario…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education