Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

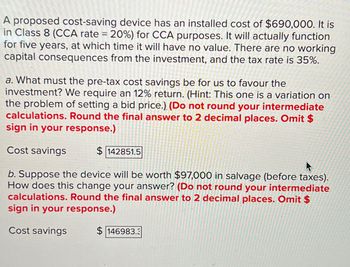

Transcribed Image Text:A proposed cost-saving device has an installed cost of $690,000. It is

in Class 8 (CCA rate = 20%) for CCA purposes. It will actually function

for five years, at which time it will have no value. There are no working

capital consequences from the investment, and the tax rate is 35%.

a. What must the pre-tax cost savings be for us to favour the

investment? We require an 12% return. (Hint: This one is a variation on

the problem of setting a bid price.) (Do not round your intermediate

calculations. Round the final answer to 2 decimal places. Omit $

sign in your response.)

Cost savings

$142851.5

b. Suppose the device will be worth $97,000 in salvage (before taxes).

How does this change your answer? (Do not round your intermediate

calculations. Round the final answer to 2 decimal places. Omit $

sign in your response.)

Cost savings

$146983.3

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? If the firm wants 15% return on investment after taxes, it can afford to pay ?.arrow_forwardwhat is the present value of the tax shield for the following project? the initial investment is $300,000. the project will last for 6 years, at which time the asset will be sold for $90,000. the asset will be depreciated on a declining balance basis at a rate of 20 percent. the firm's marginal tax rate is 40 percent. the firm's required rate of return is 8 percent a) 16,204.36 b) 82,539.68 c) 98,744.04 d) 66,335.32arrow_forwardAn investment project requires an initial payment of $500,000, and then will earn a constant return of $45,000 every year forever. Is this a profitable investment project? Oyes, it is profitable O you can't tell with this information Ono, it is not profitablearrow_forward

- martin development company is deciding whether to proceed with Project X. The cost would be $9 million in year 0, there is a 50% chance that X would be hugely successful and would generate a cash after tax flow of $6 million per year during years 1, 2 and three. however there is a 50% chance that X would be less successful and would generate only $1 million per year for the three years. If Project X is hugely successful it would open the door to another investment project why which would require an outlay of 10 million dollars at the end of year 2. project Y would then be sold to another company at a price of $20 million at the end of year 3 Martins weighted average cost of capital is 11%. A)if the company does not consider real options what is Project X expected NPV? b) What is X is expected NPV with the growth option? c)what is the value of the growth option?arrow_forwardNeed help with entire problem.arrow_forwardA corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when /- 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay thousand for this machine. (Round to one decimal place.)arrow_forward

- 3. Schultz Company is considering purchasing a machine that would cost $478,800 and have a useful life of 5 years. The machine would reduce cash operating costs by $114,000 per year. The machine would have a salvage value of $6,200. Schultz Company prefers a payback period of 3.5 years or less.Required: a. Compute the payback period for the machine. What does this mean? b. Compute the return on average investment (ROI)arrow_forwardA firm is considering taking a project that will produce $12 million of revenue per year. Cash expenses will be $5 million, and depreciation expenses will be $1 million per year. If the firm takes that project, then it will reduce the cash revenues of an existing project by $3 million. What is the free cash flow on the project, per year, if the firm uses a 40 percent marginal tax rate? O$2.8 million O $2.4 million 0 $4.6 million $3.4 millionarrow_forwardPlease solve it as soon as possible! . Consider an asset with an initial cost of $100,000 and no salvage value. Compute the difference in the present value of the tax shields if CCA is calculated at 20% declining balance compared to if CCA is calculated using a five-year, straight line write off. For your calculation use 30% as the tax rate and 16% as the required return. (The half-year rule applies.) The difference, to the nearest dollar, is A S1.724 B $4,129 C S4.483 d. 59,517 e.$49,969arrow_forward

- Given the following information, what is the financial break-even point? Initial investment = $250,000; variable cost = $95; fixed cost = $58,000; price = $130; life = 6 years; required return = 12%; SL depreciation; before-tax salvage value of assets = $28,000; initial net working capital investment = $35,000, and tax rate is 21%. Do It correctly I'll ratearrow_forwardA project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27,300 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim 100% bonus depreciation on the investment. Suppose the opportunity cost of capital is 10%. Ignore inflation.a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.)arrow_forwardProject A has an internal rate of return of 10%. Project B costs £100 this year and will generate a cash flow of £105 next year. The two projects are not mutually exclusive. 1. The company should only undertake project A 2. If the appropriate discount rate is below 10%, the company should invest in both projects 3. If the appropriate discount rate is above 5% the company should invest in both projects 4. If the appropriate discount rate is above 5%, the company should not undertake project Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education