Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

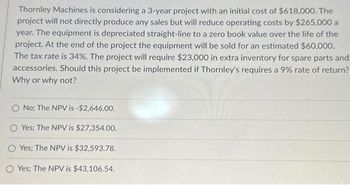

Transcribed Image Text:Thornley Machines is considering a 3-year project with an initial cost of $618,000. The

project will not directly produce any sales but will reduce operating costs by $265,000 a

year. The equipment is depreciated straight-line to a zero book value over the life of the

project. At the end of the project the equipment will be sold for an estimated $60,000.

The tax rate is 34%. The project will require $23,000 in extra inventory for spare parts and

accessories. Should this project be implemented if Thornley's requires a 9% rate of return?

Why or why not?

O No; The NPV is -$2,646.00.

O Yes; The NPV is $27,354.00.

OYes; The NPV is $32,593.78.

O Yes; The NPV is $43,106.54.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Tree's Ice Cubes is considering a new three-year expansion project. The initial fixed asset investment will be $1.80 million and the fixed assets will be depreciated straight-line to zero over its three-year tax life, after which time the assets will be worthless. The annual sales of the project is estimated to be $1,005,000, with costs of $485,000. What is the OCF for this project, if the tax rate is 21 percent? (Do not round intermediate calculations.) Multiple Choice $536,800 $812,246 $544,200 $616,150 $746150arrow_forwardfirm is considering purchasing a machine that costs $77,000. It will be used for six years, and the salvage value at that time is expected to be zero. The machine will save $41,000 per year in labor, but it will incur $16,000 in operating and maintenance costs each year. The machine will be depreciated according to five-year MACRS. The firm's tax rate is 35%, and its after-tax MARR is 18%. What is the present worth of the project?arrow_forwardQuad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three year tax life, after which time it will be worthless. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The tax rate is 35%. What is the NPV of the project if the required rate of return is 12% O $47,523 O $59,255 O $68.991 O $52.648arrow_forward

- Gateway Communications is considering a project with an initial fixed assets cost of $1.58 million that will be depreciated straight-line to a zero book value over the 9-year life of the project. At the end of the project the equipment will be sold for an estimated $237,000. The project will not change sales but will reduce operating costs by $393,000 per year. The tax rate is 34 percent and the required return is 11.2 percent. The project will require $50,500 in net working capital, which will be recouped when the project ends. What is the project's NPV? Multiple Choice $242,544 $202,140 $250,629 $233,215 $193,351arrow_forwardGateway Communications is considering a project with an initial fixed assets cost of $1.47 million that will be depreciated straight-line to a zero book value over the 9-year life of the project. At the end of the project the equipment will be sold for an estimated $248,000. The project will not change sales but will reduce operating costs by $415,000 per year. The tax rate is 21 percent and the required return is 12.3 percent. The project will require $56,000 in net working capital, which will be recouped when the project ends. What is the project's NPV? Multiple Choice O $256,094 $584,027 $193,231 $238,300 $247,833arrow_forwardHoffman company is considering a project that would have a five-year life and require a $3,200,000 investment in equipment. At the end of the five years, the project would terminate and the equipment would have no salvage value. The project would provide the following expected forecasts: Sales $ 5,000,000 Variable expenses $3,000,000 Fixed expenses (including depreciation) $1,600,000 The company’s tax rate is 20% and the WACC is 12% REQUIRED Compute the project’s NPV, IRR, payback period, discounted payback period, and profitability indexarrow_forward

- Daily Enterprises is purchasing a $10.33 million machine. It will cost $69,436.00 to transport and install the machine. The machine has a depreciable life of five years using the straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.10 million per year along with incremental costs of $1.19 million per year. Daily's marginal tax rate is 37.00%. The cost of capital for the firm is 13.00%. (answer in dollars..so convert millions to dollars) The project will run for 5 years. What is the NPV of the project at the current cost of capital?arrow_forwardThe management of Kunkel Company is considering the purchase of a $21,000 machine that would reduce operating costs by $5,000 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 12%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?arrow_forwardFitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 3-year tax life, after which it will have zero book value, and it will be depreciated by the straight-line method over 3 years. Revenues and other operating costs are expected to be constant over the project's 4-year life. What is the project's Year 4 cash flow? $65,000 Equipment cost (depreciable basis) Straight-line depreciation rate Sales revenues, each year Operating costs (excl. deprec.) Tax rate a. $27,500 b. $28,438 c. $22,750 d. $21,000 e. $30,333 33.33% $60,000 $25,000 35.0%arrow_forward

- We are evaluating a project that costs $630,700, has a seven-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 90,000 units per year. Price per unit is $46, variable cost per unit is $33, and fixed costs are $720,000 per year. The tax rate is 25 percent, and we require a return of 10 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±15 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case Worst-casearrow_forwardThe Bruin's Den Outdoor Gear is considering a new 7-year project to produce a new tent line. The equipment necessary would cost $1.83 million and be depreciated using straight-line depreciation to a book value of zero. At the end of the project, the equipment can be sold for 10 percent of its initial cost. The company believes that it can sell 29,000 tents per year at a price of $75 and variable costs of $34 per tent. The fixed costs will be $505,000 per year. The project will require an initial investment in net working capital of $237,000 that will be recovered at the end of the project. The required rate of return is 11.8 percent and the tax rate is 21 percent. What is the NPV?arrow_forwardWendy and Wayne are evaluating a project that requires an initial investment of $792,000 in fixed assets. The project will last for fourteen years, and the assets have no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 143,000 units per year. Price per unit is $43, variable cost per unit is $24, and fixed costs are $800,712 per year. The tax rate is 36 percent, and the required annual return on this project is 12 percent. The projections given for price, quantity, variable costs, and fixed costs are all accurate to within +/- 15 percent. Required: (a)Calculate the best-case NPV. (Do not round your intermediate calculations.) (Click to select) (b)Calculate the worst-case NPV. (Do not round your intermediate calculations.) (Click to select) Warrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education