FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please need answer not use chatgpt

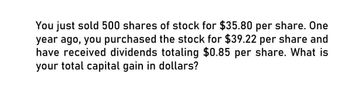

Transcribed Image Text:You just sold 500 shares of stock for $35.80 per share. One

year ago, you purchased the stock for $39.22 per share and

have received dividends totaling $0.85 per share. What is

your total capital gain in dollars?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you answer this accounting question?arrow_forwardYou just purchased a share of SPCC for $97.95. You expect to receive a dividend of $5.64 in one year. If you expect the price after the dividend is paid to be $107.44, what total return will you have earned over the year? What was your dividend yield? Your capital gain rate? The total return you will have earned over the year is %. (Round to two decimal places.)arrow_forwardYou bought a stock one year ago for $50.01 per share and sold it today for $55.64 per share. It paid a $1.45 per share dividend today. a. What was your realized return? b. How much of the return came from dividend yield and how much came from capital gain?arrow_forward

- You bought a stock one year ago for $48.45 per share and sold it today for $57.58 per share. It paid a $1.93 per share dividend today. If you assume that the stock fell $5.23 to $43.22 instead. Is your capital gain different? Why or why not?arrow_forwardYou bought a stock one year ago for $51.79 per share and sold it today for $57.42 per share. It paid a $1.03 per share dividend today. What was your realized return?arrow_forwardYou bought a stock one year ago for $50.00 per share and sold it today for $55.00 per share. It $1.00 per share dividend today. How much of the retúrn came from dividend yield and how much from capital gain? The return that came from dividend yield is (Round to one decimal place.) %arrow_forward

- One year ago, you bought a stock for $50.39 a share. You received a dividend of $2.97 per share last month and sold the stock today for $49.58 a share. What is the capital gains yield (in percent) on this investment? Correct pls.arrow_forwardYou bought a stock one year ago for $49.83 per share and sold it today for $59.22 per share. It paid a $1.74 per share dividend today. How much of the return came from dividend yield and how much came from capital gain? ..... The return that came from dividend yield is %. (Round to one decimal place.)arrow_forwardYou bought a stock one year ago for $48.83 per share and sold it today for $55.56 per share. It paid a$1.01 per share dividend today. If you assume that the stock fell $4.01 to $44.82instead: a. Is your capital gain different? Why or why not? b. Is your dividend yield different? Why or why not?arrow_forward

- One year ago, you bought a stock for $57.04 a share. You received a dividend of $2.61 per share last month and sold the stock today for $49.23 a share. What is the capital gains yield (in percent) on this investment? Answer to two decimalsarrow_forwardYou bought a stock one year ago for $51.41 per share and sold it today for $59.25 per share. It paid a $1.37 per share dividend today. How much of the return came from dividend yield and how much came from capital gain? The return that came from dividend yield is %. (Round to two decimal places.)arrow_forwardLast year you bought 100 shares of NC Corp. common stock for P53 per share. During the year you received dividends of P1.45 per share. The stock is currently selling for P60 per share. What rate of return did you earn over the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education