Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer in step by step with explanation.

Don't use

Transcribed Image Text:Prob

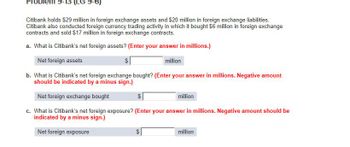

-13 (LG 9-6)

Citibank holds $29 million in foreign exchange assets and $20 million in foreign exchange liabilities.

Citibank also conducted foreign currency trading activity in which it bought $6 million in foreign exchange

contracts and sold $17 million in foreign exchange contracts.

a. What is Citibank's net foreign assets? (Enter your answer in millions.)

Net foreign assets

$

million

b. What is Citibank's net foreign exchange bought? (Enter your answer in millions. Negative amount

should be indicated by a minus sign.)

Net foreign exchange bought

$

million

c. What is Citibank's net foreign exposure? (Enter your answer in millions. Negative amount should be

indicated by a minus sign.)

Net foreign exposure

69

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- M6arrow_forward20 - If the exchange rates have risen, the value of the (forward) checks and debt securities will increase. To which account is this increase in value recorded?A) 656. Foreign Exchange Losses accountB) 100. Cash accountC) 646. Foreign Exchange Profits accountD) 950. Currencies in the Safe Deposit AccountE) 612. Other Discounts accountarrow_forwardBelow is the balance sheet for Longhorn Bank, a private bank. As a commercial bank, Longhorn Bank faces a 10% reserve requirement. This scenario applies to the questions 34 - 38. ASSETS LIABILITIES Customer Reserves deposits $1,000,000 $150,000 Loans to households and biz $850,000arrow_forward

- Suppose you work at the FOREX desk of a multinational bank. No particular country is the home country for you as your responsibility is to conduct foreign exchange trade in whichever way is profitable for the bank. Using this as your guideline, consider the following data: S0 = ¥92/US$ S180 = ¥92/US$ IUS = 2% per annum IJapan = 0.09% per annum With a starting amount of US$10 million or its Yen equivalent, can you make a UIA profit? What if a CIA was conducted at F180 of ¥90/US$? What are your observations?arrow_forwardPeter Sheffield has Euros (€) amounting to €500,000 and is provided with the following quotes: Bank A: Euro/US dollar = €0.8418/$ Bank A: British pound /US dollar = £0.7538/S Bank B: British pound/Euro = £0.8863/€ Determine whether an arbitrage opportunity exists. Show your calculation in the space below and briefly explain (in one or two sentences) why the arbitrage opportunity exists or not. For example, show your calculation as follows (The currencies used in the example are not applicable to your calculation. It just provide you with information how you should show your calculation): Yen/ZAR = 11.7654/1.3954 = 8.4316 (Round your answer to 4 decimals) Reason why arbitrage opportunity exists/ does not exist:arrow_forwardAMg eru w Question The economy records the following transactions: . Imports of goods and services: $1569 billion Exports of goods and services: $1152 billion . Interest paid to the rest of the world: $500 billion Interest received from the rest of the world: $400 billion . US official reserves, -$10 billion Net Transfers: -$81 billion Investment in US from foreigners: $1440 . US investment abroad: $860 a. Calculate the Current Account balance, the Financial Account (Capital ACcount) balance: (No Dollar symbols) CA Balance: (hint: answer is negative) FA Balance: b. What is the statistical discrepancy? c. Is this country an 'Importer' or 'Exporter' of goods and services?arrow_forward

- (14)arrow_forwardInternational financial management : MCQ Assume the Canadian dollar is equal to £0.51 and the Peruvian Sol is equal to £0.16. The value of the Peruvian Sol in Canadian dollar is: (a) about 3.1875 Canadian dollars. (b) about .3137 Canadian dollars. (c) about 2.36 Canadian dollars. (d) about .3137 British pound (e) about .3137 Peruvian Sol. 2. Assume that a bank’s bid rate on Swiss francs is £0.25 and its ask rate is £0.26. Its bid-ask percentage spread is: (a) about 3.85 (b) about 4.00% (c) about 3.55% (d) about 4.15%arrow_forwardAmazing Corporation recorded £1,000,000(pound) in Accounts Receivables for sales to a customer in the U.K. If the company recorded a foreign currency exchange gain on its receivables, it means that the Pound was ___________________ (one word - depreciated or appreciatedarrow_forward

- Translate into dollars the balance sheet of Nevada Leather Goods' Spanish subsidiary. When Nevada Leather Goods acquired the foreign subsidiary, a euro was worth $1.07. The current exchange rate is $1.36. During the period when retained earnings were earned, the average exchange rate was $1.18 per euro. E (Click the icon to view the financial data.) Requirement During the period covered by this situation, which currency was stronger, the dollar or the euro? 870,000 Assets Liabilities 560,000 Shareholders' equity Share capital 75,000 Retained earnings 235,000 Foreign-currency translation adjustment 870,000 During this period, the was stronger than the V The V produced the V translation adjustment. Choose from any list or enter any number in the input fields and then continue to the next question.arrow_forwardBalance-of-payments double-entry bookkeeping. Show how the following transactions should be recorded in the U.S. balance of payments using a double-entry accounting system: ■ Newmont Mining—a U.S. mining concern—exports $400 million worth of copper to China and is paid in the form of a payment drawn on a U.S. bank. ■ DuPont expands its plastics manufacturing capacity in its Polish plant by investing $250 million financed by a dollar bond issue in London (United Kingdom). ■ The central bank of the People’s Bank of China purchases $2.5 billion in the foreign exchange market to slow down the appreciation of the renmimbi. The dollars are invested in five-year U.S. Treasury bonds. ■ The U.S. government provides food assistance to Sudanese refugees in the amount of $25 million worth of flour.arrow_forwardCase 1. The following data are taken from the records of Elite Imports Company, a foreign subsidiary in New Zealand. NZ dollar Total Assets 12/31/20 146,000 Total Liabilities 45,000 Common Stock 12/31/20 60,000 Retained Earnings 01/01/20 29,000 Net Income 2020 15,000 Dividends Declared 12/31/20 3,000 Exchange rates:Closing/Current rate P 10Historical rate P11Weighted Average Rate P12 The peso balance of retained earnings on December 31, 2019 is P325,000.1. Compute the Cumulative Translation Adjustment reported in the Consolidated Statement of Financial Position on December 31, 2020 Group of answer choices a. 25,000 debit b. 122,000 debit c. 116,000 credit d. 125,000 creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning