EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please Provide help with this Question

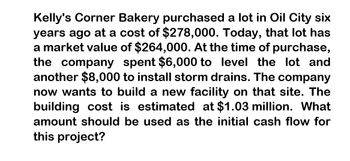

Transcribed Image Text:Kelly's Corner Bakery purchased a lot in Oil City six

years ago at a cost of $278,000. Today, that lot has

a market value of $264,000. At the time of purchase,

the company spent $6,000 to level the lot and

another $8,000 to install storm drains. The company

now wants to build a new facility on that site. The

building cost is estimated at $1.03 million. What

amount should be used as the initial cash flow for

this project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kelly's Corner Bakery purchased a lot in Oil City 6 years ago at a cost of $302,000. Today, that lot has a market value of $340,000. At the time of the purchase, the company spent $15,000 to level the lot and another $20,000 to install storm drains. The company now wants to build a new facility on that site. The building cost is estimated at $1.51 million. What amount should be used as the initial cash flow for this project?arrow_forwardKelly’s Corner Bakery purchased a lot in Oil City 6 years ago at a cost of $302,000. Today, that lot has a book value of zero and market value of $340,000. At the time of the purchase, the company spent $15,000 to level the lot and another $20,000 to install storm drains. The company now wants to build a new facility on that site. The building cost is estimated at $1.51 million, and will be depreciated using the straight-line method to a $400,000 book value over the 6-year life of the project. The company is evaluates this new facility will increase annual sales by $1.2 million and annual cash costs by $0.5 million. Based on past information, the company believes that it can sell the facility for $800,000 when they are done with it in 6 years. The applicable tax rate is 32 percent. What is the net present value of the project if the required rate of return is 10 percent?arrow_forwardParker & Stone, Inc., is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land 5 years ago for $7,385,474 in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net $3,944,875. An engineer was hired to study the land at a cost of $617,920, and her conclusion was that the land can support the new manufacturing facility. The company wants to build its new manufacturing plant on this land; the plant will cost $5,838,309 to build, and the site requires $994,648 worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project?arrow_forward

- Parker & Stone, Inc., is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land 6 years ago for $5,397,921 in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net $3,370,355. An engineer was hired to study the land at a cost of $559,424, and her conclusion was that the land can support the new manufacturing facility. The company wants to build its new manufacturing plant on this land; the plant will cost $4,394,972 million to build, and the site requires $1,358,566 worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project?arrow_forwardCompany A purchased a corner lot five years ago at a cost of $134000. The lot was recently appraised at $119000. At the time of the purchase, the company spent $2100 to grade the lot and another $24000 to build a small building on the lot to house a parking lot attendant who has overseen the use of the lot for daily commuter parking. The company now wants to build a new retail store on the site. The building cost is estimated at $126000. What amount should be used as the initial cash flow for this building project?arrow_forwardKelly's Corner Bakery purchased a lot in Oil City six years ago at a cost of 100000. Today, that lot has a market value of $120000. At the time of the purchase, the company spent $6,500 to level the lot and another $12,000 to install storm drains. The company now wants to build a new facility on the site at an estimated cost of $500000. What amount should be used as the initial cash flow for this project?arrow_forward

- The Square Market has decided to expand its retail store by building on a vacant lot it currently owns. This lot was purchased four years ago at a cost of $299,000, which the firm paid in cash. To date, the firm has spent another $38,000 on land improvements, all of which was also paid in cash. Today, the lot has a market value of $329,000. What value should be included in the analysis of the expansion project for the cost of the land? a) The sum of the cash paid to date for both the lot and the improvements b) The current market value of the land plus the cash paid for the improvements c) The current market value of the land d) Zero because the land and the improvements were purchased with casharrow_forwardAn eco-industrial park has a manufacturing plant which purchased a lathe machine for P57,500 seven years ago. A reserve for machine replacement has been provided using straight-line depreciation accounting its 20 years life span. The plant manager has decided to replace the old machine with a newer model costing P95,000. The manager can sell the old machine for P17,500. What is the amount of the additional capital needed to purchase the new machine?arrow_forwardSampson Corporation is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder. The existing grinder was purchased two years ago at an installed cost of $60,000; it was being depreciated under MACRS, using a five year recovery period. The existing grinder is expected to have a usable life of five more years. The new grinder has a cost of $105,000 and requires $5,000 in installation costs; it has a five year usable life and would be depreciated under MACRS, using a five year recovery period. Sampson can currently sell the existing grinder for $70,000 without incurring any removal and cleanup costs. To support theincreased business resulting from the purchase of the new grinder, accounts receivable would increase by $40,000, inventories by $30,000 and accounts payable by $58,000. At the end of five years, the existing grinder would have a market value of zero; the new grinder would be sold to net $29,000 after removal and clean up costs and before…arrow_forward

- Riley Co. purchased a parcel of land six years ago for $768,500. At that time, the firm invested $120,000 in grading the site so that it would be usable. Since the firm wasn't ready to use the site itself at that time, it decided to lease the land for $41,500 a year. The company is now considering building a warehouse on the site as the rental lease is expiring. The current value of the land is $652,000. What value should be included in the initial cost of the warehouse project for the use of this land? O $858,500 O $642,000 O $888,500 O $0 O $652.000arrow_forwardWTF Ltd is considering replacing its old fully depreciated forklift with a new model. Two months ago, WTF paid LMAO Consulting $14,000 in consulting fees to help them evaluate the various forklifts on offer. Your manager suggests this consulting fee be spread over the life of the project. The cost of the recommended forklift is $52,000. The consultants estimate the old forklift will be able to be sold today for a salvage value of $20,000. In addition, WTF has estimated it will need to increase its holdings of inventory from $7,000 to $36,000 at the start of the project. The company tax rate is 30%. What is the total cash flow at the start of the project (report your answer to the nearest dollar)?arrow_forwardFreida Company is considering an asset replacement project ofreplacing a control device. This old control device has been fullydepreciated but can be sold for $5,000. The new control device, whichis more automated, will cost $42,000. The new device’s installation andshipping costs will total $16,000. The new device will be depreciatedon a straight-line basis over its 2-year economic life to an estimatedsalvage value of $0. The actual salvage value of this device at the endof 2-year period (That is, the market value of the device at the end of2-year period) is estimated to be $4,000. If the replacement project is accepted, Freida will require an initial working capital investment of$2,200 (that is, adding $2,200 initially to its net working capital).During the 1st year of operations, Freida expects its annual revenue toincrease from $72,800 to $90,000. After the 1st year, revenues fromthe replacement are expected to increase at a rate of $2,800 a year forthe remainder of the project…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT