FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

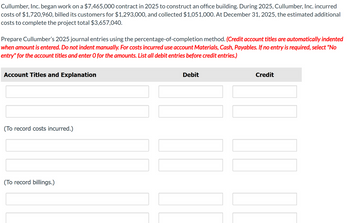

Transcribed Image Text:Cullumber, Inc. began work on a $7,465,000 contract in 2025 to construct an office building. During 2025, Cullumber, Inc. incurred

costs of $1,720,960, billed its customers for $1,293,000, and collected $1,051,000. At December 31, 2025, the estimated additional

costs to complete the project total $3,657,040.

Prepare Cullumber's 2025 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented

when amount is entered. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select "No

entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

(To record costs incurred.)

(To record billings.)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pharoah, Inc. began work on a $6,909,000 contract in 2025 to construct an office building. During 2025, Pharoah, Inc. incurred costs of $1,791,800, billed its customers for $1,174,000, and collected $1,035,000. At December 31, 2025, the estimated additional costs to complete the project total $3,478,200. Prepare Pharoah's 2025 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Construction in Process Materials, Cash, Payables (To record costs incurred.) Accounts Receivable Billings on Construction in Process (To record billings.) cash Accounts Receivable (To record collections.) Construction in Process Construction Expenses Revenue from Long-Term…arrow_forwardFlounder, Inc. began work on a $6,504,000 contract in 2020 to construct an office building. During 2020, Flounder, Inc. incurred costs of $1,639,900, billed its customers for $1,300,000, and collected $1,055,000. At December 31, 2020, the estimated additional costs to complete the project total $3,650,100.Prepare Flounder’s 2020 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.)arrow_forwardSandhill Inc. began work on a $8,900,000 non-cancellable contract in 2023 to construct an office building. During 2023, Sandhill incurred costs of $1,672,000, billed its customers for $1,450,000 (non-refundable), and collected $900,000. At December 31, 2023, the estimated future costs to complete the project totalled $2,728,000. Prepare Sandhill's 2023 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record cost of construction) (To record progress billings) (To record collections) (To record revenues) (To record construction expenses) Debit Creditarrow_forward

- Pina, Inc. began work on a $6,759,000 contract in 2020 to construct an office building. During 2020, Pina, Inc. incurred costs of $1,641,860, billed its customers for $1,319,000, and collected $1,054,000. At December 31, 2020, the estimated additional costs to complete the project total $3,187,140.Prepare Pina’s 2020 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record costs incurred enter a debit amount enter a credit amount enter an account title to record costs incurred enter a debit amount enter a credit amount (To record costs incurred.) enter an account title to record billings enter a debit amount enter a…arrow_forwardNovak, Inc. began work on a $ 6,466,000 contract in 2020 to construct an office building. During 2020, Novak, Inc. incurred costs of $ 1,547,340, billed its customers for $ 1,085,000, and collected $ 1,013,000. At December 31, 2020, the estimated additional costs to complete the project total $ 3,003,660.Prepare Novak’s 2020 journal entries using the percentage-of-completion methodarrow_forwardGrouper, Inc. began work on a $6,491,000 contract in 2020 to construct an office building. During 2020, Grouper, Inc. incurred costs of $1,941,020, billed its customers for $1,138,000, and collected $904,000. At December 31, 2020, the estimated additional costs to complete the project total $3,304,980.Prepare Grouper’s 2020 journal entries using the percentage-of-completion method.arrow_forward

- Turner, Inc. began work on a $7,000,000 contract in 2020 to construct an office building. During 2020, Turner, Inc. incurred costs of $1,700,000, billed its customers for $1,200,000, and collected $960,000. At December 31, 2020, the estimated additional costs to complete the project total $3,300,000. Prepare Turner's 2020 journal entries using the percentage-of-completion method.arrow_forwardCurtiss Construction Company, Incorporated, entered into a fixed-price contract with Axelrod Associates on July 1, 2024, to construct a four-story office building. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,720,000. The building was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: At 12-31-2024 At 12-31-2025 At 12-31-2026 Percentage of completion 10% 60% 100% Costs incurred to date $ 371,000 $ 3,024,000 $ 5,102,000 Estimated costs to complete 3,339,000 2,016,000 0 Billings to Axelrod, to date 732,000 2,410,000 4,720,000 Required: Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not…arrow_forwardCurtiss Construction Company, Incorporated, entered into a fixed price contract with Axelrod Associates on July 1, 2024, to construct a four story office building. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,240,000 The building was completed on December 31, 2026 Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows Percentage of completion Cests incurred to date Estimated costs to complete Billings to Axelrod, to date Required: At 12-11-2024 10% At 12-31-2025 $2,688,000 1,792,000 AT 12-11-2026 60% 100% $ 4,534,000 4,240,000 $363,000 3,267,000 724,000 2,250,000 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue…arrow_forward

- Grein's Construction Company, entered into a fixed-price contract with Alexa Co. on July 1, 2024, to construct a four-story office building. At that time, Grein's estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,420,000. The building was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: Costs incurred to date Estimated costs to complete Billings to Axelrod, to date At 12-31-2024 $366,000 3,294,000 727,000 Year 2024 2025 2026 At 12-31-2025 $ 2,814,000 1,876,000 2,310,000 Gross Profit (Loss) Recognized At 12-31-2026 $4,747,000 0 Assuming Grein's recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. If there is a loss, put the number in…arrow_forwardStarks firm wanted to construct a new parking lot and storage area and for that reason they signed a 5 Million contract with Lannister company limited. The work began during March 2022 and the project was completed by the end of 2024. You have the following notes related to each year: Year 1: at the end of 2022 the estimated total cost for the contract was 4,000,000 in which one quarter incurred by the end of 2022. The company billed the contractor with 30%(70% of billed amount was collected during the year) Year 2: at the end of 2023 total estimated cost increased by 30 % from last year estimations and the company's cost to date were 3 Million. The company billed the contractor with 70% in both years (year 1 and year2) (70% of billed amount was collectedduring year 1 and year 2) Year 3: the company finished the contract with total cost of 5.4 Million. The remaining of unbilled revenues was billed during the last year and only 5% remained uncollected.arrow_forwardCrane, Inc. began work on a $6,499,000 contract in 2025 to construct an office building. Crane uses the cost-recovery method. At December 31, 2025, the balances in certain accounts were Construction in Process $1,757,000, Accounts Receivable $260,000, and Billings on Construction in Process $1,055,000. Indicate how these accounts would be reported in Crane's December 31, 2025, balance sheet. (List assets in order of liquidity.) Current Assets 1 I CRANE, INC. Balance Sheet For the Year Ended December 31, 2025arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education