FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

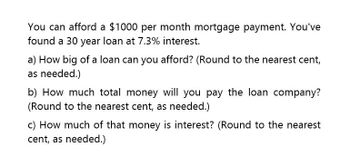

Transcribed Image Text:You can afford a $1000 per month mortgage payment. You've

found a 30 year loan at 7.3% interest.

a) How big of a loan can you afford? (Round to the nearest cent,

as needed.)

b) How much total money will you pay the loan company?

(Round to the nearest cent, as needed.)

c) How much of that money is interest? (Round to the nearest

cent, as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You can afford a $1500 per month mortgage payment. You've found a 30 year loan at 5.7% interest.a) How big of a loan can you afford? (Round to the nearest cent, as needed.)b) How much total money will you pay the loan company? (Round to the nearest cent, as needed.)c) How much of that money is interest? (Round to the nearest cent, as needed.)arrow_forwardYou can afford a $1200 per month mortgage payment. You've found a 30 year loan at 6.1% interest. a) How big of a loan can you afford? (Round to the nearest cent, as needed.) b) How much total money will you pay the loan company? (Round to the nearest cent, as needed.) S c) How much of that money is interest? (Round to the nearest cent, as needed.) Question Help: Video 1 Submit Question Video 2 Search wwww.gar aarrow_forwardYou can afford a $1400 per month mortgage payment. You've found a 30 year loan at 5.5% interest. a) How big of a loan can you afford? (Round to the nearest cent, as needed.) LA b) How much total money will you pay the loan company? (Round to the nearest cent, as needed.) LA c) How much of that money is interest? (Round to the nearest cent, as needed.) LAarrow_forward

- You can afford a $1350 per month mortgage payment. You've found a 30 year loan at 8% interest. a) How big of a loan can you afford? $ 142,944 b) How much total money will you pay the loan company? $ 486,012. X c) How much of that money is interest? $ 343,058.82 Xarrow_forwardYou can afford a $1300 per month mortgage payment. You've found a 30 year loan at 6% interest.a) How big of a loan can you afford?$b) How much total money will you pay the loan company?$c) How much of that money is interest?arrow_forwardSuppose your gross monthly income is $5,200 and your current monthly payments are $425. If the bank will allow you to pay up to 36% of gross monthly income (less current monthly payments) for a monthly house payment, what is the maximum loan you can obtain if the rate for a 30-year mortgage is 4.65%? (Round your answer to the nearest cent.) Need Help? Read It Submit Answerarrow_forward

- You can afford $1050 per month mortgage payment. You’ve found a 30 year loan at 6% interest. a) how large of a loan can you afford? b) how much total money will you pay the loan company? c) how much of that money is interest?arrow_forwardYou can afford a $1300 per month mortgage payment. You've found a 30 year loan at 8% interest. a) How big of a loan can you afford? LA b) How much total money will you pay the loan company? LA c) How much of that money is interest? $arrow_forwardYou can afford a $1,250.00 per month mortgage payment. You can get a loan at 7% interest for 30 years.A. What is the largest loan can you afford? I can afford a loan of at most $________. B. How much total money will you pay the loan company? The total of all my payments will be $_______. C. How much of that money is interest? The amount of my total payments will be $_______.arrow_forward

- Give typing answer with explanation and conclusion Suppose your gross monthly income is $5,900 and your current monthly payments are $575. If the bank will allow you to pay up to 36% of gross monthly income (less current monthly payments) for a monthly house payment, what is the maximum loan you can obtain if the rate for a 30-year mortgage is 4.65%? (Round your answer to the nearest cent.)arrow_forwardYou want to buy a $216,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan at 3.25% interest for the rest.a) What is the amount of the down payment?b) What will the amount of the mortgage?c) The bank charges 2 points on the loan. What is the amount charged for points?arrow_forwardYou can afford an $800 per month mortgage payment. You found a 30-year loan at 6% interest. How big of a loan can you afford? How much will you pay the loan company? How much of that money is interest?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education