FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

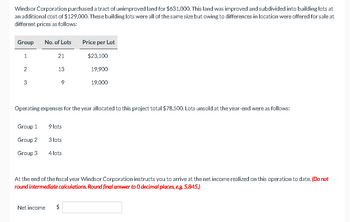

Transcribed Image Text:Windsor Corporation purchased a tract of unimproved land for $631,000. This land was improved and subdivided into building lots at

an additional cost of $129,000. These building lots were all of the same size but owing to differences in location were offered for sale at

different prices as follows:

Group

No. of Lots

Price per Lot

1

21

$23,100

2

13

19,900

3

g

19,000

Operating expenses for the year allocated to this project total $78,500. Lots unsold at the year-end were as follows:

Group 1

9 lots

Group 2

3 lots

Group 3

4 lots

At the end of the fiscal year Windsor Corporation instructs you to arrive at the net income realized on this operation to date. (Do not

round intermediate calculations. Round final answer to O decimal places, e.g. 5,845.)

Net income

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of the current year, Diamond Company Problem 11-23 (AICPA Adapted) purchased a tract of land for P12,000,000. The entity incurred additional cost of Pa,000,000 during the remainder of the year in subdividing the land for aale Of the tract nccrenge, 70% was subdivided into residential lots and 30% was conveyed to the city for roads and a park Sale, price per lot Lot elass Number of lots 100 100 200 240,000 160,000 100,000 C. Using the relative sales value method, what amount of cot should be allocated to Class A lota? a 3,000,000 b. 3,750,000 e. 6,000,000 d. 7,200,000arrow_forwardConcord Corporation purchased a tract of unimproved land for $647,000. This land was improved and subdivided into building an additional cost of $122,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows: Group No. of Lots Price per Lot 1 21 $23,600 2 13 19,200 3 9 19,300 Operating expenses for the year allocated to this project total $66,300. Lots unsold at the year-end were as follows: Group 1 9 lots Group 2 3 lots Group 3 4 lots At the end of the fiscal year Concord Corporation instructs you to arrive at the net income realized on this operation to date. (Do not round intermediate calculations. Round final answer to O decimal places, e.g. 5,845.) Net income $ D 505400arrow_forwardWhispering Corporation purchased a tract of unimproved land for $576,000. This land was improved and subdivided into building lots at an additional cost of $124,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows: Group No. of Lots Price per Lot 1 21 $26,200 2 W N 13 18,500 3 9 18,100 Operating expenses for the year allocated to this project total $66,000. Lots unsold at the year-end were as follows: Group 1 Group 2 Group 3 9 lots 3 lots 4 lots E At the end of the fiscal year Whispering Corporation instructs you to arrive at the net income realized on this operation to date. (Do not round intermediate calculations. Round final answer to O decimal places, e.g. 5,845.) Net income $ 60arrow_forward

- Sagararrow_forwardElirie Company, bought a 10-hectare land for P5,850,000 to be improved, subdivided into lots and eventually sold. Taxes and documentation expenses on the transfer of the property amounted to P80,000. Lot class Number of lots Selling price per lot Total clearing cost A 10 100,000 None 100,000 300,000 В 20 80,000 C 40 70,000 50 60,000 800,000 14. What amount should be allocated as total cost of Class B lots under the relative sales price method?arrow_forwardSplish Realty Corporation purchased a tract of unimproved land for $154,000. This land was improved and subdivided into building lots at an additional cost of $96,488. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows. Group 1 2 3 No. of Lots 9 15 Group 1 Group 2 Group 3 17 Operating expenses for the year allocated to this project total $50,960. Lots unsold at the year-end were as follows. Net income 5 lots 7 lots Price per Lot $8,400 11.200 6,720 2 lots At the end of the fiscal year Splish Realty Corporation instructs you to arrive at the net income realized on this operation to date. (Do not round intermediate calculations. Round final answer to 0 decimal places, e.g. 5,845.)arrow_forward

- Whispering Realty Corporation purchased a tract of unimproved land for $82,500. This land was improved and subdivided into building lots at an additional cost of $51,690. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows. Group 1 2 3 Group 1 Group 2 Group 3 No. of Lots 9 Net income 15 17 Operating expenses for the year allocated to this project total $27,300. Lots unsold at the year-end were as follows. 5 lots 7 lots Price per Lot $4,500 6,000 2 lots 3,600 At the end of the fiscal year Whispering Realty Corporation instructs you to arrive at the net income realized on this operation to date. (Do not round intermediate calculations. Round final answer to 0 decimal places, e.g. 5,845.)arrow_forwarda. If Elixir Company was able to sell all the lots except for 15 lots of Class C, how much is the cost of sales to be recognized for the year? b. What amount should be allocated as total cost of Class B lots under the Relative Sales Price method?arrow_forwardDoran Realty Company purchased a plot of ground for P800, 000 and spent P2, 100, 000 in developing it for building lots. The lots were classified int Midland, and Lowland grades, to sell at P100, 000, P75, 000, and P50, 000 each, respectively. Complete the table below to allocate the cost of the lots using a relative sales value method. Grade No. of Lots Selling Price Total Revenue % of Total Sales Apportioned Cost Total Per Lot Highland 20 Midland 40 Lowland 100 Total 160arrow_forward

- residential lots at a cost of P43,500,000. Problem 11-14 (AICPA Adapted) Landmark Company purchased a tract of unimproved land for P26,850,000. The land was improved and subdivided into in location were offered for sale at different prices as follows: Problem 11-14 (AICPA Adapted) A These lots were all of the same size but owing to differences a location were offered for sale at different prices as follows: Group 000 No. of lots Sales price per lot 20 3,000,000 2,500,000 2,000,000 10 10 Lots unsold at the end of the year are: Group 1 Group 2 Gróup 3 5 lots 4 lots 3 lots Required: Compute the cost of unsold lots at the end of the year. 123arrow_forwardLarsen Realty Corporation purchased a tract of unimproved land for $55,000. This land was improved and subdivided into building lots at an additional cost of $30,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows. Operating expenses allocated to this project total $18,200. Group 1 2 3 No. of Lots 9 15 19 Group # of lots 9 1 2 15 3 19 Instructions: Using the charts below calculate the net income realized on this operation to date. Relative Sales Value Chart - Cost per Lot Group Lots Sold 1 2 3 Price per Lot $ 3,000 4,000 2,000 Account Price Per Lot $3,000 4,000 2,000 Sales Cost of Goods Sold Gross Profit Operating Expenses Net Income Relative Sales Value Chart - Cost of Goods Sold Allocation Selling Price Per Lot Lots Unsold at Year-End 5 7 2 $3,000 4,000 Total Revenue Relative Sales Value Chart - Net Income Calculation Amount Total Sales Relative Sales Price Cost per Lot Total Cost Cost Allocated…arrow_forwardLand and a building on the land are purchased for $310,000. The appraised values of the land and building are $66,000 and $264,000, respectively. The cost allocated to the building should be: a. $25,200 b. $109,800 c. $135,000 d. $248,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education