Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

X inc. Is planning to issue a $1,000 face

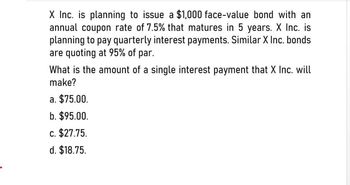

Transcribed Image Text:X Inc. is planning to issue a $1,000 face-value bond with an

annual coupon rate of 7.5% that matures in 5 years. X Inc. is

planning to pay quarterly interest payments. Similar X Inc. bonds

are quoting at 95% of par.

What is the amount of a single interest payment that X Inc. will

make?

a. $75.00.

b. $95.00.

C. $27.75.

d. $18.75.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Krystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?arrow_forwardNeubert Enterprises recently issued $1,000 par value 15-year bonds with a 5% coupon paid annually and warrants attached. These bonds are currently trading for $1,000. Neubert also has outstanding $1,000 par value 15-year straight debt with a 7% coupon paid annually, also trading for $1,000. What is the implied value of the warrants attached to each bond?arrow_forwardBond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have a 10% coupon rate, payable semiannually. The bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 8.5%. What is the price of the bonds?arrow_forward

- Need help with this accounting questionarrow_forwardPlease use finance calculator An issue of bonds with par of $1,000 matures in 8 years and pays 9% p.a. interestsemi-annually. The market price of the bonds is $955 and your required rate of returnis 8%.(a) Calculate the bonds expected rate of return.(b) Calculate the value of the bond to you, given your required rate of return.(c) Should you purchase the bond? (State the reason for your decision.)arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 9 percent interest annually and have 15 years until maturity. You can purchase the bond for $1,125. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 6 percent? a. The yield to maturity on the Saleemi bonds is %. (Round to two decimal places.)arrow_forward

- A 14-year, $1,000 par value Fingen bond pays 6% interest annually (assume semi- annual payments). The price of the bond is $1,100 and the market's required yield to maturity on a comparable-risk bond is 5.50%. a. Compute the bonds yield to maturity. b. Determine the value of the bond to you, given your required rate of return (the YTM on a comparable-risk bond). c. Should you purchase the bond? a. b. Coupon rate Par (FV) Years (n) m PMT PV (price) YTM Coupon rate Par (FV) Years (n) m PMT PV (price) YTM 6.0% $1,000 14 2 $30 Calculation $1,100 6.0% $1,000 14 2 $30 Calculation Note: if you want PV to be a positive number, you must use a minus sign for both pmt and FV 5.50%arrow_forwardTom Inc. bonds mature in 8 years, have a par value of $1,000, and make an annual coupon interest payment of $65, paid semiannually. The market requires an interest rate of 6.7% on these bonds. What is the bond's price? Group of answer choices a)$1143.2 b)$780.2 c)$987.8 d)$1156.5arrow_forwardthe following features: • Coupon rate of interest (paid annually): 10 percent • Principal: $1,000 • Term to maturity: 8 years a. What will the holder receive when the bond matures? |-Select- b. If the current rate of interest on comparable debt is 7 percent, what should be the price of this bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. Would you expect the firm to call this bond? Why? -Select- v, since the bond is selling for a-Select- v. c. If the bond has a sinking fund that requires the firm to set aside annually with a trustee sufficient funds to retire the entire issue at maturity, how much must the firm remit each year for eight years if the funds earn 7 percent annually and there is $80 million outstanding? Use Appendix C to answer the question. Round your answer to the nearest dollar.arrow_forward

- Fingen's 14-year, $1,000 par value bonds pay 9 percent interest annually. The market price of the bonds is $1,100 and the market's required yield to maturity on a comparable-risk bond is 6 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you, given your required rate of return. c. Should you purchase the bond?arrow_forwardThe Saleemi Corporation's $1000 bonds pay 7 percent interest annually and have 14 years until maturity. You can purchase the bond for $1,095. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 4 percent? ___________________________________________________________________________a. The yield to maturity on the Saleemi bond is ____ %. (Round to two decimal places.)arrow_forward2. DEF Company will issue $8,000,000 in 10%, 10-year bonds when the market rate of interest is 7%. Interest is paid semiannually. Required: a. Will this interest structure result in a Premium for DEF company or a Discount? b. How much cash will be received from the issuance of the bond? c. How much will the semi-annual interest payment be on the bond?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning  Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning