FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting Question Solution provide Answer please

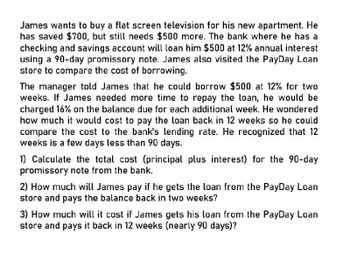

Transcribed Image Text:James wants to buy a flat screen television for his new apartment. He

has saved $700, but still needs $500 more. The bank where he has a

checking and savings account will loan him $500 at 12% annual interest

using a 90-day promissory note. James also visited the PayDay Loan

store to compare the cost of borrowing.

The manager told James that he could borrow $500 at 12% for two

weeks. If James needed more time to repay the loan, he would be

charged 16% on the balance due for each additional week. He wondered

how much it would cost to pay the loan back in 12 weeks so he could

compare the cost to the bank's lending rate. He recognized that 12

weeks is a few days less than 90 days.

1) Calculate the total cost (principal plus interest) for the 90-day

promissory note from the bank.

2) How much will James pay if he gets the loan from the PayDay Loan

store and pays the balance back in two weeks?

3) How much will it cost if James gets his loan from the PayDay Loan

store and pays it back in 12 weeks (nearly 90 days)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- After visiting several automobile dealerships, Richard selects the car he wants. He likes its $15,000 price, but financing through the dealer is no bargain. He has $3,000 cash for a down payment, so he needs a loan of $12,000. In shopping at several banks for an installment loan, he learns that interest on most automobile loans is quoted at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed even though a portion of the principal has been paid back. Richard borrows $12,000 for a period of four years at an add-on interest rate of 14 percent. a. What is the total interest on Richard's loan? Total interest b. What is the total cost of the car? Total cost c. What is the monthly payment? Monthly payment d. What is the annual percentage rate (APR)? (Enter your answer as a percent rounded to 2 decimal places.) APR %arrow_forwardAfter visiting several automobile dealerships, Richard selects the used car he wants. He likes its $10,000 price, but financing through the dealer is no bargain. He has $1,500 cash for a down payment, so he needs an $8,500 loan. In shopping at several banks for an installment loan, he learns that interest on most automobile loans is quoted at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed even though a portion of the principal has been paid back. Richard borrows $8,500 for a period of four years at an add-on interest rate of 10 percent. (a) What is the total interest on Richard's loan? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Total interest (b) What is the total cost of the car? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Total cost (c) What is the monthly payment? (Do not round intermediate calculations. Round your answer to the nearest whole…arrow_forwardBig Sean is buying a new truck from Willie’s Auto Sales, the dealer is providing the financing and he uses the discount method. If borrows $40,000 at 9% for 48 months, how much is his monthly payment?arrow_forward

- Sam can afford to spend $500 per month on a car. He figures he needs half of it for gas, parking, and insurance. He has been to the bank, and they will loan him 100% of the car’s purchase price. (Note: If he had a down payment saved, then he could borrow at a lower rate.) (a) If his loan is at a nominal 12% annual rate over 36 months, what is the most expensive car he can purchase? (b) The car he likes costs $14,000 and the dealer will finance it over 60 months at 12%. Can he afford it? If not, for how many months will he need to save his $500 per month? (c) What is the highest interest rate he can pay over 60 months and stay within his budget if he buys the $14,000 car now?arrow_forwardYou have just taken out a five-year loan from a bank to buy an engagement ring. The ring costs $6,200. You plan to put down $1,400 and borrow $4,800. You will need to make annual payments of $1,100 at the end of each year. Show the timeline of the loan from your perspective. How would the timeline differ if you created it from the bank's perspective? Show the timeline of the loan from your perspective. (Select the best choice below.) O A. Year 1 2 3 4 Cash Flow $4,800 - $1,100 -$1,100 - $1,100 - $1,100 - $1,100 O B. Year 1 2 3 4 Cash Flow - $1,400 $1,100 $1,100 $1,100 $1,100 $1,100 O C. Year 1 2 3 4 Cash Flow - $4,800 $1,100 $1,100 $1,100 $1,100 $1,100 O D. Year 1 2 3 4 Cash Flow $6,200 - $1,100 -$1,100 - $1,100 - $1,100 - $1,100arrow_forwardSmith has arranged for a mortgage loan of $200,000. The annual rate on the loan is 12%. The bank requires Mr. Smith to make payments of $4,212.90 at the end of every month. How many payments will Mr. Smith have to make? You have decided to buy a car, the price of the car is $18,000. The car dealer presents you with two choices: Purchase the car for cash and receive $2000 instant cash rebate – your out of pocket expense is $16,000 today. Purchase the car for $18,000 with zero percent interest 36-month loan with monthly payments. The market interest rate is 4%. Which of the option above is cheaper? How much do you save?arrow_forward

- Gustavo wants to borrow $900 for 20 days from a payday loan store. The payday loan finance charge is $12 per $100 borrowed up to $400, and $10 per 100 on the amount over $400. What is the dollar amount of interest I am paying? What is the APR of this loan?arrow_forwardBilly Bob would like to purchase a new truck. The salesman has given BB 2 options for financing his truck. He can finance the $30,000 loan at 0% for 60 months, or he can receive a rebate amount and finance with his bank. He will apple the $2000 rebate and finance the difference if he finances with his bank. His bank is offering a rate of 5% for a 60 month loan. a. What is BBs payment if he takes the dealers 0% offer ? (30000, 60) b. what is BBs payment if he applies the rebate to reduce the loan amount and finances with his bank? (loan amount 28000, rate& term 0.05, 60)arrow_forwardHeather borrowed $4700 on her credit card to purchase new furniture. Find the monthly interest charges, which are 1.8% per month on the unpaid balance. Find the interest charges if she moves the debt to a credit card charging 0.7% per month on the unpaid balance. What are the interest charges at 1.8% a month? What are the interest charges at 0.7% a month? What are the savings that using the 0.7% card brings over the 1.8% card?arrow_forward

- Kevin bought a washer and dryer for $1050 but only had a down payment of $150.00. He financed the rest using add-on interest of 9.8% and will pay it off in 18 months. Submit your answer in the form $250.00 (use the dollar sign and round to the nearest cent). How much interest will he pay on the dishwasher after the 18 months?Blank 1 After factoring in the interest, how much will he pay for the dishwasher in total?Blank 2 What would the monthly payment be?Blank 3arrow_forwardChuck Wells is planning to buy a Winnebago motor home. The listed price is $175,000. Chuck can get a secured add-on interest loan from his bank at 7.45% for as long as 60 months if he pays 15% down. Chuck's goal is to keep his payments below $4,100 per month and amortize the loan in 42 months. 1) Chuck spoke with his bank's loan officer, who has agreed to finance the deal with a 6.95% loan if Chuck can pay 20% down. What will Chuck's new monthly payment (in $) be with these conditions? (Round your answer to the nearest cent.) $ With these conditions, will Chuck be able to pay off the loan and meet his goals? Yes, under these conditions, Chuck will meet his goal.No, the monthly payment is too high. 2) Attempting to reduce his monthly payment further, Chuck continues to negotiate with the seller. If the seller agrees to reduce the listed price by $4,800, finance the deal with a 6.95% loan, and if Chuck pays the 20% down, what will Chuck's monthly payment be (in $)?…arrow_forwardJasmin has found a car she wants to buy. The used-car dealer says she can buy it for $298.62 per month for 48 months. If the interest rate on the loan is 9.0% APR, how much does the car cost? In other words, what is the present value of the loan payments?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education