FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer please

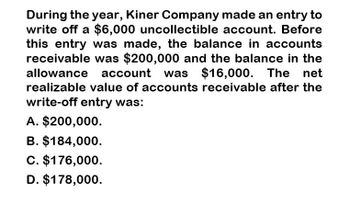

Transcribed Image Text:During the year, Kiner Company made an entry to

write off a $6,000 uncollectible account. Before

this entry was made, the balance in accounts

receivable was $200,000 and the balance in the

allowance account was $16,000. The net

realizable value of accounts receivable after the

write-off entry was:

A. $200,000.

B. $184,000.

C. $176,000.

D. $178,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dauring the year, Kiner Company made an entry to write off a $32,000 uncollectible account. Before this entry was made, the balance in accounts receivable was $400,000 and the balance in the allowance account was $36,000. The accounts receivable amount expected to be collected after write-off entry was.arrow_forwardmnarrow_forwardDuring the year, Blossom Enterprises made an entry to write off an $8100 uncollectible account. Before this entry was made, the balance in accounts receivable was $100100 and the balance in the allowance account was $9100 (credit balance). The net realizable value of accounts receivable before and after the write-off entry was O$100100. Ⓒ$99100. O $82900 O $91000arrow_forward

- On January 1, Year 2, the Accounts Receivable balance was $32,900 and the balance in the Allowance for Doubtful Accounts was $4,10o0. On January 15, Year 2, an $1,210 uncollectible account was written-off. The net realizable value of accounts receivable immediately after the write-off is: Multiple Choice $27,590. $31,690. $30,010. $28,800.arrow_forwardDuring the year, Jantz Company made an entry to write off a ₱4,000 uncollectible account. Before this entry was made, the balance in accounts receivable was ₱80,000 and the balance in the allowance account was ₱4,500. The net realizable value of accounts receivable after the write-off entry wasarrow_forwardd. The company collects Y5,000 subsequently on a specific account that had previously been determined to be uncollectible in (c.). Prepare the journal entry(ies) necessary to restore the account and record the cash collection.arrow_forward

- Company provided the following information related to its accounts receivable. Last year 12/31 Estimated that P7,000 of accounts receivable would become uncollectible. Current year 1/05 Wrote-off the P 5,000 balance owed by J Company and the 2,000 balance owed by F Company. 3/18 Reinstate the account of J Company that had been written off since they signify and confirmed the payment. 3/21 Receipt of payment in full. Required: Journalize the transactionsarrow_forwardJohnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below: The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Required: Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable.arrow_forwardBourne Company had a $150,000 beginning balance in Accounts Receivable and a $6,000 credit balance in the Allowance for Doubtful Accounts. During the year, credit sales were $ 600,000 and customers' accounts collected were $590, 000. Also, $4,000 in worthless accounts were written off. What was the net amount of receivables included in the current assets at the end of the year, before any provision was made for doubtful accounts? Select one: A. $120,000 B. $130, 000 C. $126,000 D. $154,000arrow_forward

- Tantrum Company provided the following information in relation to accounts receivable at year-end: Days outstanding estimated amount %uncollectible www M 1% 1,200,000 900,000 0-60 61-120 2% 1,000,000 3,100,000\ During the current year, the entity wrote off P70,000 in accounts receivable and recovered P20,000 that had been written off in prior years. At the beginning of current year, the allowance for uncollectible accounts was Over 120 6% P60,000. Under the aging method, what amount of uncollectible accounts expense should be reported for the current year?arrow_forwardOwearrow_forwardAssume the aging of accounts receivable method was used by the company and that $7050 of the accounts receivable as of Dec 31 were estimated to be uncollectible. You are now required to: a) Determine the amount to be charged to uncollectible expense( show your workings for the computation of this figure).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education