Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

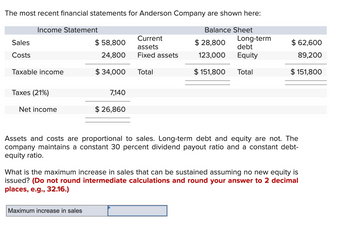

Transcribed Image Text:The most recent financial statements for Anderson Company are shown here:

Income Statement

Balance Sheet

Sales

Costs

$ 58,800

Current

assets

$ 28,800

24,800

Fixed assets

123,000

Long-term

debt

Equity

$ 62,600

89,200

Taxable income

$ 34,000

Total

$151,800

Total

$151,800

Taxes (21%)

7,140

Net income

$ 26,860

Assets and costs are proportional to sales. Long-term debt and equity are not. The

company maintains a constant 30 percent dividend payout ratio and a constant debt-

equity ratio.

What is the maximum increase in sales that can be sustained assuming no new equity is

issued? (Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.)

Maximum increase in sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Mikado Company has a long-term debt ratio (i.e., the ratio of long-term debt to long-term debt plus equity) of .49 and a current ratio of 1.38. Current liabilities are $2,450, sales are $10,630, profit margin is 10 percent, and ROE is 15 percent. What is the amount of the firm’s net fixed assets?arrow_forwardThe Haines Corporation shows the following financial data for 20X1 and 20X2: 20X2 $ 3,000,000 2,060,000 $ 940,000 300,000 $ 640,000 54,400 $ 585,600 204,960 $ 380,640 Sales Cost of goods sold Gross profit Selling & administrative expense Operating profit Interest expense Income before taxes Taxes (35%) Income after taxes 20X1 $ 3,400,000 1,880,000 $ 1,520,000 302,000 $ 1,218,000 48,000 $ 1,170,000 409,500 $ 760,500 For each year, compute the following ratios and indicate how the change in each ratio will affect profitability in 20x2. Note: Input your answers as a percent rounded to 2 decimal places. a. Cost of goods sold to sales b. Selling and administrative expense to sales c. Interest expense to sales 20X1 % % % 20X2 Profitability % Decrease % Increase % Decreasearrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forward

- You find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forwardConsider the following simplified financial statements for the Wims Corporation (assuming no income taxes): Income Statement Balance Sheet Sales $ 21,000 Assets $ 9,000 Debt $ 4,900 Costs 13,800 Equity 4,100 Net income $ 7,200 Total $ 9,000 Total $ 9,000 The company has predicted a sales increase of 10 percent. It has predicted that every item on the balance sheet will increase by 10 percent as well. Create the pro forma statements and reconcile them. What is the plug variable here? Multiple Choice $16,820 $7,494 $7,498 $7,490 $7,510arrow_forwardThe most recent financial statements for Mandy Company are shown here: Income Statement Balance Sheet $ 11,940 Debt 31,500 Equity Sales Costs Taxable income Taxes (21%) Net income $ 20,100 Current assets 13,800 Fixed assets Internal growth rate $ 6,300 1,323 $ 4,977 Total $ 43,440 % $ 16,420 27,020 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 45 percent dividend payout ratio. What is the internal growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded 2 decimal places, e.g., 32.16.) Total $ 43,440arrow_forward

- Provide Answerarrow_forwardThe following are the details from the income statements of division S and division C for the year ending March 2014. Figures in TZS "000" Sales revenue 100,000 64,000 6,000 120,000 75,000 10,000 150,000 Operating cost Interest cost Capital invested 122,000 Capital invested include debt WACC 10% 12.5% Rate of corporate tax 40% 44% Required: Calculate NOPAT as adjusted for EVA and also calculate EVA for both the divisions. Which Division performed better?arrow_forwardData for Uberto Company are presented in the following table of rates of return on investment and residual incomes: Invested Assets Income from Operations Return on Investment Minimum Return Minimum Acceptable Income from Operations Residual Income $780,000 $187,200 (a) 13% (b) (c) $620,000 (d) (e) (f) $74,400 $24,800 $330,000 (g) 14% (h) $36,300 (i) $250,000 $50,000 (j) 12% (k) (l) Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number. a. fill in the blank % b. $ fill in the blank c. $ fill in the blank d. $ fill in the blank e. fill in the blank % f. fill in the blank % g. $ fill in the blank h. fill in the blank % i. $ fill in the blank j. fill in the blank % k. $ fill in the blank l. $ fill in the blankarrow_forward

- The balance sheet of ATLF, Inc. reports total assets of $950,000 and $1,050,000 at the beginning and end of the year, respectively. Net income and sales for the year are $100,000 and $800,000, respectively. What is ATLF's profit margin? Select one: a. 8% b. 15% c. 10% d. 80% e. 12.5%arrow_forwardPlease provide solutionarrow_forwardThe following information of Red Oak Manufacturing is available for the current year: Net income $844,200 Net sales 6,809,000 Average total assets 5,911,000 Average stockholders' equity 2,575,000 The total leverage as per the DuPont analysis computation isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education