FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

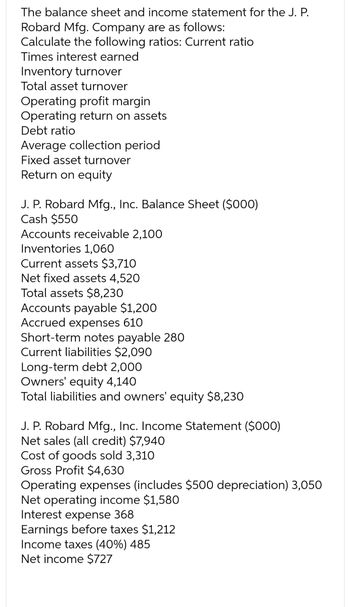

Transcribed Image Text:The balance sheet and income statement for the J. P.

Robard Mfg. Company are as follows:

Calculate the following ratios: Current ratio

Times interest earned

Inventory turnover

Total asset turnover

Operating profit margin

Operating return on assets

Debt ratio

Average collection period

Fixed asset turnover

Return on equity

J. P. Robard Mfg., Inc. Balance Sheet ($000)

Cash $550

Accounts receivable 2,100

Inventories 1,060

Current assets $3,710

Net fixed assets 4,520

Total assets $8,230

Accounts payable $1,200

Accrued expenses 610

Short-term notes payable 280

Current liabilities $2,090

Long-term debt 2,000

Owners' equity 4,140

Total liabilities and owners' equity $8,230

J. P. Robard Mfg., Inc. Income Statement ($000)

Net sales (all credit) $7,940

Cost of goods sold 3,310

Gross Profit $4,630

Operating expenses (includes $500 depreciation) 3,050

Net operating income $1,580

Interest expense 368

Earnings before taxes $1,212

Income taxes (40%) 485

Net income $727

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following condensed information is reported by Sporting Collectibles. Income Statement Information Sales revenue Cost of goods sold Net income Balance Sheet Information Current assets Long-term assets Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Profitability Ratios a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity % % % The amount of dividends paid Required: 1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.) times % 2021 $10,440,000 6,827,760 360,000 2. Determine the amount of dividends paid to shareholders in 2021. 2020 $8,400,000 5,900,000 248,000 $ 1,600,000 2,200,000 $ 3,800,000 $ 1,200,000 1,500,000 800,000 $ 900,000 1,500,000 800,000 300,000 200,000 $ 3,800,000 $3,400,000 $1,500,000 1,900,000 $3,400,000arrow_forwardSome recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forward(Ratio Computations and Effect of Transactions) Presented below is information related to Carver Inc. Check the image below for information. Instructions(a) Compute the following ratios or relationships of Carver Inc. Assume that the ending account balances are representative unless the information provided indicates differently.(1) Current ratio.(2) Inventory turnover.(3) Accounts receivable turnover.(4) Earnings per share.(5) Profit margin on sales.(6) Return on assets on December 31, 2017.(b) Indicate for each of the following transactions whether the transaction would improve, weaken, or have no effect on the current ratio of Carver Inc. at December 31, 2017.(1) Write off an uncollectible account receivable, $2,200.(2) Purchase additional capital stock for cash.(3) Pay $40,000 on notes payable (short-term).(4) Collect $23,000 on accounts receivable.(5) Buy equipment on account.(6) Give an existing creditor a short-term note in settlement of account.arrow_forward

- Selected data from Decco Company are presented below: Total assets $1,600,000 Average assets 2,000,000 Net income 380,000 Net sales 1,500,000 Average common stockholders' equity 1,000,000 Instructions Calculate the following profitability ratios from the above information. 1. Profit margin. 2. Asset turnover. 3. Return on assets.arrow_forwardWhat's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipment $336,695 Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Net income SMOLIRA GOLF CORPORATION 2021 Income Statement Earnings before interest and taxes Interest paid Dividends Retained earnings a. Current ratio b. Quick ratio c. Cash ratio Short-term solvency ratios: Asset utilization ratios: d. Total asset turnover e. Inventory tumover 1. Receivables turnover 2020 $23,066 $25,300 13,648 16,400 27,152 28,300 $63,866 $70,000 g. Total debt ratio h. Debt-equity ratio I. Equity multiplier Long-term solvency ratios: Times Interest emned K Cash coverage ratio Profitability ratios: SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 $ 400,561 $ 434,000 1. Profit margin m. Return on assels n. Return on equity $ 364,000 $ 22,000 19,891 Find the following financial ratios for Smolira Golf…arrow_forward

- How do I make a tabular format, to provide the revenues, gross profit, income from operations, net income, and earnings per share for the most recent three fiscal years. For the two most recent fiscal years, compute and indicate the annual percentage growth (or decline) in each of these numbers?arrow_forwardWhich of the following is a solvency ratio? a. Times interest earned. b. Inventory turnover ratio. c. Profit margin. d. Price-earnings ratio.arrow_forward26. Given the following financial data for Alpha Company, calculate the ratios listed below the data. (Compute all ratios and percents to 2 decimal points.) Sales (all on credit) Cost of Goods Sold $650,000 422,500 Income before 78,000 Income Taxes Net Income 54,600 Ending Beginning Balances Balances Cash $19,500 $15,000 Accounts Receivable 65,000 59,800 (net) Merchandise 71,500 66,300 Inventory Plant and Equipment (net) 195,000 183,900 Total Assets $351,000 $325,000 Current $74,100 $100,200 Liabilities Long-Term Notes Payable 97,500 100,000 Stockholders' 179,400 124,800 Equity Total Liabilities and Stockholders' $351,000 $325,000 Equityarrow_forward

- Do npt give image formatarrow_forwardUsing the fiscal year end 2019 annual report for General Mills, Inc. and the figures from the 2017 annual report as noted below, calculate the financial ratios for 2019 and 2018 indicated using the EXCEL template provided: Gross profit percentage Return on sales Asset turnover Return on assets Return on common stockholders’ equity Current ratio Quick ratio Operating-cash-flow-to-current-liabilities ratio Accounts receivable turnover Average collection period Inventory turnover Days’ sales in inventory Debt-to-equity ratio Times-interest-earned ratio Operating-cash-flow-to-capital-expenditures ratio Earnings per share Price-earnings ratio Dividend yield Dividend payout ratio Total assets 2017 = $21,812.6 Total stockholders’ equity 2017 = $4,327.9 Total current liabilities 2017 = $5,330.8 Accounts receivable 2017 = $1,430.1 Inventory 2017 = $1,483.6 Year-end closing stock price May 2019 = $50.93 Year-end closing stock price May 2018 = $39.37 Perform a comparative analysis of the…arrow_forwardCreate a comparative financial statement from the following:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education