Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

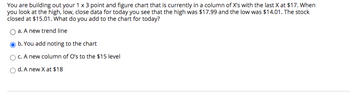

Transcribed Image Text:You are building out your 1 x 3 point and figure chart that is currently in a column of X's with the last X at $17. When

you look at the high, low, close data for today you see that the high was $17.99 and the low was $14.01. The stock

closed at $15.01. What do you add to the chart for today?

O a. A new trend line

b. You add noting to the chart

c. A new column of O's to the $15 level

d. A new X at $18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Go to Yahoo! Finance and download the monthly stock prices for Apple (AAPL) from 1/1/2016 to 12/31/2021. (1) Sort the data in increasing order by date. (2) Calculate monthly returns using Adj. Close prices. Align the returns well with the dates. (3) Calculate the average monthly return and standard deviation of the monthly returns. (Hint: use either STDEV.S or STDEV to calculate the standard deviation.) On Excel Formulas includedarrow_forwardConsider the two stocks below. Which has a positive beta (i.e., tends to move in the same direction as the market)? Which has a higher R2 (1.e., market returns explain more of its return patterns)? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. Stock 1 has a positive beta and a higher R² a b C d Stock 2 has a positive beta and a higher R² Stock 1 has a positive beta, but Stock 2 has a higher R Stock 2 has a positive beta, but Stock 1 has a higher R² ft RM Stock 2 Stock 1 Pararrow_forwardA stock has a sustainable growth rate of 4.2% and a return on equity of 23.8%. What is the plowback ratio? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES. Numberarrow_forward

- Use the times and corresponding closing prices of the stock to create coordinate pairs. Let x represent the number of weeks since the first data point, and let y represent the closing price at each time. So, x=0 represents the data point from 5 years ago. There are 52 weeks in a year, and you can write the time for each closing price recorded in terms of weeks that have passed since 5 years ago, when x=0. Fill in the table to represent your data as coordinate pairs. x (weeks since 5 yrs ago) most recent 260 7days ago 259 1 month ago 256 6 months ago 234 1 year ago 208 3 years ago 104 5 years ago 0 y (closing price, in $) most recent 7 days ago 1 month ago 6 months ago 1 year ago 3 years ago 5 years agoarrow_forwardTaarrow_forwardThe market and Stock J have the following probability distributions: Probability rM rJ 0.3 15.00 % 19.00 % 0.4 10.00 6.00 0.3 18.00 10.00 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Calculate the expected rate of return for the market. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank %Calculate the expected rate of return for Stock J. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank % Calculate the standard deviation for the market. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank %Calculate the standard deviation for Stock J. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank %arrow_forward

- If you look at stock prices over any year, you will find a high and low stock price for the year. Instead of a single benchmark PE ratio, we have a high and low PE ratio for each year. We can use these ratios to calculate a high and a low stock price for the next year. Suppose we have the following information on a particular company: High price Low price EPS Year 1 $ 62.18 40.30 2.35 a. High target price b. Low target price Year 2 $ 67.29 43.18 2.58 Year 3 $74.18 39.27 2.73 Year 4 $ 78.27 46.21 2.89 Earnings are expected to grow at 9 percent over the next year. a. What is the high target stock price in one year? Note: Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What is the low target stock price in one year? Note: Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward4. Expected dividends as a basis for stock values The following graph shows the value of a stock's dividends over time. The stock's current dividend is $1.00 per share, and dividends are expected to grow at a constant rate of 3.50% per year. The intrinsic value of a stock should equal the sum of the present value (PV) of all of the dividends that a stock is supposed to pay in the future, but many people find it difficult to imagine adding up an infinite number of dividends, Calculate the present value (PV) of the dividend paid today (De) and the discounted value of the dividends expected to be paid 10, 20, and 50 years from now (Dio, Dao, Duo). Assume that the stock's required return (r.) is 10.40%. Note: Carry and round the calculations to four decimal places. Time Period Now End of Year 10 End of Year 20 End of Year 50 Dividend's Expected Future Value Dividend's Expected Present Value Using the orange curve (square symbols), plot the present value of each of the expected future…arrow_forwardi need the answer quicklyarrow_forward

- Darrow_forwardIf you look at stock prices over any year, you will find a high and low stock price for the year. Instead of a single benchmark PE ratio, we now have a high and low PE ratio for each year. We can use these ratios to calculate a high and a low stock price for the next year. Suppose we have the following information on a particular company: High price Low price EPS Year 1 $ 85.61 68.33 6.46 a. High target price b. Low target price Year 2 $94.99 79.75 8.88 Year 3 $ 116.05 84.23 8.54 Year 4 $ 128.08 105.86 10.13 Earnings are expected to grow at 5.5 percent over the next year. a. What is the high target stock price over the next year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What is the low target stock price over the next year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward2. Dividends and stock values The following graph shows the value of a stock's dividends over time. The stock's current dividend is $1.00 per share, and dividends are expected to grow at a constant rate of 4.50% per year. The intrinsic value of a stock should equal the sum of the present value (PV) of all of the dividends that a stock is supposed to pay in the future, but many people find it difficult to imagine adding up an infinite number of dividends. Calculate the present value (PV) of the dividend paid today (Do) and the discounted value of the dividends expected to be paid 10, 20, and 50 years from now (D 10, D20, D50). Assume that the stock's required return (rs) is 5.40%. Note: Carry and round the calculations to four decimal places. Time Period Dividend's Expected Future Value Dividend's Expected Present Value Now End of Year 10 End of Year 20 End of Year 50 Using the blue curve (circle symbols), plot the future value of each of the expected future dividends for years 10, 20,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education