Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

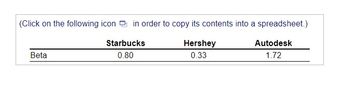

Suppose the market risk premium is 6% and the risk-free interest rate is 5% . Using the data in the table, calculate the expected

a. Starbucks' stock.

b. Hershey's stock.

c. Autodesk's stock.

Transcribed Image Text:**Beta Values for Selected Companies**

(Click on the following icon in order to copy its contents into a spreadsheet.)

| | Starbucks | Hershey | Autodesk |

|--------|-----------|---------|----------|

| **Beta** | 0.80 | 0.33 | 1.72 |

**Explanation:**

The table above displays the beta values for three companies: Starbucks, Hershey, and Autodesk.

- **Beta** is a measure of a stock's volatility in relation to the overall market.

- A beta of **1** indicates that the stock's price is expected to move with the market.

- A beta less than **1** suggests that the stock is less volatile than the market.

- A beta greater than **1** indicates that the stock is more volatile than the market.

In this data:

- Starbucks has a beta of **0.80**, meaning it is less volatile than the market.

- Hershey has a beta of **0.33**, indicating it is significantly less volatile.

- Autodesk has a beta of **1.72**, suggesting it is more volatile than the market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You invest in a portfolio of 5 stocks with an equal investment in each one. The betas of the 5 stocks are as follows: 0.8, -1.3, 0.95, 1.2, and 1.4. The risk-free return is 3% and the market return is 7%. a. Compute the beta of the portfolio. b. Compute the required return of the portfolio.arrow_forwardAmDa’s common stock has a beta of 1.4. The market risk premium is 5% and the risk-free rate is 2%. What is the required rate of return on this stock according to CAPM?arrow_forwardSuppose the risk free rate is 2, 32%, the expected return of the market portfolio is 5, 64% and the beta of stock X-Bros S. A. is 1. 10. What is the expected cost of equity of X-Bros S. A. (in percent)?arrow_forward

- The following table shows betas for several companies. Calculate each stock's expected rate of return using the CAPM. Assume the risk-free rate of interest is 4%. Use a 7% risk premium for the market portfolio. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Company. Caterpillar Apple Johnson & Johnson Consolidated Edison Beta 0.98 1.35 0.69 0.13 Cost of Capital % % %arrow_forwardFinance The risk-free rate is 3.7 percent and the expected return on the market is 12.3 percent. Stock A has a beta of 1.1and an expected return of 13.1 percent. Stock B has a beta of .86 and an expected return of 11.4 percent. Arethese stocks correctly priced? Why or why not? Use E(Ri) = Rf + βi(E(RM) − Rf).arrow_forwardThe risk-free rate is 3%, the market risk premium (MRP) is 8%, and the Beta of Lotsa Dough common stock is 0.9. What is LotsaDough's cost of common equity using the SML/CAPM approach? Group of answer choices 7.5% 10.2% 13.7% 15.1%arrow_forward

- Suppose that many stocks are traded in the market and that it is possible to borrow at the risk-free rate, rƒ. The characteristics of two of the stocks are as follows: Stock Expected Return Standard Deviation A 11 % 35 % B 20 % 65 % Correlation = –1 a. Calculate the expected rate of return on this risk-free portfolio? (Hint: Can a particular stock portfolio be substituted for the risk-free asset?) (Round your answer to 2 decimal places.) b. Could the equilibrium rƒ be greater than 14.15%?multiple choice Yes Noarrow_forwardAssume that the risk-free rate is 6.4% and the market return is 8%. Calculate the expected rate of return of a stock with a volatility (beta) of 3%.arrow_forwardThe following table shows betas for several companies. Calculate each stock's expected rate of return using the CAPM. Assume the risk-free rate of interest is 4%. Use a 6% risk premium for the market portfolio. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Company Caterpillar Apple Johnson & Johnson Consolidated Edison Beta 1.84 - 1.48 0.67 0.39 Cost of Capital % % % %arrow_forward

- Consider a CAPM economy. The risk free rate (rf ) is 4% and the expected market return (rM )is 10%. (a) Stock 1: β = 0.90. Compute the expected return of stock 1. (b) Stock 2: β = 1.1. Compute the expected return of stock 2. (c) Portfolio 1: The proportions invested in stock 1, stock 2, and risk free asset are 30%, 30%,and 40%, respectively. Compute the beta and expected return of portfolio 1. (d) Portfolio 2: The proportions invested in stock 1, stock 2, and risk free asset are 50%, 60%,and -10%, respectively. Compute the beta and expected return of portfolio 2.arrow_forwardThe payoff table below indicates the returns (in RM thousands) of investments in stock, bond and fixed deposit under different economic situations. Type of Investment Stock Bond Fixed Deposit Table 1 Economic Situation Good 150 50 45 Stable 60 40 45 Poor -30 36 45 The probabilities of good, stable and poor economy are 0.3, 0.5 and 0.2, respectively. What is the best investment based on the expected monetary value criterion? Draw a decision tree.arrow_forward1. You estimate the Fama-French 3-factor model for the two stocks, A and B, and find the following coefficients. You also estimate risk premiums for each factor. Calculate the cost of equity capital (i.e., expected rate of return) for each company using the 3-factor APT model. The risk-free rate is 4%. Stock Mkt A B Risk premiums 1.1 1.0 5% SMB -1.2 -2.0 HML -1.0 -1.5 3%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education