Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

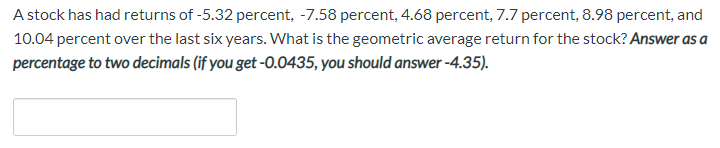

Transcribed Image Text:A stock has had returns of -5.32 percent, -7.58 percent, 4.68 percent, 7.7 percent, 8.98 percent, and

10.04 percent over the last six years. What is the geometric average return for the stock? Answer as a

percentage to two decimals (if you get -0.0435, you should answer -4.35).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- An analyst gathered the following information for a stock and market parameters: stock beta = 1.42; expected return on the Market = 11.41%; expected return on T-bills = 2.12%; current stock Price = $9.64; expected stock price in one year = $12.81; expected dividend payment next year = $1.54. Calculate the required return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forwardA stock will pay a dividend of $3.5 and is expected to sell for $87.8 in one year. If the current price is$19.4, what is the return. Answer as a percent. Answer:arrow_forwardA stock has had the following year-end prices and dividends: Year 1 Price Dividend $ 43.41 2 48.39 $0.66 3 57.31 0.69 4 45.39 0.80 5 52.31 0.85 6 61.39 0.93 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Round the final answers to 2 decimal places.)arrow_forward

- A stock has had returns of -7.77 percent, -4.59 percent, 5.87 percent, 9.98 percent, 8.7 percent, and 11.27 percent over the last six years. What is the geometric average return for the stock? Answer as a percentage to two decimals (if you get -0.0435, you should answer -4.35).arrow_forwardConsider a market value-weighted index consisting of 3 stocks: A, B, and C. The stocks' prices at time 0 (p0) and time 1 (p1) are given below, along with the number of shares outstanding. Calculate the index levels at time 0. Round your answer to 4 decimal places. For example, if your answer is 3.205%, then please write down 0.0321. stock p0 p1 outstanding shares 43 45 200 69 50 500 11 12 600 A B Carrow_forwardA stock had the following year-end prices and dividends. What is the geometric average annual return on this stock Time Price Dividend 0 $23.19 ? 1 $24.90 $0.23 2 $23.18 $0.24 3 $24.86 $0.25arrow_forward

- Suppose that you purchased a single stock five years ago for $1.22. The stock is now valued at $5.10 today. What has been the average annual percent growth in the price since you purchased it? Report your answer without the percentage symbol (for example, 75.2% would be 75.2)arrow_forwardHow can I calculate geometric average in Excel?arrow_forwardA stock has had the following year-end prices and dividends: Year 1 2355N 4 6 Price $ 64.63 71.50 77.30 63.57 73.71 82.75 Dividend Arithmetic average return Geometric average return $.66 .71 .77 .86 .93 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % %arrow_forward

- A stock has had returns of 16.72 percent, 12.20 percent, 5.90 percent, 26.86 percent, and −13.49 percent over the past five years, respectively. What was the holding period return for the stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardAn analyst gathered the following information for a stock and market parameters: stock beta= 1.08; • expected return on the Market = 11.97%; • expected return on T-bills = 1.55%; • current stock Price = $9.01; • expected stock price in one year = $11.14; • expected dividend payment next year = $3.23. Calculate the expected return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forwardSuppose a stock had an initial price of $84 per share, paid a dividend of $1.50 per share during the year, and had an ending share price of $71.50. a. Compute the percentage total return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What was the capital gains yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education