SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

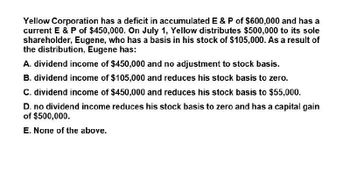

Transcribed Image Text:Yellow Corporation has a deficit in accumulated E & P of $600,000 and has a

current E & P of $450,000. On July 1, Yellow distributes $500,000 to its sole

shareholder, Eugene, who has a basis in his stock of $105,000. As a result of

the distribution, Eugene has:

A. dividend income of $450,000 and no adjustment to stock basis.

B. dividend income of $105,000 and reduces his stock basis to zero.

C. dividend income of $450,000 and reduces his stock basis to $55,000.

D. no dividend income reduces his stock basis to zero and has a capital gain

of $500,000.

E. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Blue Corporation has a deficit in accumulated E & P of $300,000 and has current E & P of $225,000. On July 1, Blue distributes $250,000 to its sole shareholder, Sam, who has a basis in his stock of $52,500. As a result of the distribution, Sam has: Oa. Dividend income of $52,500 and reduces his stock basis to zero. Ob. Dividend income of $225,000 and no adjustment to stock basis. Oc. No dividend income, reduces his stock basis to zero, and has a capital gain of $250,000. Od. Dividend income of $225,000 and reduces his stock basis to $27,500. Oe. None of these choices are correct.arrow_forwardAnsarrow_forwardAs of January 1, Cassowary Corporation has a deficit in accumulated E & P of $100,000. For the tax year, current E & P (accrued ratably) is $240,000 (prior to any distributions). On July 1, Cassowary Corporation distributes $275,000 to its sole shareholder. The amount of the distribution that is a dividend is: a. $20,000. b. $140,000. C. $240,000. d. $275,000. e. None of the above.arrow_forward

- a) Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated b) If at the beginning of the year, Archer had a basis of 20,000 compute Archer’s basis at the end of the year. c) Assume that Voyager reported a loss of $70,000 instead (and no separately stated items or distributions). If Janeway had a basis of 10,000 in her stock at the beginning of the year, what is the amount of loss she can report on her return?arrow_forwardR Corporation has a negative current earnings and profits for tax year 20X7 of $15,000. Accumulated earnings and profits as of the beginning of 20X7 equal $10,000. On June 1, 20X7, R Corporation distributes $6,000 cash to its sole shareholder Y, whose basis in the stock is $2,000. What is the amount of dividend income that Y must report for the year (if zero, write zero as the answer)? Do any allocations on a per-month basis instead of a per-day basis.arrow_forwardJayhawk Company reports current E&P of $452,500 and a deficit in accumulated E&P at the beginning of the year of ($412,500). Jayhawk distributed $597,500 to its sole shareholder, Christine Rock, on the last day of the year. Christine’s tax basis in her Jayhawk stock before the distribution is $98,500. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) a. How much of the $597,500 distribution is treated as a dividend to Christine? b. What is Christine’s tax basis in her Jayhawk stock after the distribution?arrow_forward

- Jayhawk Company reports current E&P of $310,000 and accumulated E&P of negative $282,500. Jayhawk distributed $505,000 to its sole shareholder, Christine Rock, on the last day of the year. Christine s tax basis in her Jayhawk stock is $128,750. What is Jayhawk s balance in accumulated E&P on the first day of next year?arrow_forwardJayhawk Company reports current E&P of $340,000 and a deficit in accumulated E&P at the beginning of the year of ($322,500). Jayhawk distributed $405,000 to its sole shareholder, Christine Rock, on the last day of the year. Christine's tax basis in her Jayhawk stock before the distribution is $57,000. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) b. What is Christine's tax basis in her Jayhawk stock after the distribution? Tax basisarrow_forwardTwinning, a calendar year S corporation, distributes $62,200 cash to its only shareholder, Carl, on December 31. Before the distribution, Carl's basis in his stock is $74,640, Twinning 's AAA balance is $27,990, and Twinning has $9,330 of AEP. What is Carl’s stock basis after the distribution? Answer_______arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you