EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

PLEASE USE EXCEL AND SHOW THE FORMULAS TO SOLVE THESE QUESTIONS

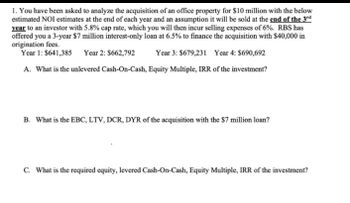

Transcribed Image Text:1. You have been asked to analyze the acquisition of an office property for $10 million with the below

estimated NOI estimates at the end of each year and an assumption it will be sold at the end of the 3rd

year to an investor with 5.8% cap rate, which you will then incur selling expenses of 6%. RBS has

offered you a 3-year $7 million interest-only loan at 6.5% to finance the acquisition with $40,000 in

origination fees.

Year 1: $641,385 Year 2: $662,792

Year 3: $679,231 Year 4: $690,692

A. What is the unlevered Cash-On-Cash, Equity Multiple, IRR of the investment?

B. What is the EBC, LTV, DCR, DYR of the acquisition with the $7 million loan?

C. What is the required equity, levered Cash-On-Cash, Equity Multiple, IRR of the investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- what is the sale price?arrow_forwardThompson Corporation is considering the purchase ofa new piece of machinery. Thompson expects the new machinery toincrease its revenues by $70,000 at the end of year 1, S60,000 atthe end of year 2, and $50,000 at the end of year 3 at which point the machinery will have exhausted its useful life. If the interestrate is 4%, what is the most Thompson should be willing to paytoday for this piece of machinery? Explainationarrow_forwardAccording to your interviews with hotel investors, equity yield rates are 14%. Year 6 NOI is expected to be 3% higher than year 5. Terminal capitalization rates are expected to be 13% at the time of the sale. Brokers charge 3% to the gross sales price to market the property you have also estimated the following NOI streams for the first five years of the property calculate the market value of the property using the income capitalization approach. Year 1 $875,000.00 Year 2 $901,000.00 Year 3 $928,000.00 Year 4 $956,000.00 Year 5 $985,000.00 **Using excelarrow_forward

- 13) A client asked the appraiser for a feasibility analysis based on equity return rates. One use provides an annual net operating income totaling $75,000. There will be a 7%, $800,000, 30-year mortgage paid monthly. The client must make $250,000 down payment and will hold the property for 20-year period. The client expects to sell the property for $458,400. What is the annual equity dividend rate? A) 13.35% B) 2.25% C) 4.45% D) 8.90%arrow_forwardAn investor is considering buying a property for shillings 500,000. The cost of land is 20% of the purchase price. The building will however be depreciated over 40 years on a straight-line basis. The investor will take a loan of 50% of the purchase price at 10% per annum payable monthly for 20 years . The net operating income for the next 2 years is sh 40000 and sh 50000 . The property can be sold for 600,000 at the end of year 2. The tax on current income is 30% of the capital gain tax is 15% of price appreciation and 30% on price depreciation recapture.Required:Calculate the after tax equity IRR. IS THE PROJECT VIABLE ASSUMING THE INVESTOR HAS A REQUIRED RATE OF RETURN OF 15%.arrow_forwardAn investor is considering the acquisition of a "distressed property" which is on Northlake Bank's REO list. The property is available for $200,800 and the investor estimates that he can borrow $160,000 at 4.5 percent interest and that the property will require the following total expenditures during the next year: Inspection Title search Renovation Landscaping Loan interest Insurance Property taxes Selling expenses Required: a. The investor is wondering what such a property must sell for after one year in order to earn a 20 percent return (IRR) on equity. b. The lender is now concerned that if the property does not sell, investor may have to carry the property for one additional year. He believes that he could rent it (starting in year 2) and realize a net cash flow before debt service of $1,440 per month. However, he would have to make an additional $7,440 in interest payments on his loan during that time, and then sell. What would the price have to be at the end of year 2 in order…arrow_forward

- The NOI for a small income property is expected to be $150,000 for the first year. Financing will be based on a 1.2 DCR applied to the first year NOI, will have a 10 percent interest rate and will be amortized over 20 years with monthly payments. The NOI will increase 3 percent per yearafter the first year. The investor expects to hold the property for five years. The resale price is estimated by applying a 9 percent terminal capitalization rate to the sixth-year NOI. Investors require a 12 percent rate of return on equity (equity yield rate) for this type of property.a. What is the present value of the equity interest in the property?b. What is the total present value of the property (mortgage and equity interests)?c. Based on your answer to part (b), what is the implied overall capitalization rate?arrow_forwardPlease correct answer and don't use hand raitingarrow_forwardCan you help me with this problem with step by step explanation, please?arrow_forward

- The NOI for a small income property is expected to be $150,300 for the first year. Financing will be based on a 1.2 DCR applied to the first year NOI, will have a 10 percent interest rate, and will be amortized over 20 years with monthly payments. The NOI will increase 4 percent per year after the first year. The investor expects to hold the property for five years. The resale price is estimated by applying a 9 percent terminal capitalization rate to the sixth-year NOI. Investors require a 12 percent rate of return on equity (equity yield rate) for this type of property. Required: a. What is the present value of the equity interest in the property? b. What is the total present value of the property (mortgage and equity interests)? c. Based on your answer to part (b), what is the implied overall capitalization rate? What is the present value of the equity interest in the property? (Do not round intermediate calculations. Round your final answer to the nearest dollar amount.)…arrow_forwardCompany C is considering a leasing arrangement for an asset that has no value after its use for 3 years. It can borrow the value of the asset, at a 3-year simple interest loan of 10% with payments at the end of the year and buy the asset, or the company can make 3 equal end-of-year lease payments of $2,100,000 each and lease them. Annual maintenance costs associated with ownership are estimated at $240,000, but this cost would be borne by the lessor if it leases. What is the net advantage to leasing (NAL), if the firm's tax rate is 25%? (round to the nearest integer)(The Depreciation rate is 33.33% for Year 1, 33.33% for Year 2, and 33.33% for Year 3. The value of the asset $4,800,000)arrow_forwardA commercial property has PGI of $5 million, expenses of 40% of EGI and the vacancy is underwritten at 10%. What values would the following parameters suggest for the property. 70% LTV with a rate of 4.5% and 360 month amortization schedule. Given a property value of $45 million, calculate PGIM, EGIM, Cap Rate, Cash on Cash return and DSSCR.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT