Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN: 9781305635937

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

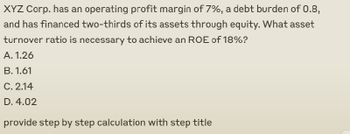

Transcribed Image Text:XYZ Corp. has an operating profit margin of 7%, a debt burden of 0.8,

and has financed two-thirds of its assets through equity. What asset

turnover ratio is necessary to achieve an ROE of 18%?

A. 1.26

B. 1.61

C. 2.14

D. 4.02

provide step by step calculation with step title

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need answer with this accounting questionarrow_forwardGet the solution with explanation of the questionarrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 1.32, total asset turnover of 1.34, and a profit margin of 7.50 percent. What is its ROE? a. 11.94% b. 13.27% c. 14.59% d. -3.22% e. 12.74% :arrow_forward

- Computearrow_forwardPlease provide answer the accounting questionarrow_forwardCroc Gator Removal has a profit margin of 10 percent, total asset turnover of 1.02 and ROE of 14.44 percent. What is the firm's debt-equity ratio? ( Do not round intermediate calculations and round your answer to 2 decimal places, e.g.,32.16) Debt-equity ratio________ timesarrow_forward

- roaarrow_forwardAssume the following relationships for the Caulder Corp.: Sales/Total assets 2.2x Return on assets (ROA) 6% Return on equity (ROE) 15% a. Calculate Caulder's profit margin assuming the firm uses only debt and common equity, so total assets equal total invested capital. Round your answer to two decimal places. % b. Calculate Caulder's debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardSolve this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning