FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Help me

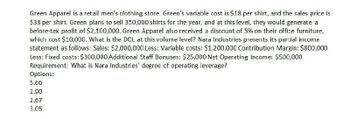

Transcribed Image Text:Green Apparel is a retail men's clothing store. Green's variable cost is $18 per shirt, and the sales price is

$38 per shirt. Green plans to sell 350,000 shirts for the year, and at this level, they would generate a

before-tax profit of $2,100,000. Green Apparel also received a discount of 5% on their office furniture,

which cost $10,000. What is the DCL at this volume level? Nara Industries presents its partial income

statement as follows: Sales: $2,000,000 Less: Variable costs: $1,200,000 Contribution Margin: $800,000

Less: Fixed costs: $300,000 Additional Staff Bonuses: $25,000 Net Operating Income: $500,000

Requirement: What is Nara Industries' degree of operating leverage?

Options:

5.66

2.90

2.67

3.05

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Green Apparel is a retail men's clothing store. Green's variable cost is $18 per shirt, and the sales price is $38 per shirt. Green plans to sell 350,000 shirts for the year, and at this level, they would generate a before-tax profit of $2,100,000. Green Apparel also received a discount of 5% on their office furniture, which cost $10,000. What is the DCL at this volume level? Nara Industries presents its partial income statement as follows: Sales: $2,000,000 Less: Variable costs: $1,200,000 Contribution Margin: $800,000 Less: Fixed costs: $300,000 Additional Staff Bonuses: $25,000 Net Operating Income: $500,000 Requirement: What is Nara Industries' degree of operating leverage? Options: 5.66 2.90 2.67 3.05arrow_forwardGreen Apparel is a retail men's clothing store. Green's variable cost is $18 per shirt, and the sales price is $38 per shirt. Green plans to sell 350,000 shirts for the year, and at this level, they would generate a before-tax profit of $2,100,000. Green Apparel also received a discount of 5% on their office furniture, which cost $10,000. What is the DOL at this volume level? Nara Industries presents its partial income statement as follows: Sales: $2,000,000 Less: Variable costs: $1,200,000 Contribution Margin: $800,000 Less: Fixed costs: $300,000 Additional Staff Bonuses: $25,000 Net Operating Income: $500,000 Requirement: What is Nara Industries' degree of operating leverage? Options: 5.66 2.90 2.67 3.05arrow_forwardPrblmarrow_forward

- Urban Styles is a retail store selling men's apparel. The variable cost per shirt is $25, and the sales price is $45 per shirt. Urban Syles expects to sell 500,000 shirts this year, which would generate a before-tax profit of $4,000,000. Additionally, the company received a $20,000 grant from the city to renovate its building. DOL? Nova Tech's partial income statement is provided as follows: Sales: $1,000,000 Less: Variable costs: $500,000 Contribution Margin: $500,000 Less: Fixed costs: $250,000 One-Time Charity Donation: $100,000 Net Operating Income: $250,000 Requirement: What is Nova Tech's degree of operating leverage? Options: 8.25 9.50 5.00 6.50arrow_forwardDon't use AIarrow_forwardPens and Prints manufactures and sells T-shirts imprinted with college names and slogans. Last year, the shirts sold for $7.50 each, and the variable cost to manufacture them was $2.25 per unit. The company needed to sell 20,000 shirts to break-even. The after tax net income last year was $5,040. Donnelly's expectations for the coming year include the following: • The sales price of the T-shirts will be $9• Variable cost to manufacture will increase by one-third • Fixed costs will increase by 10%• The income tax rate of 40% will be unchanged. Sales for the coming year are expected to exceed last year's by 1,000 units. If this occurs, How much will be the sales revenue in the coming year?arrow_forward

- Dorcan Corporation manufactures and sells T-shirts imprinted with college names and slogans. Last year, the shirts sold for $7.50 each, and the variable cost to manufacture them was $2.25 per unit. The company needed to sell 20,000 shirts to break-even. The after tax net income last year was $5,040. Donnelly's expectations for the coming year include the following: (CMA adapted) ∙ The sales price of the T-shirts will be $9. ∙ Variable cost to manufacture will increase by one-third. ∙ Fixed costs will increase by 10%. ∙ The income tax rate of 40% will be unchanged. Sales for the coming year are expected to exceed last year's by 1,000 units. If this occurs, Dorcan's sales volume in the coming year will be: 23,400 units. 21,960 units. 22,600 units. 21,000 units.arrow_forwardDona Corporation manufactures and sells T-shirts imprinted with college name and slogans. Last year, the shirts sold for P7.50 each, and the variable cost to manufacture them was P2.25 per unit. The company needed to sell 20,000 shirts to breakeven. The net income last year was P5,040. Dona’s expectation for the coming year include the following: • The sales price of the t-shirt will be P9.00 • Variable cost to manufacture will increase by one-third. • Fixed cost will increase by 10% • The income tax rate of 40% will be unchanged a. The selling price that would maintain the same contribution margin rate as last year is ______________- b. The number of T-shirts Dona must sell to break even in the coming year is ______________ c. If Dona wishes to earn P22,500 in net income for the coming year, the company’s sales in pesos must be __________arrow_forwardBright Fashions is a clothing store that sells men's shirts. Their variable cost per shirt is $22, and the sales price is $42. Bright Fashions plans to sell 450,000 shirts for the year, and they expect a before-tax profit of $3,000,000 at this volume. Additionally, they received an extra $15,000 from the sale of an old company vehide. What is the degree of operating leverage (DOL) at this volume level? Cosmos Enterprises provides the following partial income statement: Sales: $1,500,000 Less: Variable costs: $700,000 Contribution Margin: $800,000 Less: Fixed costs: $350,000 Maintenance Costs: $50,000Net Operating Income: $450,000 Requirement: What is Cosmos Enterprises' degree of operating leverage? Options: 1.57 4.38 1.86 2.00arrow_forward

- How many T-shirts must the company sell this year to break even?arrow_forwardABC Inc. is a manufacturer of T-shirts imprinted with college names and slogans. Based on last year figures, the shirts sold for $7.50 each, and the variable cost to manufacture them was $2.25 per unit. The company had to sell 20,000 shirts to break-even. The net income after taxes last year was $5,040. Razor's expectations for the coming year include the following: The sales price of the T-shirts will be $9. ∙ Variable cost to manufacture will increase by one-third. ∙ Fixed costs will increase by 10%. ∙ The income tax rate of 40% will be unchanged. The selling price that would maintain the same contribution margin ratio as last year is?arrow_forwardDon't use ai. Otherwise I will give you unhelpful ratearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education