Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Winston's Super Market is currently an all equity firm.... Please solve this financial accounting problem

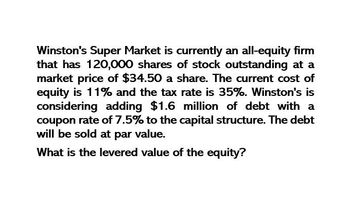

Transcribed Image Text:Winston's Super Market is currently an all-equity firm

that has 120,000 shares of stock outstanding at a

market price of $34.50 a share. The current cost of

equity is 11% and the tax rate is 35%. Winston's is

considering adding $1.6 million of debt with a

coupon rate of 7.5% to the capital structure. The debt

will be sold at par value.

What is the levered value of the equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hanover Tech is currently an all equity firm that has 600,000 shares of stock outstanding with a market price of $15.00 a share. The current cost of equity is 21 percent and the tax rate is 39 percent. The firm is considering permanently adding $5,850,000 of debt with a coupon rate of 11 percent to its capital structure. The debt will be sold at par value. What is the levered value of the equity? Round your answer to the nearest whole dollar, but don't include the $ sign. HINT: First get the value of the unlevered firm. Then calculate the value of the levered firm. The total value of any firm is the value of the debt plus the value of the equity. Numeric Response Iarrow_forwardXYZ Corp. is currently an all-equity firm that has 250,000 shares of stock outstanding with a market price of $15 a share. The current cost of equity is 12.5 percent and the tax rate is 35 percent. The firm is considering adding $1.45 million of debt with a coupon rate of 8 percent to its capital structure. The debt will be sold at par value. What is the levered value of the equity in dollars? (Do not round intermediate calculations. Round only the final answer to two decimal places and enter it without the dollar symbol ($)).arrow_forwardPastel Interiors is currently an all-equity firm that has an annual projected BIT of $136,900. The current cost of equity is 16.5% and the tax rate is 20%. The firm is considering adding $118,000 of debt with a coupon rate of 7.5% to its capital structure. The debt will be sold at par value. What is the value of the unlevered firm (pre-debt)? A $763,570 B $663.758 C $730,133 (D) $696,945 ) $630,570arrow_forward

- A firm is currently an all equity firm that has 510,000 shares of stock outstanding with a market price of $53.60 a share. The current cost of equity is 10.5 percent and the tax rate is 25 percent. The firm is considering adding $7.10million of debt with a coupon rate of 6 percent to its capital structure. The debt will be sold at par value. What is the levered value of the equity ?arrow_forwardA firm is currently an all equity firm that has an annualprojectedEBIT of $112,230. The current cost of equity is 16.5% and the tax rate is 20%. The firm is considering adding $118,000 of debt with a coupon rate of 7.5% to it's capital structure. The debt will be sold at par value. What is the value of the levered firm (with the debt)? A) 624, 520 B) 652,907 C) 567,745 D) 593, 133 E) 539,538arrow_forwardAn all-equity firm has expected earnings of $14,200 and a market value of $82,271. The firm is planning to issue $15,000 of debt at 6.3 percent interest and use the proceeds to repurchase shares at their current market value. Ignore taxes. What will be the cost of equity after the repurchase?arrow_forward

- A Hook Industries's capital structure consists solely of debt and common equity. It can issue debt at rd = 11%, and its common stock currently pays a $3.75 dividend per share (Do $3.75). The stock's price is currently $21.75, its dividend is expected to grow at a constant rate of 7% per year, its tax rate is 25%, and its WACC is 13.10%. What percentage of the company's capital structure consists of debt? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardA firm is currently an all equity firm that has 395,000 shares of stock outstanding with a market price of $19.50 a share. The current cost of equity is 15.5% and the tax rate is 24%. The firm is considering adding $925,000 of debt with a coupon rate of 8% to it's capital structure. The debt will be sold at par value. What is the leveled value of the equity? A) 7,349,475 B) 8 716,950 C) 6,999,500 D) 7,528,275 E) 7,132,050arrow_forwardGRK Co. is currently an all-equity firm with an expected return of 10%. The expected EBIT is $ 50,000 forever. Assume that the firm distributes all the net income to the equity holders. The firm is considering a leveraged recapitalization in which it would borrow $ 250,000 and repurchase existing shares. The firm's tax rate is 40%. The cost of debt is 7%. 1/ Calculate the value of the firm with leverage. 2/ Calculate the expected return of equity after recapitalization. 3/ Calculate the cost of capital of the firm after recapitalization.arrow_forward

- An unlevered firm has expected earnings of $4,780,000 and a market value of equity of $56,478,000. The firm is planning to issue $22,591,200 of debt at 5.1 percent interest and use the proceeds to repurchase shares at their current market value. Ignore taxes. What will be the cost of equity after the repurchase? 10.71% 10.58% 10.45% 10.32% 10.19%arrow_forwardHook Industries’s capital structure consistssolely of debt and common equity. It can issue debt at rd 5 11%, and its commonstock currently pays a $2.00 dividend per share (D0 5 $2.00). The stock’s price is currently$24.75, its dividend is expected to grow at a constant rate of 7% per year, its tax rate is35%, and its WACC is 13.95%. What percentage of the company’s capital structure consistsof debt?arrow_forwardensen's, an all-equity firm, has a total market value of $548,000. The firm is thinking of adding $262,000 of debt at an interest rate of 6% and using the proceeds to buy back shares. What would be the firm's weighted average cost of capital after it adds the debt if the firm pays a tax rate of 40% and its unlevered cost of equity is 12.6%? Question 14 options: A) 15.25% B) 9.95% C) 16.23% D) 10.19% E) 10.57%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning