FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer general Accounting

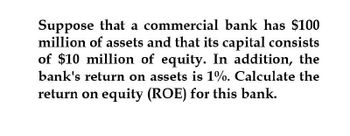

Transcribed Image Text:Suppose that a commercial bank has $100

million of assets and that its capital consists

of $10 million of equity. In addition, the

bank's return on assets is 1%. Calculate the

return on equity (ROE) for this bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A bank has a net income after taxes of $4 million, assets of $200 million, and bank capital of $10 million. What is the bank's return on assets (ROA)? Write your answer as a percent rate.arrow_forwardBased on the information provided below about banks A and B, compute for each bank its return on assets (ROA), return on equity (ROE) and Equity Multiplier. Show your work. a. Bank A has net profit after taxes of $2.38 million and the balance sheet below: Bank A (in millions) Assets Liabilities Reserves $10 Deposits $100 Loans $80 Borrowing $15 Securities $50 Bank Capital $25 b. Bank B has net profit after taxes of $1 million and the balance sheet below: Bank B (in millions) Assets Liabilities Reserves $8 Deposits $75.0 Loans $60 Borrowing $5.0 Securities $22 Bank Capital $10.0arrow_forwardA bank has earning assets of $100 million including $30 million of securities that pay an interest rate of 3%, and $70 million of loans that pay an interest rate of 6% financed by $100 million of deposits paying an interest rate of 3%. What is the bank's Net Interest Margin (NIM)?arrow_forward

- so.3arrow_forwardBank ABC has a Return on Equity (ROE) equal to 22%, a total assets/debt ratio equal to 1.02 and an asset utilisation ratio equal to 0.02. From this we know that the profit margin of bank ABC is:arrow_forwardLambrook Bank has the following assets and liabilities: Asset A has a maturity of 4 years and a market value of $600,000 and asset B has a maturity of 6 years and a market value of $800,000. Liability X has a maturity of 2 years and a market value of $200,000 and liability Y has a maturity of 5 years and a market value of $300,000. What is the maturity gap of the bank? . .arrow_forward

- Please answer Fast in typing. I ll upvote Thank You Based on the following information about Banks A and B, compute for each the return on assets (ROA), return on equity (ROE), and leverage ratio. a. Bank A has net profit after taxes of $1.8 million and the following balance sheet: The return on assets (ROA) for Bank A: ___% The return on equity (ROE) for Bank A: ___% The leverage ratio for Bank A: ___ Bank B has net profit after taxes of $1 million and the following balance sheet: Instructions: Enter your responses rounded to two decimal places.) The return on assets (ROA) for Bank B: ___% The return on equity (ROE) for Bank B: ___% The leverage ratio for Bank B: ___arrow_forwardImagine that a given investment bank generated a return on assets of 10% which lead to a doubling of bank capital. What was the asset to equity ratio in this bank? 0.5 10 5 1arrow_forward(c) A bank has 100 in assets and 60 in liabilities. Suppose assets pay on average 6% and liabilities cost 2%. What is the expected rate of return on capital? A. 4% B. 12% C. 8% D. -4%arrow_forward

- The financial statements for BSW National Bank (BSWNB) are shown below: What is the dollar value of earning assets held by BSWNB? What is the dollar value of interest-bearing liabilities held by BSWNB? What is BSWNB’s total operating income? Calculate BSWNB’s asset utilization ratio. Calculate BSWNB’s net interest margin.arrow_forwardBank A has the following balance sheet: A ssets Reserves $50 million Liabilities Deposits $200 million Bank capital 850 million Securities $50 million Loans $150 million Bank B has the following balance sheet: A ssets Liabilities Deposits $225 million Bank capital $25 million Reserves $50 million Securities $50 million Loans $150 million 1. Both banks earn 85 million as an annual after-tax profit. Calculate ROA (return on asset) and ROE (return on equity) for both banks.arrow_forwardBank ABC has a Return on Equity (ROE) equal to 24%, an equity/debt ratio equal to 0.05 and an asset utilisation ratio equal to 0.07. From this we know that the profit margin of bank ABC is?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education