Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

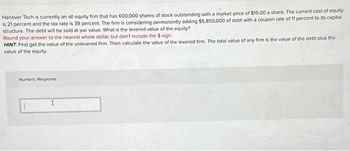

Transcribed Image Text:Hanover Tech is currently an all equity firm that has 600,000 shares of stock outstanding with a market price of $15.00 a share. The current cost of equity

is 21 percent and the tax rate is 39 percent. The firm is considering permanently adding $5,850,000 of debt with a coupon rate of 11 percent to its capital

structure. The debt will be sold at par value. What is the levered value of the equity?

Round your answer to the nearest whole dollar, but don't include the $ sign.

HINT: First get the value of the unlevered firm. Then calculate the value of the levered firm. The total value of any firm is the value of the debt plus the

value of the equity.

Numeric Response

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Antiques R Us is a mature manufacturing firm. The company just paid a dividend of $8, but management expects to reduce the payout by 6 percent per year indefinitely.If you require a return of 13 percent on this stock, what will you pay for a share today? choose the correct option: A. 39.58 B.39.97 C. 107.43 D. 42.11 E. 39.18arrow_forwardScampini Technologies is expected to generate $100 million in free cash flow next year, and FCF is expected to grow at a constant rate of 6% per year indefinitely. Scampini has no debt or preferred stock, and its WACC is 14%, and it has zero nonoperating assets. If Scampini has 55 million shares of stock outstanding, what is the stock's value per share? Do not round intermediate calculations. Round your answer to the nearest cent. Each share of common stock is wortharrow_forwardAbercrombie & Fitch's common stock pays a dividend of $0.75. It is currently selling for $35.91. If the firm's investors require a return of 15 percent on their investment from buying Abercrombie & Fitch stock, what growth rate would Abercrombie & Fitch have to provide the investors?arrow_forward

- Abercrombie & Fitch's common stock pays a dividend of $3.00. It is currently selling for $30.78. If the firm's investors require a return of 15 percent on their investment from buying Abercrombie & Fitch stock, what growth rate would Abercrombie & Fitch have to provide the investors?arrow_forwardBoston Company has just paid dividends of $2.5 per share, which the company projects will grow at a constant rate of 5 percent forever. If Boston Company’s shareholders require 15 percent rate of return, what is the price of its common stock? Can you show the excel formula?arrow_forwardBushwhacker Mowing needs $360 million to support growth. If it issues new common stock to raise the funds, the issuing cost charged by the investment banker will be 4 percent. Additional costs associated with the issue will total $288,000. If Bushwhacker can issue stock at $60 per share, how many shares of common stock must be issued so that it has $360 million after flotation costs? Show how much of the issue will consist of flotation costs and how much Bushwhacker will receive after flotation costs are paid.arrow_forward

- Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang’s current value of equity is $60 million. Zang currently has 4 million shares outstanding and will issue 1 million new shares. ESM charges a 7% spread. What is the correctly valued offer price, rounded to the nearest penny? How much cash will Zang raise net of the spread (use the rounded offer price)?arrow_forwardBecker industries is considering an all equity capital structure against one with both debt and equity. The all equity capital structure would consist of 34000 shares of stock. The debt and equity option would consist of 17000 shares of stock plus $265000 of debt with an interest rate of 8 percent. What is the break even level of earnings before interest and taxes between these two options? Ignore taxesarrow_forwardCovan, Inc. is expected to have the following free cash flow: a. Covan has 8 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price? c. Assume you bought Covan stock at the beginning of year 1. What is your expected return from holding Covan stock until year 2? a. Covan has 8 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? The stock price should be $ (Round to the nearest cent.) A b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price? If you plan to sell Covan at the beginning of year 2, its price should be $ (Round to the nearest cont.) c. Assume you bought Covan stock at the beginning of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education