FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please provide correct answer with correct calculation of this accounting question

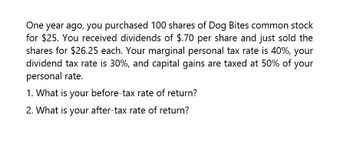

Transcribed Image Text:One year ago, you purchased 100 shares of Dog Bites common stock

for $25. You received dividends of $.70 per share and just sold the

shares for $26.25 each. Your marginal personal tax rate is 40%, your

dividend tax rate is 30%, and capital gains are taxed at 50% of your

personal rate.

1. What is your before-tax rate of return?

2. What is your after-tax rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please get the correct answer for the questions a) and b)arrow_forwardSuppose you earn $60,000 per year and pay taxes based on marginal tax rates. The first tax bracket, which taxes at 5 percent, ranges from $0 to $30,000. The second tax bracket, which taxes at 25 percent, ranges from $30,001 to $120,000. How much will you pay in total taxes? Instructions: Enter your answer as a whole number. %24arrow_forwardSuppose your principal investment is $1800 and you have a nominal interest rate of 6.5%. what is your nominal interest income? Presume you are taxed at the 22% tax rate, who much will you pay in taxes and what is your after tax nominal income? Presume inflation was 2.7% during the year, what is the loss of principal due to inflation? What is your real interest income? What is after-tax real interest income?arrow_forward

- Suppose the tax amount on the first $10,000 income is $0; $2000 on the next $20,000; $4000 on the next $20,000; $6000 on the next $30,000; and 40 percent on any income over $80,000. Family A has income of $30,000 and Family B has income of $80,000. What is the marginal and average tax rate for each family? A.Family A: marginal10 percent; average20 percent; Family B: marginal30 percent; average23 percent. B.Family A: marginal10 percent; average15 percent; Family B: marginal40 percent; average20 percent. C.Family A: marginal10 percent; average6.7 percent; Family B: marginal30 percent; average15 percent. D.Family A: marginal10 percent; average10 percent; Family B: marginal40 percent; average40 percentarrow_forwardIf the tax rates are 15% on the first $50,000 of taxable income, and 20% on the next $25,000, and 25% on the next $25,000, what is the tax liability for an individual with $80,000 of taxable income, what is the marginal tax rate, and what is the average tax rate ? a. $10,250, 15%, and 20% b. $25,122, 22%, and 16% c. $11,345, 15%, and 34% d. $13,750, 25%, and 17.19%arrow_forwardHow much does he need before tax on this financial accounting question?arrow_forward

- Suppose you are in the 25% marginal tax bracket and earn $15,000. Then a tax credit of $1500 will reduce your tax bill by how much?arrow_forwardIf your gross salary is $273 000 and your taxable income is $73 000 and your tax rate is 25% how much is your net income?arrow_forwardSuppose the tax rate on the first $10,000 income is 0; 10 percent on the next $20,000; 20 percent on the next $20,000; 30 percent on the next $30,000; and 40 percent on any income over $80,000. Family A has income of $40,000 and Family B has income of $100,000. What is the marginal and average tax rate for each family? Question 10 options:Family A: marginal20 percent; average10 percent; Family B: marginal40 percent; average23 percent.Family A: marginal20 percent; average20 percent; Family B: marginal40 percent; average40 percent.Family A: marginal20 percent; average15 percent; Family B: marginal40 percent; average20 percent.Family A: marginal10 percent; average10 percent; Family B: marginal30 percent; average30 percent.Savearrow_forward

- Mr. Borbon had the following data for his income tax return for the current year: Php 490, 000 150, 000 200, 000 120, 000 70, 000 320,000 Sales Personal Exemption Cost of Sales Administrative and Selling Expenses Personal Expenses Professional Income If he opted to be taxed by 8%, how much is the tax base?arrow_forward2) Suppose the income tax rate schedule is O percent on the first $10,00O; 10 percent on the next $20,000; 20 percent on the next $20,000; 30 percent on the next $20,000; and 40 percent on any income over $70,000. Family A earns $32,000 a year and Family B earns $70,000 a year. Both families each receive a ten percent raise. What is the marginal tax rate of each and what is the extra tax paid by each after the raise? 3) "Only in a progressive tax system does the amount of taxes increase as income increases." Do you agree or disagree? Explain.arrow_forwardUse the following Income Tax Calculation table to calculate the total income tax that someone would owe if their annual income was $83,350. In the image.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education