FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

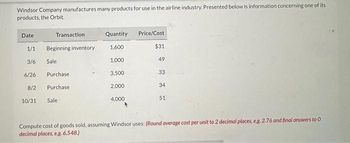

Transcribed Image Text:Windsor Company manufactures many products for use in the airline industry. Presented below is information concerning one of its

products, the Orbit.

Date

1/1

3/6

6/26

8/2

10/31

Transaction

Beginning inventory

Sale

Purchase

Purchase

Sale

Quantity

1,600

1,000

3,500

2,000

4,000

Price/Cost

$31

49

33

34

51

Compute cost of goods sold, assuming Windsor uses: (Round average cost per unit to 2 decimal places, e.g. 2.76 and final answers to 0

decimal places, e.g. 6,548.)

Transcribed Image Text:Windsor Company manufactures many products for use in the airline industry. Presented below is information concerning one of its

products, the Orbit.

Date

1/1

3/6

6/26

8/2

10/31

Transaction

Beginning inventory

Sale

Purchase

Purchase

Sale

Quantity

1,600

1,000

3,500

2,000

4,000

Price/Cost

$31

49

33

34

51

Compute cost of goods sold, assuming Windsor uses: (Round average cost per unit to 2 decimal places, e.g. 2.76 and final answers to 0

decimal places, e.g. 6,548.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Inventory system:

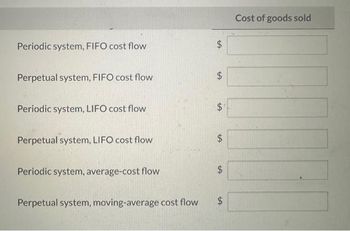

VIEW Step 2: a)Calculation of Cost of Goods sold using Periodic system, FIFO cost flow,

VIEW Step 3: b) Calculation of Cost of Goods sold using Perpetual system, FIFO cost flow:

VIEW Step 4: c)Calculation of Cost of Goods sold using Periodic system, LIFO cost flow:

VIEW Step 5: d) Calculation of Cost of Goods sold using Perpetual system, LIFO cost flow:

VIEW Step 6: Calculation of Cost of Goods sold using Periodic system, Average cost flow

VIEW Step 7: Calculation of Cost of Goods sold using Perpetual system, moving average cost flow:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ames Trading Company has the following products in its ending inventory. Cost per Unit Market per Product Quantity Unit Mountain bikes 20 $ 610 $ 550 Skateboards 21 260 320 Gliders 28 930 900 Compute lower of cost or market for inventory applied separately to each product. Per Unit Total LCM applied to each product Inventory Items Units Cost Market Cost Market Mountain bikes Skateboards Glidersarrow_forward2. Below is the Statement of Cost of Goods Manufactured and the Income Statement for two separate companies. Determine the amounts for each of the missing items (the highlighted items). Hint: start with the cost of goods manufactured Statement of Net Income Snoopy Co. Woodstock Co. Sales 2,760,000 1,117,000 Cost of Goods Sold: Beginning Inventory - Finished Goods 316,800 136,000 Cost of Goods Manufactured 683,000 Cost of Goods Available for Sale Less: Ending Inv - Finished Goods 331,200 Cost of Goods Sold 701,000 Gross Profit Operating Expenses 360,000 Net Income 256,000 Statement of Cost of Goods Manufactured Snoopy Co. Woodstock Co. Direct Materials: Beginning Inventory - Direct Materials 187,200 118,000 Purchases of Direct Materials 475,200 228,000 Materials Available for Use Less: Ending Inv - Direct Materials 120,000 Total Direct Materials Costs 501,600 Direct Labor 705,600 Overhead 218,400 120,000 Total Manufacturing Costs Incurred 690,000 Beginning Inventory - WIP 360,000…arrow_forwardTB MC Qu. 6-93 Inventory records for Marvin Company... 38 Inventory records for Marvin Company revealed the following: of Onite Cost Мar. 1 Beginning inventory 960 $7.28 34 Mar.10 Purchase 570 7.71 Mar.16 Purchase 790 8.16 Mar.23 Purchase 550 8.56 Marvin sold 1,960 units of inventory during the month. Cost of goods sold assuming FIFO would Round your answer to the nearest dollar amount.) Multiple Choice $13,942.arrow_forward

- Hancock Company manufactures and sells two lines of furniture, case goods and upholstery. During the most recent accounting period, the Case Goods and Upholstery Divisions sold 15,600 and 2,090 units, respectively. The company's most recent financial statements are shown below: (Do not round intermediate calculations.) Case Goods Upholstery Sales $1,663,000 $418,000 Less cost of goods sold: Unit-level production cost 1,039,000 250,800 Depreciation, production equipment Gross margin 249,000 62,700 $ 375,000 $104,500 Less operating expenses: Unit-level selling and administrative costs 62,400 52,250 Corporate-level facility expenses (fixed) 55,000 55,000 Net income (loss) $ 257,600 $ (2,750) If unit sales for both divisions increased 10%, the company would report which of the following? Multiple Choice A $55,000 increase in net income for the Upholstery Division A 10% increase in total net income of the company A decline in profit for the Upholstery Division A net income for the…arrow_forwardHh3. Ehlo Company is a multiproduct firm. Presented below is information concerning one of its products, the Hawkeyearrow_forwardAJXKXJ923 Corp. is a merchandiser with a single product. Corp.'s accountants have provided the following cost data for two levels of sales volume. Sales units Cost of goods sold (ID#77379) Selling and Administrative costs Selling price per unit 10,000 $470,000 20,000 $800,000 $500,000 $150 $780,000 $150 Q)What's the best estimate of AJXKXJ923's net operating income if 15,920 units are sold? A.) $ Next > 14.of 25arrow_forward

- Winner Company has two products with cost and selling price as follows: Product X Product Y Selling price 2,000,000 3,000,000 Estimated selling cost 600,000 700,000 Materials and conversion cost 1,500,000 1,800,000 General administration cost 300,000 800,000 At year-end, the manufacture of inventory has been completed but no selling cost has yet been incurred. Under LCNRV by individual item, the inventory shall be measured at what amount?arrow_forwardPresented below is information related to Sheffield Inc's inventory, assuming Sheffield uses lower-of-LIFO cost-or-market. Historical cost Selling price Cost to distribute Current replacement cost Normal profit margin (per unit) Floor $ Skis $254.60 $ $ 284.08 25.46 272.02 42.88 Boots $142.04 194.30 10.72 140.70 Parkas $71.02 98.83 Determine the following: (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling $ 3.35 68.34 38.86 28.48 (b) The cost amount that should be used in the lower-of-cost-or-market comparison of boots. (Round answer to 2 decimal places, e.g. 52.75.) (c) The market amount that should be used to value parkas on the basis of the lower-of-cost-or-market. (Round answer to 2 decimal places, e.g. 52.75.)arrow_forwardAmes Trading Co. has the following products in its ending inventory. Compute lower of cost or market for inventory applied separately to each product.arrow_forward

- Ames Trading Co. has the following products in its ending inventory. Market per Unit $ 550 Quantity Cost per Unit $ 600 35e Product Mountain bikes 11 Skateboards 13 425 Gliders 26 800 700 Compute lower of cost or market for inventory applied separately to each product. Per Unit Total LCM applied to Inventory Items Units Cost Market Cost Market each product Mountain bikes 2$ $ Skateboards Gliders 24arrow_forwardon Given the following data, calculate the cost of goods sold using the FIFO costing method: Jan Beginning inventory 110 units at $30 per unit, Feb 25 Purchased 100 units at $32 per unit; June 15 Purchased 80 units at $33 per unit; Sept 20 Purchased 75 units at $31 per unit; Dec 31 Ending inventory 125 units. It might help to make a table. Select one: O a $11,465 O b. $4,965 Oc: $7,490 Od. $3,975arrow_forwardCherokee Inc. is a merchandiser that provided the following information: Number of units sold 11,000 Selling price per unit $ 17.00 Variable selling expense per unit $ 1.00 Variable administrative expense per unit $ 1.00 Total fixed selling expense $ 21,000 Total fixed administrative expense $ 16,000 Beginning merchandise inventory $ 10,000 Ending merchandise inventory $ 26,000 Merchandise purchases $ 90,000 Required: 1. Prepare a traditional income statement. 2. Prepare a contribution format income statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education