FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

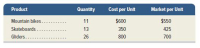

Ames Trading Co. has the following products in its ending inventory. Compute lower of cost or market for

inventory applied separately to each product.

Transcribed Image Text:Product

Quantity

Cost per Unit

Market per Unit

Mountain bikes..

11

$600

$550

Skateboards .

13

350

425

Gliders..

26

800

700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- d The records of Cordova Corp. showed the following transactions, in the order given, relating to the major inventory item: Required: Complete the following schedule for each independent assumption. (Round unit costs to the nearest cent.) a. 1. Inventory 2. Purchase 3. Sale (at $15.20) 4. Purchase 5. Sale (at $15.20) 6. Purchase 7. Sale (at $18.20) 8. Purchase Independent Assumptions FIFO Weighted average, periodic inventory system Moving average, perpetual inventory system b. Unit Units Cost 5,600 $7.00 11,200 7.30 7,900 10,200 7.60 16,800 18,800 7.76 16,800 11,200 7.90 C. $ Ending Inventory 121,848 121,675 X 121,676 Units and Amounts Cost of Goods Sold $ 311,000 311,064 311,328 $ Gross Margin 370,200 370,136 X 369,872arrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10. Product InventoryQuantity Cost PerUnit Market Value per Unit(Net Realizable Value) Class 1: Model A 16 $162 $169 Model B 32 190 198 Model C 34 152 148 Class 2: Model D 31 298 309 Model E 42 72 78 Question Content Area a. Determine the value of the inventory at the lower of cost or market applied to each item in the inventory. Inventory at the Lower of Cost or Market Product InventoryQuantity Costper Unit Market Valueper Unit(Net Realizable Value) Cost Market Lower of Cost or Market Model A fill in the blank 1b67cb01c017023_1 $fill in the blank 1b67cb01c017023_2 $fill in the blank 1b67cb01c017023_3 $fill in the blank 1b67cb01c017023_4 $fill in the blank 1b67cb01c017023_5 $fill in…arrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exh Inventory Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) Birch 28 $82 $68 Cypress 8 137 128 Mountain Ash 48 106 102 Spruce 10 135 155 Willow 18 80 93 Inventory at the Lower of Cost or Market Inventory Item Total Cost Total Market Total Lower of C or M Birch Cypress Mountain Ash Spruce Willow Totalarrow_forward

- Identify each item as describing the FIFO method, LIFO method, or average cost method of inventory valuation. A. Involves calculating the total number of units in the warehouse FIFO LIFO Average cost B. To determine cost of goods sold, begin with the earliest goods acquired FIFO LIFO Average cost C. To determine merchandise inventory balance, begin with the earliest goods acquired FIFO LIFO Average costarrow_forwardLower of cost or market: Multiple Choice Records only an increase in inventory value. Is only applicable to companies using LIFO. Reports all inventory items at full cost Can be applied to each individual item, major categories of items, or the whole inventory- Is only applicable to companies using FIFO.arrow_forward1-2: ABC Co. stated the following: "Merchandise inventories are valued at the lower of cost or market, with cost determined under the first-in, first-out ("FIFO") assumption." The lower of cost or market method is an example of the use of:arrow_forward

- Differentiate between the specific identification, FIFO, LIFO, and average cost methods used to determine the cost of ending inventory and cost of goods sold.arrow_forwardLower-of-cost-or-market method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Commodity InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) JFW1 78 $58 $55 SAW9 148 28 33arrow_forwardDetermine the ending inventory amount by applying the lower of cost or market value to a. Each inventory item of inventoryb. Total inventory The following data refer to Froning Company’s ending inventoryItem Code, Quantity, Unit Cost, Unit MarketLXC 60 $45 $48KMT 210 $38 $34MOR 300 $22 $20NES 100 $27 $32arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education