FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

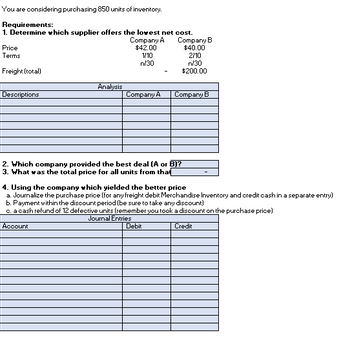

Transcribed Image Text:You are considering purchasing 850 units of inventory.

Requirements:

1. Determine which supplier offers the lowest net cost.

Price

Terms

Freight (total)

Descriptions

Analysis

Company A

$42.00

1/10

n/30

Company A

Company B

$40.00

2/10

n/30

$200.00

Company B

2. Which company provided the best deal (A or B)?

3. What was the total price for all units from tha

4. Using the company which yielded the better price

a. Journalize the purchase price (for any freight debit Merchandise Inventory and credit cash in a separate entry)

b. Payment within the discount period (be sure to take any discount)

c. a cash refund of 12 defective units (remember you took a discount on the purchase price)

Journal Entries

Account

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sanarrow_forwardI need help calculating not only the net realizable value for all four products but also calculating the ending inventory using the LOWER OF COST OR MARKET METHOD for- individual items, category, and total inventory (Please Show Calculations).arrow_forward4) The data below is the stock record for item 345 Date Receipts 14/3 10 Unit cost 11 sales balance 10 12/4 3 7 22/5 2 5 10/6 5 15 10 30/6 17/7 32 7 5 What is the value of the inventory based on: FIFO costing Average costing LIFO costingarrow_forward

- MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 7) Given the following data, what is cost of goods sold as determined under the FIF0 method? 7) Sales revenue 350 units at $35 per unit Beginning inventory 120 units at $15 per unit Purchases 400 units at $20 per unit A) $4,600 B) $7,000 C) $6,400 D) $5,250arrow_forwardSheffield Company follows the practice of pricing its inventory at the lower-of-cost-or-market, on an individual-item basis. Item No. Quantity Cost per Unit Cost to Replace Estimated Selling Price Cost of Completion and Disposal Normal Profit 1320 1,300 $3.74 $3.51 $5.27 $0.41 $1.46 1333 1,000 3.16 2.69 4.10 0.59 0.59 1426 900 5.27 4.33 5.85 0.47 1.17 1437 1,100 4.21 3.63 3.74 0.29 1.05 1510 800 2.63 2.34 3.80 0.94 0.70 1522 600 3.51 3.16 4.45 0.47 0.59 1573 3,100 2.11 1.87 2.93 0.88 0.59 1626 1,100 5.50 6.08 7.02 0.59 1.17 From the information above, determine the amount of Sheffield Company inventory. The amount of Sheffield Company’s inventoryarrow_forwardA manufacturer has the following per-unit costs and values for its sole product: Cost $10.00 5.50 Current replacement cost Net realizable value 6.00 Net realizable value less normal profit 5.20 margin Under the first-in first-out (FIFO) cost method, what is the per-unit carrying value of inventory in the manufacturer's statement of financial position? O 55.20 $5.50 $6.00 $10.00arrow_forward

- A-2arrow_forwardInformation pertaining to the inventory of Palette Company follows. LIFO Selling Replacement Cost Price Cost Category: Supreme Item A $5,600 $6,400 $4,800 Item B 7,200 7,200 7,680 Item C 17,600 17,600 16,800 Category: Classic Item X 28,800 28,800 30,400 Item Y 35,200 42,400 41,600 Item Z 56,000 48,000 52,800 The company has a normal profit margin of 20% of selling price and has no additional costs to complete or sell the items. What is the lower-of-cost-or-market value of the company's inventory applying the rule to (a) each individual item and (b) to each inventory category? Select one: a. Inventory item: $147,200; Inventory Category: $147,200 b. Inventory item: $150,400; Inventory Category: $150,400 c. Inventory item: $143,520; Inventory Category: $150,400 d. Inventory item: $141,120; Inventory Category: $147,520arrow_forwardvalue on units in ending inventory: 20,000 per-unit product cost using absorption costing method: 130 units Dollar amount of the value of ending inventory using the absorption costing method: 2,600,000 per-unit product cost using variable costing method: 110 units dollar amount of the value of ending inventory using the variable costing method: 2,200,000 1. If you were advising the accounting department on whcih method to use, which would you recommend?arrow_forward

- Question - Company sells three different categories of tools (small, medium, and large). The cost and market value of its inventory of tools is as follows. Cost Market Value Small $ 63,200 $ 72,000 Medium 2,89,400 2,60,800 Large 1,52,100 1,72,800 Determine the value of the company's inventory under the lower-of- cost-or-market value approach.arrow_forwardThe inventory of Royal Decking consisted of five products. Information about ending inventory is as follows: Product A n C D Cost $70 110 70 70 30 Product Per Unit ABCDE Selling Price Costs to sell consist of a sales commission equal to 20% of selling price and shipping costs equal to 10% of cost. Required: What unit value should Royal Decking use for each of its products when applying the lower of cost or net realizable value (LCNRV) rule to units of ending inventory? $90 160 110 100 40 Cost NRV Per Unit Inventory Valuearrow_forwardThe inventory of Royal Decking consisted of five products. Information about ending inventory is as follows: Per Unit Product A Cost $ 80 Selling Price $ 100 B 120 160 80 120 D E 80 40 110 50 Costs to sell consist of a sales commission equal to 20% of selling price and shipping costs equal to 5% of cost. Required: What unit value should Royal Decking use for each of its products when applying the lower of cost or net realizable value (LCNRV) rule Co units of ending inventory? Product Cost NRV Per Unit Inventory Value A $ 80 B 56 104 104 C 80 D 80 E 40arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education