FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

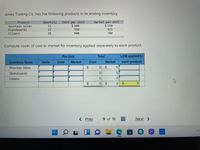

Transcribed Image Text:Ames Trading Co. has the following products in its ending inventory.

Market per Unit

$ 550

Quantity

Cost per Unit

$ 600

35e

Product

Mountain bikes

11

Skateboards

13

425

Gliders

26

800

700

Compute lower of cost or market for inventory applied separately to each product.

Per Unit

Total

LCM applied to

Inventory Items

Units

Cost

Market

Cost

Market

each product

Mountain bikes

2$

$

Skateboards

Gliders

24

< Prev

9 of 18

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Smoky Mountain Corporation makes two types of hiking boots—the Xtreme and the Pathfinder. Data concerning these two product lines appear below: Xtreme Pathfinder Selling price per unit $ 132.00 $ 94.00 Direct materials per unit $ 64.60 $ 53.00 Direct labor per unit $ 9.60 $ 8.00 Direct labor-hours per unit 1.2 DLHs 1.0 DLHs Estimated annual production and sales 24,000 units 70,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead $ 2,470,000 Estimated total direct labor-hours 98,800 DLHs Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company’s traditional costing system. 2. The company is considering replacing its traditional costing system with an…arrow_forwardFairmount Travel Gear produces backpacks and sells them to vendors who sell them under their own label. The cost of one of its backpacks follows. Materials $ 19.60 Labor 13.60 Variable overhead 6.60 Fixed overhead ($3,541,600 per year; 466,000 units per year) 7.60 Total $ 47.40 Riverside Discount Mart, a chain of low-price stores, has asked Fairmount to supply it with 35,000 backpacks for a special promotion Riverside is planning. Riverside has offered to pay Fairmount a unit price of $52 per pack. The regular selling price is $76. The special order would require some modification to the basic model. These modifications would add $5.60 per unit in material cost, $3.10 per unit in labor cost, and $2.10 in variable overhead cost. Although Fairmount has the capacity to produce the 35,000 units without affecting its regular production of 466,000 units, a one-time rental of special testing equipment to meet Riverside’s requirements would be…arrow_forwardOriental Furnitures makes three types of quality wooden furniture. Information for these three products are shown below: A1 A2 A3 Total Selling price per unit $200 $500 $1 000 Variable cost per unit $60 $250 $600 Expected unit sales (annual) 15,000 7,000 2,000 24,000 Sales mix 60 percent 30 percent 10 percent 100 percent Total annual fixed costs are $4,000,000. Assume the sales mix remains the same at all levels of sales. Required: SHOW YOUR WORKINGS FOR ALL SECTIONS How many units of each furniture type must be sold to break even?arrow_forward

- Pharoah Industries manufactures chairs and tables that are in high demand by local office furniture stores. Following is information for each of these products: Selling price per item Variable cost per item Contribution margin per item Machine hours per item Chairs O $11270 $11520 $10880 O $17390 $78.00 61.00 $17.00 1.60 Tables $95.00 77.00 $18.00 1.60 Pharoah has 1024 machine hours available each month. The demand for chairs is 610 units per month and the demand for tables is 390 units per month. If Pharoah allocates its production capacity between the chairs and tables so that it maximizes the company's contribution margin, what will the total contribution margin be?arrow_forwardEdgerron Company is able to produce two products, G and B, with the same machine in its factory. The following information is available. Product G Product B Selling price per unit $ 200 $ 230 Variable costs per unit 85 138 Contribution margin per unit $ 115 $ 92 Machine hours to produce 1 unit 0.4 hours 1.0 hours Maximum unit sales per month 650 units 250 units The company presently operates the machine for a single eight-hour shift for 22 working days each month. Management is thinking about operating the machine for two shifts, which will increase its productivity by another eight hours per day for 22 days per month. This change would require $11,500 additional fixed costs per month. (Round hours per unit answers to 1 decimal place. Enter operating losses, if any, as negative values.)arrow_forwardVisnoarrow_forward

- Oriental Furnitures makes three types of quality wooden furniture. Information for these three products are shown below: A1 A2 A3 Total Selling price per unit $200 $500 $1 000 Variable cost per unit $60 $250 $600 Expected unit sales (annual) 15,000 7,000 2,000 24,000 Sales mix 60 percent 30 percent 10 percent 100 percent Total annual fixed costs are $4,000,000. Assume the sales mix remains the same at all levels of sales. Required: SHOW YOUR WORKINGS FOR ALL SECTIONS Calculate the weighted average unit contribution margin, assuming a constant sales mix.arrow_forwardA firm makes a range of running shoes. There are three models – Short; Middle; and Long distance. The products are aimed at different segments of the market. Product costs are computed using an overhead rate based on the labour hour method. Selling prices are set on full cost plus 20%. A unit refers to a pair of running shoes. The following information is available: Short distance Middle distance Long distance Direct material cost per unit $25 $35 $40 Labour hours per unit 2 hrs 2 hrs 2 hrs Labour rate per hour $12 $12 $12 Total labour hours used 120,000 hrs 24,000 hrs 16,000 hrs Total number of units 60,000 units 12,000 units 8,000 units Cost driver information: Short distance Middle distance Long distance No. of machine hours 60,000 48,000 48,000 No. of material orders 30 100 200 No. of sales orders 12 48 63 The total overhead costs for the business amount to $1.2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education