FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Quick answer of this accounting questions

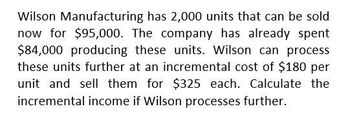

Transcribed Image Text:Wilson Manufacturing has 2,000 units that can be sold

now for $95,000. The company has already spent

$84,000 producing these units. Wilson can process

these units further at an incremental cost of $180 per

unit and sell them for $325 each. Calculate the

incremental income if Wilson processes further.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kobe Company has manufactured 200 partially finished cabinets at a cost of $102,000. These can be sold as is for $122,400. Instead, the cabinets can be stained and fitted with hardware to make finished cabinets. Further processing costs would be $24,500, and the finished cabinets could be sold for $163,200. If Kobe Company processes the cabinets further, incremental income is:arrow_forwardMaple Inc. manufactures a product that costs $25 per unit plus $43,000 in fixed costs each month. Maple currently sells 6,000 of these units per month for $47 each. If Maple leased a machine for $12,000 a month, it could add features to the product that would allow it to sell for $53 each. It would cost an additional $9 per unit to add these features. How much would Maple's profit be affected if it leased the machine and added features to its product? Multiple Choice Increase $252,000 Decrease $252,000 Increase $6,000 Decrease $30,000arrow_forwardZen Inc. uses one raw material type in its manufacturing process. It needs 3,750 kilos of this material each month. It incurs P500 each time when making and receiving orders. Annual carrying cost per unit costs P15 in warehousing and P5 in financing costs. If Zen purchases 1,000 kilograms each time, how much lower would the annual cost be if Zen would now follow the EOQ model?arrow_forward

- Crane Company uses 9000 units of Part A in producing its products. A supplier offers to make Part A for $5. CraneCompany has relevant costs of $8 a unit to manufacture Part A. If there is excess capacity, the relevant cost of buying Part A from the supplier is $72000. $45000. $27000. $0.arrow_forwardBryant Company has already manufactured 21,000 units of Product A at a cost of $15 per unit. The 21,000 units can be sold at this stage for $410,000. Alternatively, the units can be further processed at a $200,000 total additional cost and be converted into 5,800 units of Product B and 11,200 units of Product C. Per unit selling price for Product B is $104 and for Product C is $59. 1. Prepare an analysis that shows whether the 21,000 units of Product A should be processed further or not? Sell as is Process Further Sales Relevant costs: Total relevant costs Income (loss) Incremental net income (or loss) if processed further The company shouldarrow_forwardChang Industries has already spent $230,000 to produce tables. Those tables can be sold as is for SA42000. Alternatively, the tables can be processed a stain for an additional cost of $150,00O. The stained tables can be sold for $620,000. Chang should: Multiple Choice Sell unfinished tables for incremental revenue of $212,00. Sell the unfinished tables for incremental income of $390,000. Finish the tables for incremental cost of $380,000. Finish the tables for incremental income of $178,000. Finish the tables for incremental income of $28,000.arrow_forward

- Harcourt Manufacturing (HM) has the capacity to produce 11,800 fax machines per year. HM currently produces and sells 8,800 units per year. The fax machines normally sell for $280 each. Modem Products has offered to buy 3,800 fax machines from HM for $150 each. Unit-level costs associated with manufacturing the fax machines are $51 each for direct labor and $76 each for direct materials. Product-level and facility-level costs are $68,000 and $83,000, respectively. How much would profit increase (decrease) if HM accepted this special order?arrow_forwardHomerun Corporation produces baseball bats for kids that it sells for $36 each. At capacity, the company can produce 50,000 bats a year. The costs of producing and selling 50,000 bats are as follows: (Click to view the costs.) Read the requirements. Requirement 1. Suppose Homerun is currently producing and selling 38,000 bats. At this level of production and sales, its fixed costs are the same as given in the preceding table. Cobb Corporation wants to place a one-time special order for 12,000 bats at $20 each. Homerun will incur no variable selling costs for this special order. Should Homerun accept this one-time special order? Show your calculations. Determine the effect on operating income if the order is accepted. (Enter decreases in operating income with parentheses or a minus sign.) Data Table Increase (decrease) in operating income if order is accepted Cost per Bat Total Costs Homerun should Cobb's special order because it operating income by $ Direct materials 11 $ 550,000…arrow_forwardCobe Company has already manufactured 20,000 units of Product A at a cost of $30 per unit. The 20,000 units can be sold at this stage for $490,000. Alternatively, the units can be further processed at a $300,000 total additional cost and be converted into 5,900 units of Product B and 11,400 units of Product C. Per unit selling price for Product B is $102 and for Product C is $59. 1. Prepare an analysis that shows whether the 20,000 units of Product A should be processed further or not?arrow_forward

- ABC Co. uses one raw material type in its manufacturing process. It needs 3,750 kilos of its material each month. It incurs 500 each time when making and receiving orders. Annual carrying cost per unit costs 15 in warehousing and 5 in financing cost. If XYZ purchases 1,000 kg each time, how much lower would the annual cost be if XYZ would now follow the EOQ model?arrow_forwardJohnson's Plumbing's fixed costs are $700,000 and the unit contribution margin is $18. What amount of units must be sold in order to realize an operating income of $100,000?arrow_forwardCobe Company has already manufactured 28,000 units of Product A at a cost of $28 per unit. The 28,000 units can be sold at this stage for $700,000. Alternatively, the units can be processed further at a $420,000 total additional cost and be converted into 5,600 units of Product B and 11,200 units of Product C. Per unit selling price for Product B is $105 and for Product C is $70. Should the 28,000 units of Product A be processed further or not?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education