Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you please solve these general accounting question?

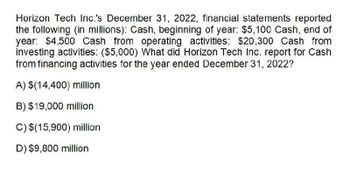

Transcribed Image Text:Horizon Tech Inc.'s December 31, 2022, financial statements reported

the following (in millions): Cash, beginning of year: $5,100 Cash, end of

year: $4,500 Cash from operating activities: $20,300 Cash from

investing activities: ($5,000) What did Horizon Tech Inc. report for Cash

from financing activities for the year ended December 31, 2022?

A) $(14,400) million

B) $19,000 million

C) $(15,900) million

D) $9,800 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forwardPresented below is selected information pertaining to the Cone Company:§ Cash balance, January 1, 2021- P13,000§ Accounts receivable, January 1, 2021- P19,000§ Collections from customers in 2021- P210,000§ Capital account balance, January 1, 2021- P38,000§ Total assets, January 1, 2021- P75,000§ Cash investment added, July 1, 2021-P5,000§ Total asset, December 31, 2021- P101,000§ Cash balance, December 31, 2021- P20,000§ Accounts receivable, December 31, 2021- P36,000§ Merchandise taken for personal use during 2021- P11,000§ Total liabilities, December 31, 2021- P41,000How much is the net income for 2021?arrow_forwardPresented below is selected information pertaining to the Cone Company:§ Cash balance, January 1, 2021- P13,000§ Accounts receivable, January 1, 2021- P19,000§ Collections from customers in 2021- P210,000§ Capital account balance, January 1, 2021- P38,000§ Total assets, January 1, 2021- P75,000§ Cash investment added, July 1, 2021-P5,000§ Total asset, December 31, 2021- P101,000§ Cash balance, December 31, 2021- P20,000§ Accounts receivable, December 31, 2021- P36,000§ Merchandise taken for personal use during 2021- P11,000§ Total liabilities, December 31, 2021- P41,000How much is the net income for 2021? A. 28,000 B. 26,000 C. 30,000 D. 22,000arrow_forward

- The following December 31, 2021, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents $ 5,000Accounts receivable (net) 20,000Inventory 60,000Property, plant, and equipment (net) 120,000Accounts payable 44,000Salaries payable 15,000Paid-in capital 100,000 The only asset not listed is short-term investments. The only liabilities not listed are $30,000 notes payable due in two years and related accrued interest of $1,000 due in four months. The current ratio at year-end is 1.5:1.Required:Determine the following…arrow_forwardDonnelly Company's balance in Interest Payable was $80,000 at December 31, 2020 and $65,000 at December 31, 2019. Interest expense was $92,000 for 2020 and $84,000 for 2019. What amount of cash disbursements for Interest would be reported in Donnelly's 2020 net cash provided by operating activities presented on a direct basis? O a. S69,000 O b. $84,000 O c. $72,000 O d. $77,000arrow_forwardKela Corporation reports net income of $530,000 that includes depreciation expense of $74,000. Also, cash of $55,000 was borrowed on a 4-year note payable. Based on this data, total cash inflows from operating activities are Mutiple Choice S604.000 O $585,000 O $669.000. $456,000. Ps >>> Type here to search Ps 39% A d) O 99+ ブォ PISO F10 F1 F12 Insert CE T D G H. K アV MI Alt Ctriarrow_forward

- The following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents Accounts receivable (net) $ 6,300 33,000 73,000 Inventory Property, plant, and equipment (net) 185,000 Accounts payable 52,000 Salaries payable Paid-in capital 24,000 165,000 The only asset not listed is short-term investments. The only liabilities not listed are $43,000 notes payable due in two years and related accrued interest payable of $1,000 due in four months. The current ratio at year-end is 1.5:1. Required: Determine the following at December 31, 2024: 1. Total current assets 2. Short-term investments 3. Retained earningsarrow_forwardLozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash Receivables Inventories Total current assets Net fixed assets $ 210,000 1,575,000 1,115,000 $2,900,000 1,315,000 Sales/Fixed assets Sales/Total assets $4,215,000 Accounts payable Notes payable Other current liabilities Total current liabilities Long-term debt Common equity Total liabilities and equity Total assets Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) Sales Cost of goods sold Selling, general, and administrative expenses Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Federal and state income taxes (25%) Net income Net income/Sales Net income/Total assets Net income/Common equity Total debt/Total assets Total liabilities/Total assets a. Calculate the indicated ratios for Lozano. Do not round intermediate calculations. Round your answers to two decimal places. Ratio Lozano Industry Average Current…arrow_forwardThe following information (in $ millions) comes from the Annual Report of Saratoga Springs Company for the year ending 12/31/2024: Year ended 12/31/2024 $ 8,139 4,957 2,099 Net sales Cost of goods sold Selling and administrative expense Interest expense Income before taxes Net income Cash and cash equivalents Receivables, net Inventories Land, buildings and equipment at cost, net Total assets Total current liabilities Long-term debt Total liabilities Total stockholders' equity 606 477 648 Profit margin on sales 12/31/2024 $ 1,165 1,200. 1,245 13,690 $ 17,300 $ 5,937 5,781 $ 11,718 $5,582 Required: Compute the profit margin on sales for 2024. Note: Round your answer to 1 decimal place, e.g., 0.1234 as 12.3%. 12/31/2023 $ 83 854 709 4,034 $ 5,680 $ 2,399 2,411 $ 4,810 $ 870arrow_forward

- Suppose the following financial data were reported by 3M Company for 2019 and 2020 (dollars in millions). 3M CompanyBalance Sheets (partial) 2020 2019Current assets Cash and cash equivalents $3,200 $1,845Accounts receivable, net 3,450 3,180Inventories 2,639 3,042Other current assets 1,872 1,549Total current assets $11,161 $9,616Current liabilities $4,853 $5,893 (a)Calculate the current ratio and working capital for 3M for 2019 and 2020. (Round current ratio to 2 decimal places, e.g. 1.25 : 1. Enter working capital answers to million.) Current ratio 2019 :12020 :1 Working capital 2019 $ million2020 $ million (b)The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardSuppose the following financial data were reported by 3M Company for 2019 and 2020 (dollars in millions). 3M CompanyBalance Sheets (partial) 2020 2019Current assets Cash and cash equivalents $3,180 $1,836Accounts receivable, net 3,600 3,180Inventories 2,738 3,019Other current assets 1,932 1,590Total current assets $11,450 $9,625Current liabilities $4,830 $5,887 Calculate the current ratio and working capital for 3M for 2019 and 2020. (Round current ratio to 2 decimal places, e.g. 1.25 : 1. Enter working capital answers to million.) Current ratio 2019 :12020 :1 Working capital 2019 $ million2020 $ million Link to Textarrow_forwardQuinze Seize Corp. reported the following amounts in its statement of financial position at each year-end:a. What is the net cash provided by operating activities?b. What is the net cash used in investing activities?c. What is the net cash provided by financing activities?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub