SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

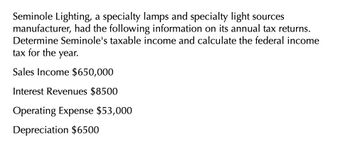

Transcribed Image Text:Seminole Lighting, a specialty lamps and specialty light sources

manufacturer, had the following information on its annual tax returns.

Determine Seminole's taxable income and calculate the federal income

tax for the year.

Sales Income $650,000

Interest Revenues $8500

Operating Expense $53,000

Depreciation $6500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During the year, Madison began offering warranties on its products and has a Warranty liability for financial reporting purposes of 5,000 at the end of the year. Warranty expenses are not deductible until paid for income tax purposes. Prepare the journal entry to record Madisons income taxes at the end of the year.arrow_forwardBarth James Inc. has the following deferred tax assets and liabilities: 12,000 noncurrent deferred tax asset, and 10,500 noncurrent deferred tax liability. Show how Barth James would report these deferred tax assets and liabilities on its balance sheet.arrow_forwardHow do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.arrow_forward

- Beaver Dam Inc. (BDI) listed the following items to prepare a reconciliation between book and taxable income. GAAP net income before tax $700,000 Meal and entertainment expense 100,000 GAAP depreciation expense 110,000 Depreciation expense for tax purposes 120,000 c. Compute the net increase in BDI’s deferred tax assets or deferred tax liabilities for the year. d. Prepare the journal entry to record taxes for the year.arrow_forwardCarla Vista Corporation reports pretax financial income of $265,900 for 2025. The following items cause taxable income to be different than pretax financial income: 1. Rental income on the income statement is less than rent collected on the tax return by $64,100. Depreciation on the tax return is greater than depreciation on the income statement by $41.200. Interest on an investment in a municipal bond of $8,000 on the income statement. 2. 3. Carla Vista' tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2025. (a) Your Answer Correct Answer (Used) Compute taxable income and income taxes payable for 25. Taxable income Income taxes payable 280,800 84,240 Qarrow_forwardMarrow_forward

- Baltimore inc reported pretax gaap income of $45,000 in 2020. The company determined it had deducted $5000 in nondeductible fines and added $2800 in tax exempt municipal interest revenue to Gaap income. Given a statutory tax rate of 25%, determine the taxable income, income tax payable, income tax expense, net income, and effective tax rate.arrow_forwardBroncos Co. reports pretax financial income of $70,000 for 20x1. The following items cause taxable income to be different than pretax financial income: Depreciation on the tax return is greater than depreciation on the income statement by $15,000. Rent collected on the tax return is greater than rent earned on the income statement by $20,000. Interest income from Denver municipal bonds $12,000 Broncos’ tax rate is 30% for all years and the company expects to report taxable income in all future years. Compute taxable income for 20x1. Show your computation. No credit if not. Prepare the journal entry to record income tax expense, deferred income tax, and income tax payable for 20x1. Compute net income for 20x1.arrow_forwardFor the year ended December 31, 2019, Nelson Co.’s income statement showed income of $425,000 before income tax expense. To compute taxable income, the following differences were noted: Income from tax-exempt municipal bonds $60,000 Depreciation deducted for tax purposes in excess of depreciation recorded on the books 130,000 Proceeds received from life insurance on death of an insured employee 100,000 Corporate tax rate for 2019 30% Enacted tax rate for future periods 35% Required: 1. Calculate taxable income and tax payable for tax purposes. 2. Prepare Nelson’s income tax journal entry at the end of 2019.arrow_forward

- The following information was taken from the accounting records of Lancer Inc, for the year ending 2020. Pretax accounting income $ 1,500,000 Interest Revenue on Municipal bonds 100,000 Litigation expense 2, 000,000 Excess Depreciation for tax purposes 1, 300,000 Deferred revenue 200,000 The tax rate for 2020 is 40% The total taxable income computed by Lancer for 2020 should be : A) $2,300,000 B) $4.900,000 C) $ 900,000 D) $3,700,000arrow_forwardABC Corporation provides you with the following information for the 2020 tax year, which was the company’s first year of operation:Book Income Before Taxes $100,000,000Book Depreciation $ 5,000,000MACRS Depreciation $ 7,500,000Foreign Sourced Income $ 40,000,000Assume a federal tax rate of 21%, disregard state taxes.a. Calculate federal taxable income.b. Calculate the federal tax payable and federal tax expense.c. Given your answer above in b., is a deferred tax asset or a deferred tax liability created? Provide the journal entry needed to reflect this.arrow_forwardBluth, Inc. reported the following financial information: Taxable income for current year $200,000 Deferred tax liability, beginning of year 46,000 Deferred tax liability, end of year 57,000 Deferred tax asset, beginning of year 12,000 Deferred tax asset, end of year 18,000 Current and future years' tax rate 21% The current year's income tax expense is what amount?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT