Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Dengar

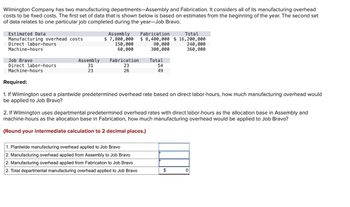

Transcribed Image Text:Wilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead

costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set

of data relates to one particular job completed during the year-Job Bravo.

Estimated Data

Manufacturing overhead costs

Direct labor-hours

Machine-hours

Assembly

$ 7,800,000

150,000

60,000

Fabrication

Total

$ 8,400,000 $ 16,200,000

90,000

300,000

240,000

360,000

Assembly

Direct labor-hours

Machine-hours

31

23

Fabrication

23

26

Total

54

49

Required:

Job Bravo

1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would

be applied to Job Bravo?

2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and

machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied to Job Bravo?

(Round your intermediate calculation to 2 decimal places.)

1. Plantwide manufacturing overhead applied to Job Bravo

2. Manufacturing overhead applied from Assembly to Job Bravo

2. Manufacturing overhead applied from Fabrication to Job Bravo

2. Total departmental manufacturing overhead applied to Job Bravo

$

0

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardSmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forwardQueen Bees Honey, Inc., estimated its annual overhead to be $110,000 and based its predetermined overhead rate on 27,500 direct labor hours. At the end of the year, actual overhead was $106,000 and the total direct labor hours were 29,000. What is the entry to dispose of the over applied or under applied overhead?arrow_forward

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardRulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forward

- Abbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardKokomo Kayak Inc. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during the month of March: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 18,000 units finished and transferred to stockroom. Work in process, end of period, 3,000 units, two-thirds completed. Required: Prepare a cost of production summary for March.arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Cushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forwardSteeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardDetermining job costcalculation of predetermined rate for applying overhead by direct labor cost and direct labor hour methods Beemer Products Inc. has its factory divided into three departments, with individual factory overhead rates for each department. In each department, all the operations are sufficiently alike for the department to be regarded as a cost center. The estimated monthly factory overhead for the departments is as follows: Forming, 64,000; Shaping, 36,000; and Finishing, 10,080. The estimated production data include the following: The job cost ledger shows the following data for X6, which was completed during the month: Required: Determine the cost of X6. Assume that the factory overhead is applied to production orders, based on the following: 1. Direct labor cost 2. Direct labor hours (Hint: You must first determine overhead rates for each department, rounding rates to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,