Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

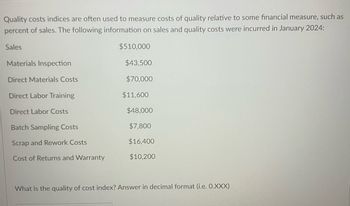

Transcribed Image Text:Quality costs indices are often used to measure costs of quality relative to some financial measure, such as

percent of sales. The following information on sales and quality costs were incurred in January 2024:

Sales

$510,000

Materials Inspection

$43,500

Direct Materials Costs

$70,000

Direct Labor Training

$11,600

Direct Labor Costs

$48,000

Batch Sampling Costs

$7,800

Scrap and Rework Costs

$16,400

Cost of Returns and Warranty

$10,200

What is the quality of cost index? Answer in decimal format (i.e. O.XXX)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Quality Cost Report Loring Company had total sales of 2,400,000 for fiscal 20X1. The costs of quality-related activities are given below. Required: 1. Prepare a quality cost report, classifying costs by category and expressing each category as a percentage of sales. What message does the cost report provide? 2. Prepare a bar graph and pie chart that illustrate each categorys contribution to total quality costs. Comment on the significance of the distribution.arrow_forwardKang Company reported sales of 3,240,000 in 20x5. At the end of the calendar year, the following quality costs were reported: Required: 1. Prepare a quality cost report. 2. Prepare a graph (pie chart or bar graph) that shows the relative distribution of quality costs, and comment on the distribution.arrow_forwardEvans Company had total sales of 3,000,000 for fiscal 20x5. The costs of quality-related activities are given below. Required: 1. Prepare a quality cost report, classifying costs by category and expressing each category as a percentage of sales. What message does the cost report provide? 2. Prepare a bar graph and pie chart that illustrate each categorys contribution to total quality costs. Comment on the significance of the distribution. 3. What if, five years from now, quality costs are 7.5 percent of sales, with control costs being 65 percent of the total quality costs? What would your conclusion be?arrow_forward

- Walton Company has measured its quality costs for the past two years. After the company gathers its quality cost data, it summarizes those costs using the four categories shown below: Last Year This Year Prevention costs $ 392,700 $ 708,500 Appraisal costs $ 413,900 $ 550,500 Internal failure costs $ 821,600 $ 465,000 External failure costs $ 1,122,000 $ 632,400 Required: 1. Calculate the total cost of quality last year and this year. 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. 3. For this year, calculate the cost in each of the four categories as a percent of the total cost of quality. 4-a. Calculate the change in total cost of quality over the two-year period. 4-b. Is performance trending in a favorable or unfavorable direction? 1.Calculate the total cost of quality last year and this year?= total cost of quality 2.For last year, calculate the cost in each of the four categories as a percent of the total…arrow_forwardWalton Company has measured its quality costs for the past two years. After the company gathers its quality cost data, it summarizes those costs using the four categories shown below: This Year $ 357,000 $ 650,000 $ 445,000 $ 545,000 $ 790,000 $ 500,000 $1,100,000 $ 680,000 Last Year Prevention costs Appraisal costs Internal failure costs External failure costs Required: 1. Calculate the total cost of quality last year and this year. Last Year This Year Total cost of quality $ 2,692,000 $ 2,375,000 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. (Round your answers to 1 decimal place.) Last Year Prevention costs 13.3 % Appraisal costs 16.5 % Internal failure costs % 40.9 % 70.7 % External failure costs Total percentarrow_forwardWalton Company has measured its quality costs for the past two years. After the company gathers its quality cost data, it summarizes those costs using the four categories shown below: Last Year This Year Prevention costs $ 357,000 $ 650,000 Appraisal costs $ 445,000 $ 545,000 Internal failure costs $ 790,000 $ 500,000 External failure costs $ 1,100,000 $ 680,000 Required:1. Calculate the total cost of quality last year and this year. 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. (Round your answers to 1 decimal place.) 3. For this year, calculate the cost in each of the four categories as a percent of the total cost of quality. (Round your answers to 1 decimal place.) 4-a. Calculate the change in total cost of quality over the two-year period. 4-b. Is performance trending in a favorable or unfavorable direction?multiple choice Favorable Unfavorablearrow_forward

- Walton Company has measured its quality costs for the past two years. After the company gathers its quality cost data, it summarizes those costs using the four categories shown below: Prevention costs Appraisal costs Internal failure costs Last Year $ 378,400 $ 440,600 This Year $ 591,500 $ 550,500 $ 813,700 $ 455,000 $ 1,144,000 $ 652,800 External failure costs Required: 1. Calculate the total cost of quality last year and this year. 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. 3. For this year, calculate the cost in each of the four categories as a percent of the total cost of quality. 4-a. Calculate the change in total cost of quality over the two-year period. 4-b. Is performance trending in a favorable or unfavorable direction? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4A Required 4B Calculate the total cost of quality last year and this year. Total…arrow_forwardWalton Company has measured its quality costs for the past two years. After the company gathers its quality cost data, it summarizes those costs using the four categories shown below: Prevention costs Appraisal costs Internal failure costs External failure costs Last Year $ 357,000 $ 445,000 $ 790,000 $ 1,100,000 This Year $ 650,000 $ 545,000 $ 500,000 $ 680,000 Required: 1. Calculate the total cost of quality last year and this year. 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. 3. For this year, calculate the cost in each of the four categories as a percent of the total cost of quality. 4-a. Calculate the change in total cost of quality over the two-year period. 4-b. Is performance trending in a favorable or unfavorable direction? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4A Required 48 Calculate the change in total cost of quality over the two-year…arrow_forwardWalton Company measured its quality costs for the past two years and summarized those costs using the four categories shown below: Prevention costs Appraisal costs Internal failure costs External failure costs Last Year $ 324,900 $ 409,400 $ 869,000 $ 1,188,000 This Year $ 689,000 $ 545,000 $ 550,000 $ 673,200 Required: 1. Calculate the total cost of quality last year and this year. 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. 3. For this year, calculate the cost in each of the four categories as a percent of the total cost of quality. 4-a. Calculate the change in total cost of quality over the two-year period. 4-b. Is performance trending in a favorable or unfavorable direction?arrow_forward

- Walton Company measured its quality costs for the past two years and summarized those costs using the four categories shown below: Prevention costs Appraisal costs Internal failure costs External failure costs Required: Last Year This Year $ 389,100 $ 669,500 $ 467,300 $ 545,000 $ 837,400 $ 465,000 $ 1,100,000 $ 612,000 1. Calculate the total cost of quality last year and this year. 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. 3. For this year, calculate the cost in each of the four categories as a percent of the total cost of quality. 4-a. Calculate the change in total cost of quality over the two-year period. 4-b. Is performance trending in a favorable or unfavorable direction? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4A Required 4B Calculate the total cost of quality last year and this year. Total cost of quality Last Year This Yeararrow_forwardPreparing a standard cost income Statement McCarthy Fender, which uses a standard cost system, manufactured 20,000 boat fenders during 2018. The 2018 revenue and cost information for McCarthy follows: Assume each fender produced was sold for the standard price of $365, and total selling and administrative costs were $250,000. Prepare a standard cost income statement for 2018 for McCarthy Fender.arrow_forwardWhich of the preceding costs is variable? Fixed? Mixed? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning