FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Chapter X +

mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/que

apter 15, 16, and 17 1

Saved

Help

Save & Ex

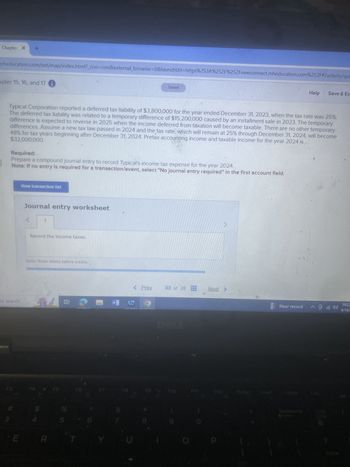

Typical Corporation reported a deferred tax liability of $3,800,000 for the year ended December 31, 2023, when the tax rate was 25%.

The deferred tax liability was related to a temporary difference of $15,200,000 caused by an installment sale in 2023. The temporary

difference is expected to reverse in 2025 when the income deferred from taxation will become taxable. There are no other temporary

differences. Assume a new tax law passed in 2024 and the tax rate, which will remain at 25% through December 31, 2024, will become

$32,000,000.

48% for tax years beginning after December 31, 2024. Pretax accounting income and taxable income for the year 2024 is

Required:

Prepare a compound journal entry to record Typical's income tax expense for the year 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

to search

3

View transaction list

E

Journal entry worksheet

Record the income taxes.

Note: Enter debits before credits.

FA

< Prev

33 of 38

Next >

Near record

10:22

4/14/2

DOLL

F5

F6

F7

FB

F9

F10

F11

F12

Priser

Insert

Delete

Calc

Backspace

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hawkeye Corporation starts business on April 2, 2023. The corporation reports startup expenditures of $64,000 all incurred in the prior year. Determine the total amount that Hawkeye Corporation can elect to deduct in 2023. O a. $0 O b. $3,200 O c. $4,267 O d. $7,950arrow_forwardNonearrow_forward1- Sohar Co. has income before income tax and extraordinary item of $200,000. It has an extraordinary loss from a major casualty of $10,000. Assuming a 35 percent income tax rate. Instruction: Compute net incomearrow_forward

- Chapter 7 Homework Help Save & Exit Submit Saved TGW, a calendar year corporation, reported $4,016,000 net income before tax on its financial statements prepared in accordance with GAAP. The corporation's records reveal the following information: • TGW's depreciation expense per books was $457,000, and its MACRS depreciation deduction was $382,400. • TGW capitalized $687,000 indirect expenses to manufactured inventory for book purposes and $820,000 indirect expenses to manufactured inventory for tax purposes. • TGW's cost of manufactured goods sold was $2,566,000 for book purposes and $2,656,000 for tax purposes. • Four years ago, TGW capitalized $2,304,000 goodwill when it purchased a competitor's business. This year, TGW's auditors required the corporation to write the goodwill down to $1,545,000 and record a $759,000 goodwill impairment expense. 2 points eBook Required: Compute TGW's taxable income. (Do not round intermediate calculations. Amounts to be deducted should be indicated…arrow_forward4aarrow_forwardMukhi Don't upload any image pleasearrow_forward

- Time left 0:43:13 Y Pty. Ltd. has assessable income of $100,000, deductions of $15,000 and tax offsets of $500. What is Y Pty. Ltd.'s tax payable for the year assuming a corporate tax rate of 25%? ut of O a. $21,200 O b. $25,500 O c. $20,750 O d. $25,000arrow_forwardpvn.6arrow_forwardAccarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education