Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

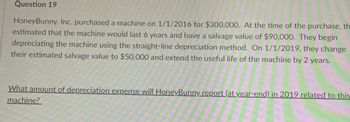

Transcribed Image Text:Question 19

HoneyBunny, Inc. purchased a machine on 1/1/2016 for $300,000. At the time of the purchase, th

estimated that the machine would last 6 years and have a salvage value of $90,000. They begin

depreciating the machine using the straight-line depreciation method. On 1/1/2019, they change

their estimated salvage value to $50,000 and extend the useful life of the machine by 2 years.

What amount of depreciation expense will HoneyBunny report (at year-end) in 2019 related to this

machine?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE CALCULATION OF DEPRECIATION On January 1, 20-1, Dans Demolition purchased two jackhammers for 2,500 each with a salvage value of 100 each and estimated useful lives of four years. On January 1, 20-2, a stronger blade to improve performance was installed in Jackhammer A for 800 cash and the compressor was replaced in Jackhammer B for 200 cash. The compressor is expected to extend the life of Jackhammer B one year beyond the original estimate. REQUIRED 1. Using the straight-line method, prepare general journal entries for depreciation on December 31, 20-1, for Jackhammers A and B. 2. Enter the transactions for January 20-2 in a general journal. 3. Assuming no other additions, improvements, or replacements, calculate the depreciation expense for each jackhammer for 20-2 through 20-4.arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. Dunedin buys equipment frequently and wants to print a depreciation schedule for each assets life. Review the worksheet called DEPREC that follows these requirements. Since some assets acquired are depreciated by straight-line, others by units of production, and others by double-declining balance, DEPREC shows all three methods. You are to use this worksheet to prepare depreciation schedules for the new machine.arrow_forwardNonearrow_forward

- Just question 1arrow_forwardQuestion On October 1, 2019, Jay Company purchased a new machine for $112 500 The machine is estimated to have a $10,500 salvage value after its 10-year useful life. The machine is expected to be used 20,000 working hours over As usolut tre Instructions: Complate the lollowing depreciation schedules for 2019 and 2020. All answers should have dollar signs and commas. For example, your answers could be in the following formats: $5,000 or $15,000 or $150,000. Straight-Line Method Depreciation Expense Accumulated Depreciation Book Value 2020. Declining Balance Method (Assuming double the straight-line rate) Year Depreciation Expense Accumulated Depreciation Book Value 2019 2020 Units of Activity Method (Assuming machine working hours are as follows: 2019: 1,500; 2020: 4,000) Year Depreciation Expense Accumulated Depreciation Book Value 2019 2020arrow_forward21. Revision of Depreciation On January 1, 2020, Shapiro Inc. purchased a machine for $115,000. Shapiro depreciated the machine with the straight-line depreciation method over a useful life of 10 years, using a residual value of $5,000. At the beginning of 2022, a major overhaul costing $30,000 was made. After the overhaul, the machine's residual value is estimated to be $7,500, and the machine is expected to have a remaining useful life of 11 years. Required: Determine the depreciation expense for 2022.arrow_forward

- Question 1 On January 1, 2014, Evers Company purchased the following machine for use in its production process: Machine: The recorded cost of this machine was $180,000. Evers estimates that the useful life of the machine is 4 years with a $10,000 salvage value remaining at the end of that time period. Instructions a) Calculate the amount of depreciation expense that Evers should record each year of its useful life under the following assumptions. Show your workings. (1) Straight-line method (2) Double declining balance method (3) Units-of-activity method and estimates that the useful life of machine is 125,000 units. Actual usage is as follows: 2014, 45,000 units; 2015, 35,000 units; 2016, 25,000 units; 2017, 20,000 units. b) Which method used to calculate depreciation reports the highest amount of depreciation expense year 1? The highest in year 4? The highest total amount over the 4-year period? inarrow_forwardNeed answer with explanationarrow_forwardView Policies Show Attempt History Current Attempt in Progress * Your answer is incorrect. Vaughn Company purchased a machine on January 1, 2019, for $59000 with an estimated salvage value of $25000 and an estimated useful life of 8 years. On January 1, 2021, Vaughn decides the machine will last 12 years from the date of purchase. The salvage value is still estimated at $25000. Using the straight-line method, the new annual depreciation will be O $2550. O $2833. O $3400. O $4917.arrow_forward

- 25. Depreciation Methods On January 1, 2021, Loeffler Company acquired a machine at a cost of $200,000. Loeffler estimates that it will use the machine for four years or 8,000 machine-hours. It estimates that after four years the machine can be sold for $20,000. Loeffler uses the machine for 2,100 and 1,800 machine-hours in 2021 and 2022, respectively. Required: Compute depreciation expense for 2021 and 2022 using the: 1. Straight-line method of depreciation. 2. Double declining balance method of depreciation. 3. Units-of-production method of depreciation.arrow_forwardI want correct answerarrow_forwardQuestion 6 Porker Company purchased a machine on January 2, 2022, by paying cash of $160,000. The machine has an estimated useful life of five years (or the production of 300,000 units) and an estimated residual value of $15,000. Required: 1. Determine depreciation expense (to the nearest dollar) for each year of the machine's useful life under (a). straight-line depreciation; and (b). the declining-balance method with a 200% acceleration rate. 2. What is the book value of the machine after three years with the declining-balance method and a 200% acceleration rate? 3. What is the net book value of the machinery after three years with straight-line depreciation. 4. If the machine was used to produce and sell 55,000 units in 2022, what would the depreciation expense be under the units of production method?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning