FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

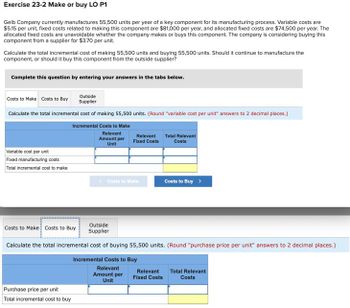

Transcribed Image Text:Exercise 23-2 Make or buy LO P1

Gelb Company currently manufactures 55,500 units per year of a key component for its manufacturing process. Variable costs are

$5.15 per unit, fixed costs related to making this component are $81,000 per year, and allocated fixed costs are $74,500 per year. The

allocated fixed costs are unavoidable whether the company makes or buys this component. The company is considering buying this

component from a supplier for $3.70 per unit.

Calculate the total incremental cost of making 55,500 units and buying 55,500 units. Should it continue to manufacture the

component, or should it buy this component from the outside supplier?

Complete this question by entering your answers in the tabs below.

Costs to Make Costs to Buy

Outside

Supplier

Calculate the total incremental cost of making 55,500 units. (Round "variable cost per unit" answers to 2 decimal places.)

Incremental Costs to Make

Variable cost per unit

Fixed manufacturing costs

Total incremental cost to make

Relevant

Amount per

Unit

Relevant

Fixed Costs

Total Relevant

Costs

<Costs to Make

Costs to Buy >

Costs to Make Costs to Buy

Outside

Supplier

Calculate the total incremental cost of buying 55,500 units. (Round "purchase price per unit" answers to 2 decimal places.)

Incremental Costs to Buy

Purchase price per unit

Total incremental cost to buy

Relevant

Amount per

Unit

Relevant

Fixed Costs

Total Relevant

Costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Exercise 21.12 (Static) Pricing a Special Order (LO21-1, LO21-2, LO21-3) Mazeppa Corporation sells relays at a selling price of $28 per unit. The company's cost per unit, based on full capacity of 160,000 units, is as follows: Direct materials $ 6 Direct labor 4 Overhead (2/3 of which is variable) 9 Mazeppa has been approached by a distributor in Montana offering to buy a special order consisting of 30,000 relays. Mazeppa has the capacity to fill the order. However, it will incur an additional shipping cost of $2 for each relay it sells to the distributor. a-1. Assume that Mazeppa is currently operating at a level of 100,000 units. Show the calculation for the unit price to charge the distributor which will generate an increase in operating income of $2 per unit? a-2. What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? b-1. Assume that Mazeppa is currently operating at full…arrow_forward8.5 Special order pricing Marston Manufacturing has an annual capacity of 85,000 units per year. Currently, the company is making and selling 78,000 units a year. The normal sales price is $120 per unit, cariable costs are $90 per unit, and total fixed expenses are $2,000,000. an out of state distributor has offered to buy 12,000 units at $105 per unit. Marston's cost structure should not change as the result of this special order. REQUIRED By how much will Marstonsincome change if the company accepts this order?arrow_forwardQuestion 2 Kosova Itd is a new formed firm which intends to penetrate in the international market. The newly formed firm produces car radios, which currently it sells to car manufacturers for £60 each. Next year the business plans to make and sell 20,000 radios. The business's costs are as follows: Manufacturing Variable materials £20 per radio £14 per radio £12 per radio Variable labour Other variable costs Fixed cost £80,000 per year Administration and selling Variable £3 per radio £60,000 per year Fixed Required: (a) Calculate the break-even point for next year, expressed both in quantity of radios and sales value. (b) Calculate the operating leverage for next year, and discuss why operating leverage is useful. value.arrow_forward

- a1arrow_forwardEX 22arrow_forwardQuestion 16 Direct Labor Order Allocation Rate Machine Time Allocation Rate Request (Easy-Medium) Use the information below to answer the questions that follow. $ $ $ 38.00 per hour 46.55 $ of OH / order 2.83 $ of OH / machine hour Place the answer to each part of the question in the box provided. Under job costing, how much overhead will be applied to a unit that takes 0.5 hours to produce and is part of an order for 100 units? Under job costing, how much overhead will be applied to a unit that takes 2 hours to produce and is part of an order for 10 units? What is the total cost of the first product if materials are $2.50 and a person must be present to run the machines? What is the total cost of the second product if materials are $1 and a person must be present to run the machines for half the total time?arrow_forward

- dot image plasarrow_forwardExercise 21.12 (Static) Pricing a Special Order (LO21-1, LO21-2, LO21-3) Mazeppa Corporation sells relays at a selling price of $28 per unit. The company's cost per unit, based on full capacity of 160,000 units, is as follows: Direct materials Direct labor Overhead (2/3 of which is variable) Mazeppa has been approached by a distributor in Montana offering to buy a special order consisting of 30,000 relays. Mazeppa has the capacity to fill the order. However, it will incur an additional shipping cost of $2 for each relay it sells to the distributor. a-1. Assume that Mazęppa is currently operating at a level of 100,000 units. Show the calculation for the unit price to charge the distributor which will generate an increase in operating income of $2 per unit? a-2. What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? b-1. Assume that Mazeppa is currently operating at full capacity.…arrow_forward%23 Requlred Information The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product. Its average cost per unit for each product at this level of activity are given below. Alpha $ 42 42 Beta $ 24 Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses 32. 24 27. 34. Total cost per unit The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses. are unavoidable and have been allocated to products based on sales dollars. 9. Assume that Cane expects to produce and sell 99,000 Alphas during the current year. A supplier has offered to manufacture and deliver 99,000 Alphas to Cane for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education