Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Multinational Accounting

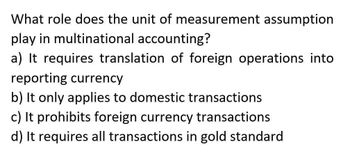

Transcribed Image Text:What role does the unit of measurement assumption

play in multinational accounting?

a) It requires translation of foreign operations into

reporting currency

b) It only applies to domestic transactions

c) It prohibits foreign currency transactions

d) It requires all transactions in gold standard

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Answerarrow_forwardThis is Accounting MCQ i want answer and explanation why it's correct and another incorrect Thanks waiting for answerarrow_forward1. Which of the following statements is incorrect? * A. A foreign operation (e.g., a branch) that is essentially an extension of the entity (e.g., the home office) would have the same functional currency as that of the entity. B. An entity can only have one functional currency but it can have as many presentation currencies as it wishes. C. Subsequent to initial recognition, both monetary and non-monetary items arising from a foreign currency transaction are translated at the closing rate. D. A foreign currency transaction is initially recognized at the spot exchange rate at the date of the transaction. 2. According to PAS 21, exchange differences arising from the translation of monetary items arising from foreign currency transactions are recognized in * A. Directly in equity B. Any of these C. Other comprehensive income D. Profit or lossarrow_forward

- Accounting for Foreign Currency Transactions: Accounting for foreign currency transactions involves recording and reporting financial transactions denominated in a currency other than the entity's functional currency. Here are the key steps involved in handling such transactions: **1. Identifying Foreign Currency Transactions: Definition: Foreign currency transactions occur when a business entity conducts financial transactions, such as sales, purchases, or investments, in a currency different from its functional currency. Examples: Buying goods from a foreign supplier, selling products to overseas customers, or borrowing funds in a foreign currency. **2. Determining the Functional Currency: Primary Currency: Each business entity designates a functional currency, which is the primary currency used in its day-to-day operations and financial reporting. Factors Considered: Factors such as the location of the entity's primary economic activities, the currency in…arrow_forward22.Examples of external reporting issues include the following except:Select one:a. Should accounts of foreign operations be translated to parent currency when consolidated statements are prepared?b. Which exchange rates should be employed when translating from one currency to another?c. Does translation from one set of measurement rules to another change the information content of the original message?d. Should foreign managers be evaluated in terms of parent currency or the local currency of the country in which the manager operates?arrow_forwardWhich of the following suggests that the foreign entity's functional currency is the parent's currency? a. Intercompany transaction volume is low. b. Debt is serviced through local operations. c. There is an active and primarily local market. d. Sale prices are influenced by international factors.arrow_forward

- what are implications for analysis of financial statements that result from the accounting for foreign currency translation?arrow_forwardF. Accountingarrow_forwardA). Why do we need to translate the financial statement of foreign operations? B). Explain the concepts of local currency, functional currency and presentation, orrency with example. K C). How is the profit or loss from translating foreign operations' financial statements from local currency to functional currency treated? D) How are the profit and loss from translating foreign ope ions' financial statements from functional currency to presentation currency treated?arrow_forward

- Why is it important that foreign currency financial statements are translated at the appropriate currency exchange rates? What would happen if companies can translate their foreign subsidiary's financial statements at whatever exchange rate they like? Can the integrity of consolidated financial statements be maintained in such situation?arrow_forwardQ1. Explain the differences between translation and remeasurement of financial statements of a foreign subsidiary.arrow_forwardWhich of the following items will result to foreign currency transaction gain/loss due to settlement or remeasurement? Foreign currency denominated non-monetary liabilities such as unearned revenue, warranty liability, premium liability and deferred tax liability. Foreign currency denominated non-monetary assets such as inventory, PPE, intangible asset or prepaid asset. Foreign currency denominated monetary items such as accounts payable, accounts receivable, notes payable, loans receivable or interest payable. Foreign currency denominated income statement accounts such as revenue, income, expense or loss.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning