Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

DOL : FINANCIAL ACCOUNTING 4 MARKS

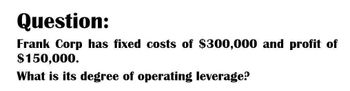

Transcribed Image Text:Question:

Frank Corp has fixed costs of $300,000 and profit of

$150,000.

What is its degree of operating leverage?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- degree of operating leverage?arrow_forwardOhio Steel has a degree of operating leverage of 2.9. The company predicted EBIT of $332,000 and EPS of $5.7 for the year. Actual EBIT were $284,000 and EPS were $2.42. What is the degree of financial leverage? What is the degree of total leverage? What were earnings before taxes (EBIT - Interest)? What was the company's gross profit (sales - variable costs)?arrow_forward3. Cerry Technologies has sales of $4,000,000. The company's fixed operating costs total $700,000 and its variable costs equal 60 percent of sales, so the company's current operating income is $900,000. The company's interest expense is $300,000. What is the company's degree of total operating leverage? What is the company's degree financial leverage?arrow_forward

- A firm with $800,000 of variable costs, $600,000 of fixed costs and $200,000 of depreciation is expected to produce $225,000 in profits. What is its degree of operating leverage (DOL)?arrow_forwardWhat is Harley's operating leverage? 3.1, 1.3 or 1.2arrow_forwardNeed Help with this Questionarrow_forward

- Requirement 1. If SnowDreams cannot reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level? Complete the following table to calculate SnowDreams' projected income. Revenue at market price Less: Total costs Operating incomearrow_forwardAssume company ABC’s only product is priced at K20 per unit and its variable costs amount to K15 per unit while fixed costs are K3,600.a. Compute the quantity required to achieve a profit of K2 per unit b. Define the term: Degree of Operating Leverage and how it can be computed c. What is the degree of operating leverage for this company at the level of output earning a profit of K3 per unit?arrow_forwardIf financial leverage of a firm is 4, Interest 6,00,000, Operating Leverage is 3, Variable cost to sales is 66.66%, Income tax rate is 30%, Number of Equity Shares 1, 00, 000. Calculate fixed cost and EPS of the firms. (For your reference, OL = Contribution/EBIT; FL = EBIT/EBT and CL = OL*FL)arrow_forward

- 1. If ABC company achieves its projections, what will be its degree of operating leverage?arrow_forwardThe Long-Life Battery Co. generates $8 million of profits on sales of $10 million and generates $10 million of profits on sales of $15 million. What is the degree of operating leverage?arrow_forwardWhat is the firm's ROE ???arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub