Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I need answer of this question solution general accounting

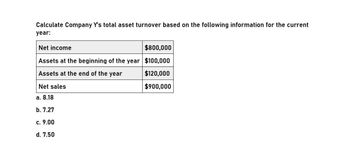

Transcribed Image Text:Calculate Company Y's total asset turnover based on the following information for the current

year:

Net income

$800,000

Assets at the beginning of the year $100,000

Assets at the end of the year

Net sales

a. 8.18

b. 7.27

c. 9.00

d. 7.50

$120,000

$900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Asset turnover A company reports the following: Sales $1,284,150 Average total assets (excluding long-term investments) 611,500 Determine the asset turnover ratio. If required, round your answer to one decimal place.arrow_forwardPlease provide answer the general accounting questionarrow_forwardAsset turnover A company reports the following: Sales $858,000Average total assets (excluding long-term investments) 572,000Determine the asset turnover ratio. If required, round your answer to one decimal place.fill in the blank 1arrow_forward

- General Accountingarrow_forwardWhat is the asset turnover ratio on these general accounting question?arrow_forwardAsset turnover A company reports the following: Sales $1,189,650 Average total assets (excluding long-term investments) 566,500 Determine the asset turnover ratio. If required, round your answer to one decimal place.fill in the blank 1arrow_forward

- Asset turnover A company reports the following: Sales $6,480,000 Average total assets 2,400,000 Determine the asset turnover ratio. Round your answer to one decimal place.arrow_forward(46) Calculate Company Y's total asset turnover based on the following information for the current year: Net income $200,000 Assets at the beginning of the year $100,000 Assets at the end of the year $140,000 Net Sales $900,000arrow_forwardA company reports the following: Sales $8,296,860 Average total assets (excluding long-term investments) 1,063,700 Determine the asset turnover ratio. Round your answer to one decimal place.fill in the blank 1arrow_forward

- Need help ASAP :(arrow_forwardUse the following selected balance sheet and income statement information for Stevens Co. to compute asset turnover, to the nearest hundredth of a percent. Operating profit before tax Net Income Average total assets Sales Tax rate on operating profit $120,000 $192,500 $653,000 $1,250,000 35% a. 1.34 b. 1.91 c. 0.52 d. 0.29arrow_forwardQuestion: A company reports the following: Sales $4,400,000 Average total assets (excluding long-term investments) 2,000,000 Determine the asset turnover ratio.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT