Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting Question need help please

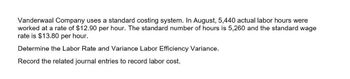

Transcribed Image Text:Vanderwaal Company uses a standard costing system. In August, 5,440 actual labor hours were

worked at a rate of $12.90 per hour. The standard number of hours is 5,260 and the standard wage

rate is $13.80 per hour.

Determine the Labor Rate and Variance Labor Efficiency Variance.

Record the related journal entries to record labor cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forwardRath Company showed the following information for the year: Required: 1. Calculate the standard direct labor hours for actual production. 2. Calculate the applied variable overhead. 3. Calculate the total variable overhead variance.arrow_forward

- The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardMulliner Company showed the following information for the year: Required: 1. Calculate the standard direct labor hours for actual production. 2. Calculate the applied variable overhead. 3. Calculate the total variable overhead variance.arrow_forwardFoamy Inc. manufactures shaving cream and uses the weighted average cost method. In November, production is 14,800 equivalent units for materials and 13,300 units for labor and overhead. During the month, materials, labor, and overhead costs were as follows: Beginning work in process for November had a cost of 11,360 for materials, 11,666 for labor, and 9,250 for overhead. Compute the following: a. Weighted average cost per unit for materials b. Weighted average cost per unit for labor c. Weighted average cost per unit for overhead d. Total unit cost for the montharrow_forward

- Yohan Company has the following balances in its direct materials and direct labor variance accounts at year-end: Unadjusted Cost of Goods Sold equals 1,500,000, unadjusted Work in Process equals 236,000, and unadjusted Finished Goods equals 180,000. Required: 1. Assume that the ending balances in the variance accounts are immaterial and prepare the journal entries to close them to Cost of Goods Sold. What is the adjusted balance in Cost of Goods Sold after closing out the variances? 2. What if any ending balance in a variance account that exceeds 10,000 is considered material? Close the immaterial variance accounts to Cost of Goods Sold and prorate the material variances among Cost of Goods Sold, Work in Process, and Finished Goods on the basis of prime costs in these accounts. The prime cost in Cost of Goods Sold is 1,050,000, the prime cost in Work in Process is 165,200, and the prime cost in Finished Goods is 126,000. What are the adjusted balances in Work in Process, Finished Goods, and Cost of Goods Sold after closing out all variances? (Round ratios to four significant digits. Round journal entries to the nearest dollar.)arrow_forwardCost and production data for Binghamton Beverages Inc. are presented as follows: Required: Calculate net variances for materials, labor, and factory overhead. Calculate specific materials and labor variances by department, using the diagram format in Figure 8-4. Comment on the possible causes for each of the variances that you computed. Make all journal entries to record production costs in Work in Process and Finished Goods. Determine the balance of ending Work in Process in each department. Assume that 4,000 units were sold at $40 each. Calculate the gross margin based on standard cost. Calculate the gross margin based on actual cost. Why does the gross margin at actual cost differ from the gross margin at standard cost. As the plant controller, you present the variance report in Item 1 above to Paul Crooke, the plant manager. After reading it, Paul states: “If we present this performance report to corporate with that large unfavorable labor variance in Blending, nobody in the plant will receive a bonus. Those standard hours of 5,500 are way too tight for this production process. Fifty-eight hundred hours would be more reasonable, and that would result in a favorable labor efficiency variance that would more than offset the unfavorable labor rate variance. Please redo the variance calculations using 5,800 hours as the standard.” You object, but Paul ends the conversation with, “That is an order.” What standards of ethical professional practice would be violated if you adhered to Paul’s order? How would you attempt to resolve this ethical conflict?arrow_forwardEllis Companys labor information for September is as follows: A. Compute the standard direct labor rate per hour. B. Compute the direct labor time variance. C. Compute the standard direct labor rate if the direct labor rate variance was $2,712.30 (unfavorable).arrow_forward

- Eagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forwardShasta Fixture Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 70 employees. Each employee presently provides 38 hours of labor per week. Information about a production week is as follows: Instructions Determine (a) the standard cost per unit for direct materials and direct labor; (b) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; and (c) the direct labor rate variance, direct labor time variance, and total direct labor cost variance.arrow_forwardAbbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College