FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the geometric return for this stock on these accounting question?

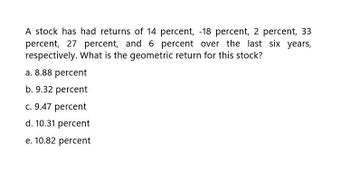

Transcribed Image Text:A stock has had returns of 14 percent, -18 percent, 2 percent, 33

percent, 27 percent, and 6 percent over the last six years,

respectively. What is the geometric return for this stock?

a. 8.88 percent

b. 9.32 percent

c. 9.47 percent

d. 10.31 percent

e. 10.82 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A stock has had returns of 11 percent, -8 percent, 6 percent, 21 percent, 24 percent, and 16 percent over the last six years. What is the geometric retúrn for this stock? O 10.82 percent 11.13 percent O 11.31 percent O 11.42 percent O 11.47 percentarrow_forwardA stock had returns of 2 percent, 1.4 percent, -4.2 percent, 5.8 percent, -9.9 percent, and 17.8 percent over the past six years. What is the arithmetic average return for this time period? _____%arrow_forwardA stock had returns of 18.94 percent, 22.58 percent, -15.98 percent, 9.38 percent, and 28.45 percent for the past five years. What is the average return? A) 12.67% B) 19.07% C)6.12% D) 7.19% E) 28%arrow_forward

- A stock had returns of 14 percent, 13 percent, −10 percent, and 7 percent for the past four years. What is the 99 percent probability range of returns for this stock? A. −16.2 percent to 17.1 percent B. −5.1 percent to 17.1 percent C. −16.2 percent to 28.2 percent D. −27.3 percent to 39.3 percentarrow_forwardA stock has had returns of 14 percent, −18 percent, 2 percent, 33 percent, 27 percent, and 6 percent over the last six years, respectively. What is the geometric return for this stock?arrow_forwardA stock had returns of 11.57 percent, -15.55 percent, 21.95 percent, 27.00 percent, and 10.50 percent over the past five years. What was the geometric average return for this stock?arrow_forward

- A stock had returns of 13 percent, 11 percent, 8 percent, 14 percent, -9 percent, and -5 percent over the past siX years. What is the geometric average return for this time period? ()5.39% 4.93% 5.13% 5.26% 4.67%arrow_forwardYour stock's returns for the past four years are as follows. t Return t1 19.79% t2 -0.58% t3 8.55% t4 4.68% Compute the geometric average return for this stock. Please enter your answer as a PERCENT rounded to 2 decimal places.arrow_forwardA stock has had returns of −19 percent, 29 percent, 24 percent, −10.1 percent, 34.8 percent, and 27 percent over the last six years. What is the geometric return for the stock?arrow_forward

- A stock has yielded returns of 6 percent, 11 percent, 14 percent, and -2 percent over the past four years, respectively. What is the standard deviation of these returns? Group of answer choices 5.52 percent 5.86 percent 6.05 percent 6.47 percent 6.99 percentarrow_forwardA stock has had returns of -5.32 percent, -7.58 percent, 4.68 percent, 7.7 percent, 8.98 percent, and 10.04 percent over the last six years. What is the geometric average return for the stock? Answer as a percentage to two decimals (if you get -0.0435, you should answer -4.35).arrow_forwardFinancial Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education