Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

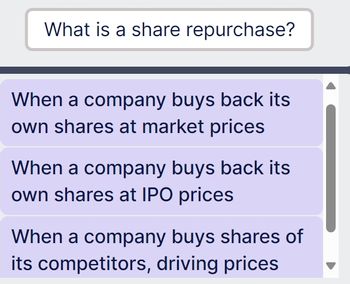

Transcribed Image Text:What is a share repurchase?

When a company buys back its

own shares at market prices

When a company buys back its

own shares at IPO prices

When a company buys shares of

its competitors, driving prices

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- What is a share repurchase? When a company buys back its own shares at IPO prices When a company buys back its own shares at market prices When a company buys shares of its competitors, driving prices downarrow_forwardExplain what ‘short selling’ means and how short-sellers profit from a fall in share prices.arrow_forwardIndicate whether its TRUE or FALSE. Then give an explanation. Firms concerned with the sharemarket reaction to dividend announcements may adopt a “sticky” dividend policy.arrow_forward

- What are the share price implications of increasing and decreasing leverage to a firm?arrow_forwardSuppose that in April 2019, Nike Inc. had sales of $36,403 million, EBITDA of $5,214 million, excess cash of $5,245 million, $3,818 million of debt, and 1,583.3 million shares outstanding. a. Using the average enterprise value to sales multiple in the table here,, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? a. Using the average enterprise value to sales multiple in the table above, estimate Nike's share price. Nike's share price using the average enterprise value to sales multiple will be $ (Round to the nearest cent.) b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples…arrow_forwardWhich statement about book value per share (BVPS) is true? A. Market price per share usually approximates BVPS. B. BVPS can be misleading because it is based on historical cost. C. Market price per share greater than BVPS is an indication of an overvalued stock. D. BVPS is the amount that would be paid to shareholders if the firm is sold to another firm.arrow_forward

- Which of the following theories is supported by the argument that shareholders can transform a company dividend policy into a different policy by means of investors buying and selling on their own account? a. dividend irrelevance theory b. "bird-in-the-hand" theory C. residual distribution model d. tax preference theoryarrow_forwardWhich of the following techniques allow firms to gain market access in a new market? Select one: a. buyback b. All of the answers c. offset d. switch tradingarrow_forwardDividend Policy. How is it possible that dividends are so important, but at the same time, dividend policy is irrelevant? If increases in dividends tend to be followed by (immediate) increases in share prices, how can it be said that dividend policy is irrelevant?arrow_forward

- Which statement about book value per share (BVPS) is true???A. Market price per share usually approximates BVPS.B. BVPS can be misleading because it is based onhistorical cost.C. Market price per share greater than BVPS is anindication of an overvalued stockD. BVPS is the amount that would be paid to shareholdersif the firm is sold to another firmarrow_forwardWhich of the following should lead to a lower share price: (as the result of a mechanical effect, not due to signaling) 1. firm does a stock split 2. firm pays dividends 3. firm repurchases shares 4. firm issues shares 5. firm issues debt 6. firm makes an acquisition at a fair price, with negligible synergies O 1,2,3 0 23 O 1,2,3,4,5,6 O 2,3,5,6 O 1,2,3,5 0 1,2 O 2,3,5arrow_forwardWhy would a company want to repurchase some of its own stock that they have previously issued?’arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College