Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

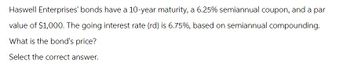

Transcribed Image Text:Haswell Enterprises' bonds have a 10-year maturity, a 6.25% semiannual coupon, and a par

value of $1,000. The going interest rate (rd) is 6.75%, based on semiannual compounding.

What is the bond's price?

Select the correct answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Consider a 10-year bond with a face value of $1,000 that has a coupon rate of 5.8%, with semiannual payments.arrow_forwardCalculate the fair present values of the following bonds, all of which pay interest semiannually, have a face value of $1,000, have 12 years remaining to maturity, and have a required rate of return of 10 percent. The bond has a 6 percent coupon rate. The bond has a 8 percent coupon rate. The bond has a 10 percent coupon rate. What do your answers to parts (a) through (c) say about the relation between coupon rates and present values?arrow_forwardConsider a 20-year bond with a face value of $1,000 that has a coupon rate of 5.7%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. (Round to the nearest cent.)arrow_forward

- A bond that pays interest semiannually has a coupon rate of 5.08 percent and a current yield of 5.37 percent. The par value is $1,000. What is the bond's price?arrow_forwardThe market price of a 10-year bond is 957$, its yield to maturity is 8% per year, and annual coupon payments are equal to 957$. The face value of the bond is $1000. Calculate the present value of the bond. Would you buy it? The answer is to be written in the reasons box. Round your answer to the nearest tenth. Optional: Provide calculation details in the reasons box. Answer: Give your reasonsarrow_forwardSolve each of the following questions using both pricing formulas and Excel. 4. A bond with a face value of $1,000 pays a 10% (APR) semiannual coupon and matures in 10 years. Similar bonds trade at a YTM of 8% (APR). What is the price of the bond?arrow_forward

- Consider a bond with semiannual interest payments that has a Settlement Date of 8/15/2020, a Maturity Date of 2/15/2031, a Coupon Rate of 5.00%, a Market Price of $975, a Face Value of $1,000, and a Required Return of 5.35%. What is the Macaulay Duration using the Duration function on these bonds expressed as a decimal calculated to two decimal places if you purchase them at the current market price? For example, if your answer is 12.345 then enter as 12.35 in the answerarrow_forwardSuppose that all bonds have $1,000 of face value. The current prices of zero coupon bonds are as follows: $960 for a one-year bond; $910 for a two-year bond; $850 for a three-year bond. a. What is the price of a three-year bond with 8% annual coupon payment? b. What is the YTM of the two-year zero coupon bond? c. Consider the following two-year bonds: (i) a zero coupon bond as above; (ii) a bond with 6% annual coupon payment. Whose YTM is higher?arrow_forwardWhat is the market price of a bond if the face value is $1,000 and the yield to maturity is 5.7%? The bond has a 5.15% coupon rate and matures in 14 years. The bond pays interest semiannually. Please express answer as $X.XX or XX.XX and use rounding guideline included in "Course Information" module. Do not round until the final result.arrow_forward

- Consider a $1,000-par-value Bond with the following characteristics: a current market price of $761, 12 years until maturity, and an 8% coupon rate. We want to determine the discount rate that sets the present value of the bond’s expected future cash-flow stream to the bond’s current market price. You are required to determine the discount rate that equates the present value of the bond?arrow_forwardField Industries' outstanding bonds have a 25-year maturity and $1,000 par value. Their nominal yield to maturity is 9.25%, they pay interest semiannually, and they sell at a price of $850. What is the bond's nominal (annual) coupon interest rate? Solve using excel,please show all steps.arrow_forwardA 14-year, $1000 par value Fingen bond pays 9 percent interest annually. The market price of the bond is $1100, and the market's required yield to maturity on a comparable-risk bond is 10 percent. (Use microsoft excel) a. Compute the bond's yield to maturity b. Determine the value of the bond to you, given your required rate of return. C. Should you purchase the bond?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education