ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

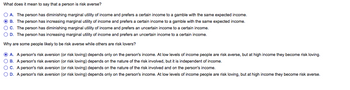

Transcribed Image Text:What does it mean to say that a person is risk averse?

O A. The person has diminishing marginal utility of income and prefers a certain income to a gamble with the same expected income.

ⒸB. The person has increasing marginal utility of income and prefers a certain income to a gamble with the same expected income.

OC. The person has diminishing marginal utility of income and prefers an uncertain income to a certain income.

O D. The person has increasing marginal utility of income and prefers an uncertain income to a certain income.

Why are some people likely to be risk averse while others are risk lovers?

ⒸA. A person's risk aversion (or risk loving) depends only on the person's income. At low levels of income people are risk averse, but at high income they become risk loving.

OB. A person's risk aversion (or risk loving) depends on the nature of the risk involved, but it is independent of income.

OC. A person's risk aversion (or risk loving) depends on the nature of the risk involved and on the person's income.

O D. A person's risk aversion (or risk loving) depends only on the person's income. At low levels of income people are risk loving, but at high income they become risk averse.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. Maria has $100. There is a 50% that she will lose all of it. Her utility as a functionof wealth is u(c) = √c. a. What is the maximum amount she would be willing to pay to fully insure againstthe 50% probability of the loss? b. Is she risk averse, risk loving, or risk neutral?arrow_forwardQ5arrow_forwardB's profit B invests B does not invest 100 80 100 -40 -40 10 80 10 Which of the following statements are correct? Select one or more: O a. If A invests, B's best strategy is to not invest since A will take all the profit O b. Whoever invests first gains a first-mover advantage O c. The co-ordination game exhibits two Nash equilibria. O d. If B chooses to not invest, A's best strategy is also to not invest. A's profit A does not invest A investsarrow_forward

- 6 Consider Bob's utility function. a. What is Bob's expected value of a gamble with a 50% chance of $0 and a 50% chance of $100? 4 d b 30 50 75 100arrow_forwardp Consider the following lottery scenarios. Which of these is an example of the Allais Paradox, a well-known deviation from expected utility theory? O a. Lottery P offers a 1% chance of winning $10,000 and a 99% chance of winning nothing, while Lottery Q offers a 50% chance of winning $200 and a 50% chance of winning nothing. Even though the expected value of Lottery P is greater, most people choose Lottery Q because they overweight the low probability event in P. O b. Lottery M offers a 90% chance of winning $5,000,000 and a 10% chance of winning nothing, while Lottery N offers a 10% chance of winning $50,000,000 and a 90% chance of winning nothing. Despite Lottery N having a higher expected value, a majority of people choose Lottery M. Oc. Lottery X offers a 50% chance of winning $1,000 and a 50% chance of winning nothing, while Lottery Y offers a guaranteed win of $450. Despite the higher expected value of Lottery X ($500 vs $450), a majority of people choose Lottery Y. O d. Lottery…arrow_forwardAn individual is o ered a choice of either $50 or a lottery which may result in $0and $100, each with equal probability 1/2 . If the individual has a utility function u(w) = 5 + 2w, which one would they choose? If the individual has a utility function u(w) =w1/2 + 1?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education